The cost of shipping has become a significant concern for businesses and individuals alike, and UPS, a leading global shipping giant, is no exception. As inflation continues to grip the economy, UPS insurance rates have also risen, impacting the bottom line for many. This trend raises important questions about the factors driving these increases, the strategies available to mitigate costs, and the future of UPS insurance.

Understanding the intricacies of UPS insurance is crucial for navigating this complex landscape. This comprehensive guide delves into the key factors influencing UPS insurance rates, exploring the impact of inflation, increased shipping volume, and potential changes in UPS’s risk assessment practices. We’ll also examine strategies for minimizing insurance costs, including optimizing packaging, negotiating better rates, and exploring alternative insurance providers. Finally, we’ll discuss industry trends and provide insights into the future of UPS insurance rates.

Understanding UPS Insurance Rates

UPS insurance rates are designed to protect shippers against loss or damage to their packages during transit. Understanding the factors that influence these rates is crucial for businesses and individuals seeking to ensure their shipments are adequately covered.

Factors Influencing UPS Insurance Rates

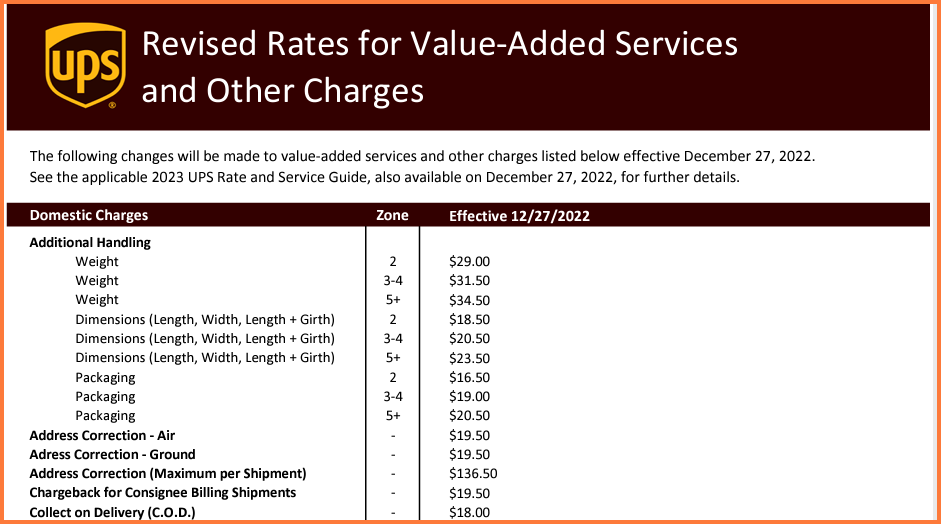

The cost of UPS insurance is determined by a combination of factors, including the value of the package, the destination, and the service type chosen.

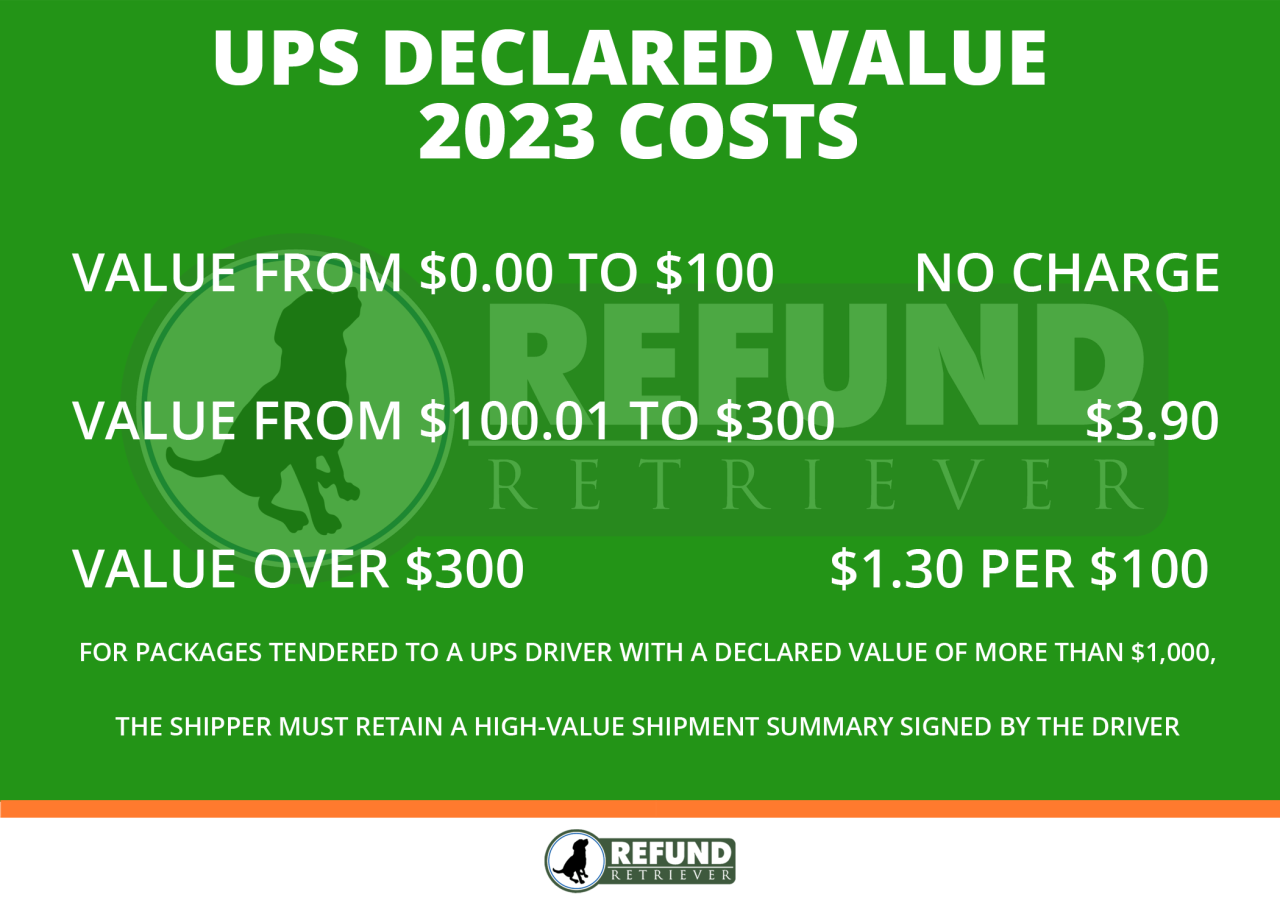

- Package Value: The primary factor determining insurance cost is the declared value of the package. Higher declared values result in higher premiums.

- Destination: Shipping packages to international destinations often incurs higher insurance rates due to increased risks associated with longer transit times and complex customs procedures.

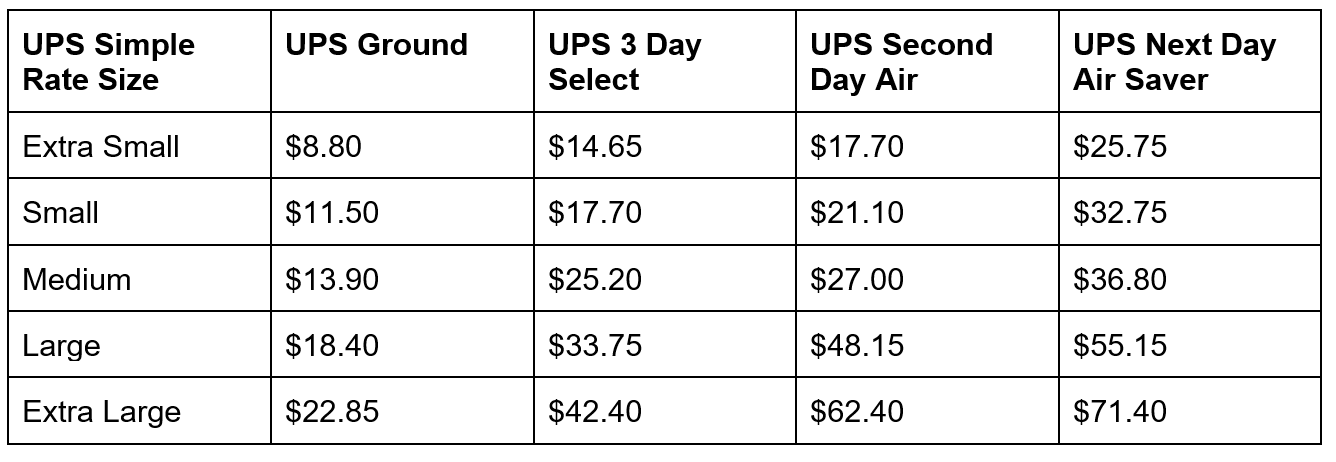

- Service Type: The chosen shipping service also influences insurance costs. Expedited services, such as UPS Next Day Air, typically have higher premiums due to the faster delivery time and associated risks.

Types of UPS Insurance Coverage

UPS offers various insurance coverage options to meet different needs and budgets.

- Basic Coverage: Included with all UPS shipments, this coverage provides limited protection against loss or damage, typically up to $100 per package.

- Declared Value Coverage: This option allows shippers to declare the full value of their package and purchase insurance for the declared amount.

- Additional Coverage: For valuable or sensitive shipments, UPS offers additional coverage options, such as coverage for specific perils like theft or accidental damage.

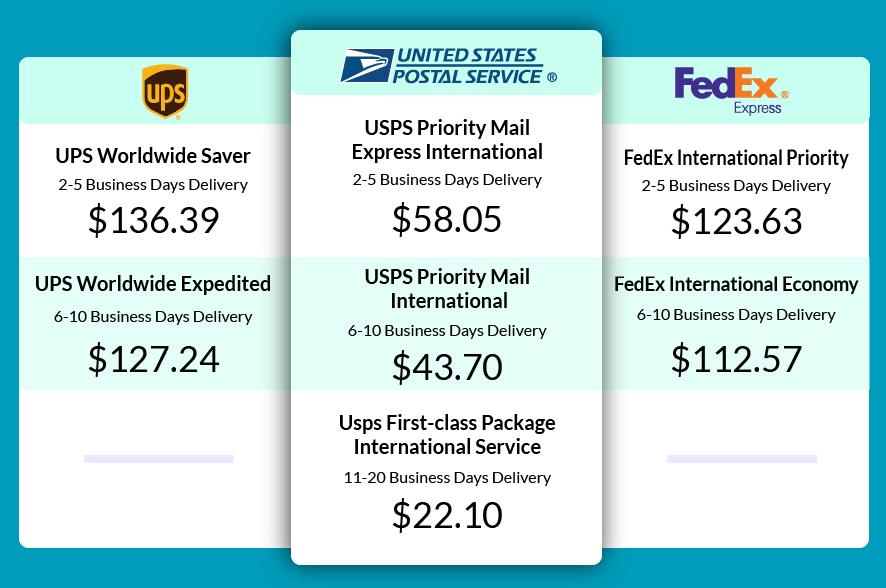

Cost Comparison with Other Carriers

UPS insurance rates are generally competitive with other shipping carriers. However, it’s essential to compare rates and coverage options from different carriers to find the best value for your specific needs.

Factors such as package value, destination, and service type can significantly impact insurance costs across different carriers.

Factors Contributing to Rising UPS Insurance Rates

The recent surge in UPS insurance rates is a complex issue driven by a confluence of factors, primarily stemming from the inflationary environment and the increasing demands placed on the shipping giant. These factors have significantly impacted UPS’s operational costs and claim payouts, ultimately necessitating adjustments to its insurance premiums.

Impact of Inflation

Inflation has significantly impacted UPS insurance rates. The rising cost of goods and services has directly impacted UPS’s operational expenses, including fuel, labor, and packaging materials. Consequently, the cost of claims has also risen, as damaged or lost shipments are now more expensive to replace. This inflationary pressure forces UPS to increase its insurance premiums to cover the escalating costs associated with its operations and claims.

Increased Shipping Volume and Demand

The exponential growth in e-commerce and the surge in consumer demand have led to a significant increase in shipping volume for UPS. This increased volume puts strain on UPS’s infrastructure and workforce, potentially leading to more mishandled packages and higher claims. To mitigate these risks, UPS may increase insurance premiums to account for the heightened probability of claims and the associated costs.

Changes in UPS’s Risk Assessment and Underwriting Practices

UPS’s risk assessment and underwriting practices play a crucial role in determining insurance rates. The company may adjust its risk assessment models to reflect evolving shipping patterns, customer demographics, and the types of goods being shipped. This adjustment could lead to higher premiums for certain types of shipments deemed to be more prone to damage or loss. Furthermore, UPS might introduce new underwriting practices, such as stricter requirements for packaging or shipping documentation, to minimize potential claims and manage its risk exposure.

Strategies for Minimizing UPS Insurance Costs

UPS insurance costs can significantly impact your bottom line, especially if you ship frequently. While it’s essential to protect your shipments, there are several strategies you can employ to minimize these expenses. By understanding the factors that influence insurance rates and implementing proactive measures, you can effectively reduce your insurance costs without compromising the safety of your goods.

Packaging Options and Their Impact on Insurance Rates

The packaging you choose plays a crucial role in determining your insurance rates. UPS assesses the risk associated with different packaging types, factoring in their ability to protect the contents during transit. Sturdy, well-designed packaging reduces the likelihood of damage, leading to lower insurance premiums.

Here are some key considerations:

- Use Sturdy Materials: Opt for boxes made from corrugated cardboard with a high burst test rating, ensuring they can withstand the rigors of shipping. Avoid using flimsy boxes or recycled materials that may compromise the integrity of your package.

- Proper Padding: Utilize appropriate cushioning materials like bubble wrap, packing peanuts, or foam inserts to protect fragile items from impact and vibration. Ensure adequate padding around all sides of the product to prevent movement within the box.

- Secure Closure: Properly seal boxes with strong tape, ensuring all flaps are securely adhered. Consider using reinforced tape for heavier or fragile shipments to prevent the box from opening during transit.

- Clear Labeling: Clearly label packages with “Fragile” or “Handle with Care” stickers to alert handlers of sensitive contents. Include a detailed description of the contents inside the box to facilitate proper handling and minimize potential damage.

Optimizing Shipping Practices to Reduce Damage

Effective shipping practices significantly reduce the risk of damage, leading to lower insurance premiums. By implementing a systematic approach to packing and handling, you can minimize the likelihood of claims and, in turn, lower your insurance costs.

- Inspect Packaging Before Packing: Before packing your items, carefully inspect boxes for any signs of damage, such as tears, punctures, or weak spots. Avoid using damaged boxes, as they may compromise the protection of your goods.

- Properly Pack Items: Securely pack items inside the box, ensuring they are properly padded and cannot move freely. Avoid overpacking, as it can increase the weight and stress on the box, making it more susceptible to damage.

- Choose the Right Shipping Method: Select the most appropriate shipping method for your needs, considering the fragility of the items, the distance they need to travel, and the delivery timeline. For fragile or valuable items, consider using a premium shipping service with enhanced handling and tracking capabilities.

- Securely Seal and Label Packages: Use strong tape to seal boxes securely, ensuring all flaps are firmly adhered. Clearly label packages with the recipient’s address and contact information, including a return address.

- Handle Packages with Care: When handling packages, avoid dropping or mishandling them. Use proper lifting techniques and ensure the packages are stacked securely to prevent damage.

Negotiating Better Insurance Rates with UPS

While UPS insurance rates are generally standardized, there are opportunities to negotiate better rates, particularly for high-volume shippers. By demonstrating a history of responsible shipping practices and leveraging your shipping volume, you can potentially secure more favorable insurance terms.

- Leverage Volume Discounts: If you ship large quantities of goods, inquire about volume discounts on insurance premiums. UPS may offer reduced rates for customers who consistently ship significant volumes.

- Demonstrate Low Claim History: A history of low claims can demonstrate your commitment to safe shipping practices and potentially qualify you for lower insurance rates. Maintain detailed records of your shipping activities and claims history to showcase your responsible handling practices.

- Explore Alternative Insurance Options: Consider exploring alternative insurance options, such as third-party insurance providers, to compare rates and coverage. You may find more competitive rates and tailored coverage options outside of UPS’s standard insurance offerings.

Alternative Insurance Options for UPS Shipments

While UPS offers its own insurance, it’s not the only option for protecting your shipments. Alternative insurance providers offer a range of policies designed to cater to the specific needs of businesses and individuals shipping with UPS.

Comparison of Insurance Options for UPS Shipments

Understanding the different insurance options available for UPS shipments is crucial for making informed decisions. Here’s a table comparing the key features of various insurance providers:

| Insurance Provider | Coverage Limits | Deductibles | Claim Procedures |

|---|---|---|---|

| UPS Insurance | Up to $100,000 per package | Varies based on declared value | File claim online or by phone |

| Third-Party Insurers (e.g., Chubb, AIG) | Customized coverage options | Variable, often negotiable | More comprehensive claim processes |

| Freight Forwarder Insurance | Typically covers entire shipment | May vary depending on carrier | Managed by freight forwarder |

Case Studies of UPS Insurance Rate Increases

UPS insurance rate increases have become a common occurrence in recent years, impacting businesses and consumers across various industries. These increases are often driven by a combination of factors, including rising shipping costs, increased claims, and evolving regulatory landscapes.

Examples of UPS Insurance Rate Increases Across Different Industries

The following case studies illustrate how UPS insurance rate increases have impacted businesses in different sectors:

- E-commerce: A rapidly growing online retailer specializing in electronics experienced a 15% increase in UPS insurance rates for shipments within the US. This increase was attributed to a surge in shipping volume during the holiday season, leading to higher claims due to increased handling and potential damage. The retailer adjusted its pricing strategy to absorb the increased insurance costs, passing on a small portion of the expense to customers.

- Healthcare: A medical device manufacturer witnessed a 10% increase in UPS insurance rates for shipments of sensitive medical equipment. This increase was linked to the growing demand for medical supplies, particularly during the COVID-19 pandemic. The company implemented stricter packaging protocols and opted for expedited shipping to minimize the risk of damage and reduce the likelihood of insurance claims.

- Manufacturing: A manufacturer of heavy machinery experienced a 20% increase in UPS insurance rates for shipments of large, complex components. This increase was attributed to the rising costs of materials and labor, leading to higher repair and replacement costs in case of damage. The company implemented a risk management program to identify and mitigate potential hazards during shipping, reducing the frequency of claims and ultimately lowering its insurance premiums.

Factors Contributing to UPS Insurance Rate Increases in Each Case Study

The case studies highlight several common factors that contribute to UPS insurance rate increases:

- Increased Shipping Volume: As online commerce and global trade continue to grow, UPS experiences a surge in shipping volume, leading to higher handling costs and increased risk of damage.

- Rising Claims Costs: The cost of repairing or replacing damaged goods has been steadily rising due to inflation and the increasing complexity of products.

- Evolving Regulatory Landscape: Changes in regulations, such as those related to hazardous materials handling and data privacy, can impact insurance rates by increasing the complexity and cost of compliance.

- Natural Disasters: Extreme weather events and natural disasters can disrupt shipping operations, leading to delays, damage, and increased insurance claims.

Impact of UPS Insurance Rate Increases on Businesses and Consumers

UPS insurance rate increases have a significant impact on businesses and consumers:

- Increased Shipping Costs: Businesses often pass on the increased insurance costs to customers, resulting in higher prices for goods and services.

- Reduced Profit Margins: Businesses may experience a reduction in profit margins if they cannot fully pass on the increased insurance costs to customers.

- Increased Risk Aversion: Businesses may become more risk-averse and opt for less cost-effective shipping options to reduce their insurance premiums.

- Consumer Burden: Consumers ultimately bear the brunt of increased insurance costs, paying higher prices for goods and services.

Industry Trends and Future Outlook for UPS Insurance Rates

The shipping and insurance industries are constantly evolving, influenced by factors such as technological advancements, economic conditions, and regulatory changes. These trends have a significant impact on UPS insurance rates, making it crucial for businesses to understand the factors that drive these changes.

Impact of E-commerce Growth and Supply Chain Disruptions

The surge in e-commerce activity has driven a significant increase in package volume, leading to greater demand for shipping and insurance services. The COVID-19 pandemic further exacerbated this trend, causing widespread supply chain disruptions and increased shipping costs. These disruptions have resulted in higher insurance premiums as carriers face increased risks of damage, loss, and delays.

Technological Advancements in Risk Assessment and Fraud Detection

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming risk assessment and fraud detection in the insurance industry. AI-powered algorithms can analyze vast amounts of data, including shipment history, package characteristics, and delivery routes, to identify potential risks and predict future claims. This enables insurers to refine their pricing models, potentially leading to more accurate and customized insurance rates.

Increased Focus on Sustainability and Environmental Risks

The growing awareness of climate change and its impact on shipping operations has prompted insurers to consider environmental factors in their risk assessments. This includes evaluating the potential for extreme weather events, such as hurricanes and floods, to disrupt shipping routes and damage packages. As a result, insurance premiums for shipments that traverse vulnerable areas or utilize less sustainable transportation methods may increase.

Expert Opinions and Forecasts

Industry experts predict that UPS insurance rates will continue to rise in the coming years, driven by the factors discussed above. The increasing complexity of supply chains, rising shipping costs, and the need for more sophisticated risk management strategies will contribute to higher premiums.

“The insurance industry is facing a perfect storm of rising claims costs, increasing volatility, and the need to adapt to new technologies,” said [Expert Name], a leading insurance analyst. “These factors will continue to drive up insurance rates across all sectors, including shipping.”

In addition to rising rates, businesses can expect to see a greater emphasis on data-driven risk assessment, personalized insurance plans, and the integration of sustainability considerations into insurance pricing models.

UPS Insurance Claims Process

Navigating the UPS insurance claims process is crucial for recovering losses from damaged or lost goods. Understanding the steps involved, required documentation, and effective strategies can significantly impact the outcome of your claim.

Steps in Filing a UPS Insurance Claim

The claims process for damaged or lost goods insured by UPS typically involves the following steps:

- Report the Damage or Loss: Contact UPS immediately upon discovering the damage or loss, providing details about the shipment, including the tracking number, date of shipment, and nature of the issue.

- File a Claim: Submit a claim form through UPS’s website or by contacting their customer service department. The form will require information about the shipment, the value of the goods, and details about the damage or loss.

- Provide Supporting Documentation: Gather and submit any relevant documentation to support your claim. This may include:

- Proof of purchase for the goods

- Photographs or videos of the damaged goods

- Delivery confirmation from UPS

- Police report (if applicable)

- UPS Investigation: UPS will review your claim and conduct an investigation. This may involve contacting the shipper and receiver, inspecting the damaged goods, and reviewing shipping records.

- Claim Approval or Denial: UPS will notify you of their decision regarding your claim. If approved, the payment will be processed according to the terms of your insurance policy. If denied, UPS will provide a detailed explanation of the reasons for denial.

Documentation and Evidence Required for UPS Insurance Claims

Adequate documentation is essential for supporting a UPS insurance claim and increasing the likelihood of successful recovery. Key documents include:

- Proof of Purchase: This document establishes the value of the goods and provides evidence of ownership. It can be a sales receipt, invoice, or other purchase documentation.

- Photographs or Videos: Visual evidence of the damage or loss is crucial. Capture clear images or videos of the damaged goods, packaging, and any other relevant details.

- Delivery Confirmation: UPS delivery confirmation provides evidence of the shipment’s arrival and condition. This can be a signature confirmation, delivery scan, or other tracking information.

- Police Report: If the loss involves theft or other criminal activity, a police report is essential for supporting the claim.

- Shipping Manifest: This document details the contents of the shipment and can be helpful in identifying the specific items that were damaged or lost.

Strategies for Navigating the UPS Insurance Claims Process

- Act Promptly: Contact UPS immediately upon discovering the damage or loss to initiate the claims process.

- Document Thoroughly: Gather all relevant documentation and evidence to support your claim. Take clear photographs and videos of the damage or loss.

- Communicate Effectively: Maintain open and clear communication with UPS throughout the claims process. Respond to any inquiries promptly and provide any requested information.

- Keep Records: Maintain a record of all communications, documents, and evidence related to your claim.

- Seek Legal Advice: If you encounter difficulties or believe that your claim has been unfairly denied, consider seeking legal advice from an experienced shipping and insurance attorney.

Tips for Avoiding UPS Insurance Claims

Minimizing the risk of insurance claims is a crucial aspect of managing shipping costs. While UPS insurance offers financial protection against losses, proactive measures can significantly reduce the likelihood of needing to file a claim in the first place. By adopting best practices for packaging, labeling, and shipping, businesses can minimize the potential for damage to their goods during transit.

Proper Packaging for Protection

Proper packaging is the cornerstone of preventing damage during shipping. A well-designed package acts as a buffer, absorbing shocks and protecting goods from external forces. Here are some key considerations for effective packaging:

- Choose the Right Box: Select a box that is the appropriate size for your goods. A box that is too large can allow items to move around, increasing the risk of damage. Conversely, a box that is too small can lead to crushing or bending of the contents.

- Use Protective Padding: Fill empty spaces within the box with cushioning materials like bubble wrap, packing peanuts, or foam. This helps absorb shocks and prevent items from shifting during transport.

- Securely Pack Items: Place fragile items in the center of the box, surrounded by cushioning. Secure heavy items to the bottom of the box to prevent them from shifting.

- Use the Right Tape: Use high-quality packing tape to seal the box securely. Avoid using masking tape or duct tape, which can easily tear or come unstuck.

Labeling for Clarity and Accuracy

Clear and accurate labeling is essential for efficient handling and delivery. Accurate labels ensure that packages reach their destination without delays or misdirection, reducing the risk of damage or loss.

- Include a Return Address: Always include a clear return address on the package. This helps UPS locate the sender in case of any issues or delays.

- Use a Shipping Label: Use a pre-printed shipping label with the correct address and tracking information. Handwritten labels can be difficult to read and can lead to errors.

- Mark Fragile Items: Clearly mark fragile items with “Fragile” stickers or labels. This alerts handlers to take extra care when handling the package.

- Include Contact Information: Include the recipient’s contact information on the label. This allows UPS to contact the recipient if there are any delivery issues.

Shipping Checklist for Reduced Risk

Before shipping, it’s helpful to create a checklist to ensure that all necessary steps have been taken to minimize the risk of insurance claims.

- Inspect Goods: Before packaging, inspect goods for any pre-existing damage. Document any existing damage to avoid potential disputes later.

- Choose the Right Shipping Method: Consider the nature of the goods and the destination when selecting a shipping method. Some items may require specialized handling or expedited shipping.

- Review Shipping Terms: Familiarize yourself with UPS’s shipping terms and conditions. This will help you understand your responsibilities as a shipper.

- Document the Package: Take photos of the packaged goods before shipping. This documentation can be valuable if you need to file an insurance claim.

UPS Insurance Policies and Exclusions

UPS offers insurance coverage for shipments, protecting against loss or damage during transit. While this provides peace of mind, it’s essential to understand the limitations and exclusions within these policies.

UPS insurance policies are designed to cover a range of potential risks, including:

Coverage Provisions

UPS insurance policies generally cover the following:

* Loss or damage due to mishandling: This includes instances where the package is dropped, crushed, or otherwise damaged during handling.

* Theft or pilferage: Coverage extends to packages stolen during transit.

* Natural disasters: Damage caused by events like floods, earthquakes, or hurricanes may be covered.

* Accidental damage: Coverage can apply to packages damaged due to accidents, such as a vehicle collision.

Exclusions

It’s crucial to note that UPS insurance policies have certain exclusions. These are instances where coverage is not provided. Common exclusions include:

* Intrinsic value: UPS insurance typically does not cover the intrinsic value of items, such as the sentimental value of a family heirloom.

* Perishable goods: Coverage may be limited or excluded for perishable goods, like food or flowers, as their condition can deteriorate during transit.

* Illegal or prohibited items: UPS insurance does not cover shipments of illegal or prohibited items, such as weapons or narcotics.

* Pre-existing damage: UPS insurance does not cover damage that existed prior to the shipment.

* Improper packaging: If a package is not properly packaged, resulting in damage during transit, coverage may be denied.

* Acts of war or terrorism: Coverage for losses or damages caused by war or terrorism is typically excluded.

Common Insurance Claim Denials

UPS insurance claims can be denied for various reasons. Some common instances of claim denials include:

* Insufficient packaging: Packages that are not properly protected can be easily damaged during transit, leading to claim denials.

* Incorrectly declared value: If the value of the shipment is underestimated, the insurance payout may be insufficient to cover the actual loss.

* Missing documentation: Claims may be denied if essential documentation, such as the original receipt or proof of purchase, is missing.

* Delay in reporting: Filing a claim promptly is essential. If you delay reporting the loss or damage, your claim may be denied.

Conclusive Thoughts

As shipping costs continue to fluctuate, staying informed about UPS insurance rates is essential for businesses and individuals seeking to minimize expenses and protect their shipments. By understanding the factors driving these rates, exploring cost-saving strategies, and staying abreast of industry trends, stakeholders can make informed decisions and navigate the evolving landscape of UPS insurance.