Introduction to Car Insurance in Colorado

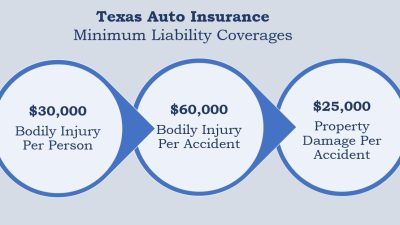

Car insurance is a crucial aspect of vehicle ownership in Colorado, where the legal framework mandates certain coverage requirements to protect drivers, pedestrians, and other road users. In the state, drivers are required to carry minimum liability insurance, which serves as the foundational element of car insurance policies. The minimum coverage required by law includes bodily injury liability and property damage liability, ensuring that motorists can cover costs associated with injuries to others and damages to their property in the event of an accident.

Understanding the legal obligations surrounding car insurance in Colorado is essential for all drivers. The penalties for driving without insurance can be severe, ranging from monetary fines to suspension of driving privileges. These repercussions underscore the importance of adhering to state insurance laws to avoid legal complications and ensure personal and public safety on the roads. Additionally, the financial implications of inadequate insurance can be substantial; drivers involved in accidents without sufficient coverage may face significant out-of-pocket expenses for medical bills, vehicle repairs, and other associated costs.

Beyond the mandatory coverage, car insurance in Colorado offers a variety of additional coverage options, such as comprehensive and collision coverage, which can provide further financial protection. Comprehensive coverage protects against non-collision-related incidents such as theft or vandalism, while collision coverage addresses damage to your vehicle resulting from an accident, regardless of fault. Considering various car insurance quotes in Colorado allows drivers to tailor their policies to their specific needs and risk levels, enhancing their overall protection.

In light of these factors, it is clear that obtaining adequate car insurance is not only a legal necessity in Colorado but also a pivotal financial safeguard. By being informed about the state’s requirements and the types of coverage available, drivers can make informed decisions regarding their car insurance options, ensuring they are adequately protected on the road.

Factors That Influence Car Insurance Quotes in Colorado

When it comes to obtaining car insurance quotes in Colorado, several key factors come into play that insurance companies utilize to assess the risk associated with the driver and the vehicle. Understanding these factors can help individuals manage their premiums more effectively and find the best possible rates.

One of the primary considerations is the driver’s age. Statistically, younger drivers, particularly those under 25, are considered higher-risk due to their lack of experience. Consequently, car insurance quotes for this demographic tend to be higher. In contrast, older, more experienced drivers often enjoy lower premiums, provided their driving records are clean.

Another crucial factor is the driver’s driving history. A record free of accidents and violations can significantly reduce insurance premiums. Conversely, a history of accidents or tickets can lead to increased rates, as insurers view these drivers as higher-risk. Regularly reviewing one’s driving habits and maintaining a clean record is an effective strategy for individuals looking to lower their car insurance quotes in Colorado.

The credit score of the applicant also plays an important role in determining car insurance quotes. Insurers often use credit scores as an indicator of responsibility and reliability. A high credit score can lead to lower premiums, while a poor score may result in higher costs.

The type of vehicle being insured is equally significant. Cars that are deemed safer tend to attract lower premiums, while high-performance or luxury vehicles usually come with higher insurance costs. Similarly, the location where the vehicle is primarily parked can influence rates; areas with higher crime rates generally result in higher insurance quotes.

Finally, the annual mileage driven adds another layer of complexity. Individuals who drive less each year can often receive lower car insurance quotes as they are statistically less likely to be involved in accidents. Monitoring driving habits and making conscious decisions about vehicle usage can ultimately aid in securing more favorable insurance rates.

By understanding these factors, Colorado residents can take proactive measures to improve their risk profile, potentially leading to more competitive car insurance quotes. Engaging with insurers to discuss these considerations can further enhance the likelihood of securing the best coverage at the most affordable price.

How to Obtain and Compare Car Insurance Quotes

Obtaining and comparing car insurance quotes in Colorado is a crucial step for any driver seeking appropriate coverage. The first step in this process is to research various insurance providers operating in the state. There are numerous local and national insurance companies that offer tailored policies, and a comprehensive understanding of their offerings can help you make a more informed choice.

Utilizing online comparison tools is an effective way to gather multiple car insurance quotes quickly. These platforms allow potential policyholders to input their basic information and receive instant quotes from various insurers, making it easier to compare rates and coverage options side by side. However, it is also advisable to seek personalized quotes from insurance agents, as they can provide valuable insights and help tailor policies to your specific needs.

When requesting car insurance quotes in Colorado, be prepared to provide information such as your vehicle’s make and model, your driving history, and demographic details like age and location. This information assists insurers in accurately assessing risk and determining premiums. Additionally, it is important to carefully analyze the details of each quote. Factors such as coverage options, deductibles, and customer service ratings should all be considered. Reading customer reviews and ratings can provide helpful insight into an insurer’s reliability and responsiveness.

Moreover, understanding the fine print in each insurance policy is critical. Features such as limits on liability coverage, exclusions for certain situations, and specific claims processes can significantly affect your coverage. By closely examining these details and comparing various quotes, you can ensure you are making a well-informed decision, ultimately selecting an insurance policy that meets your needs without exceeding your budget.

Tips for Saving on Car Insurance in Colorado

Finding affordable car insurance quotes in Colorado doesn’t have to be a daunting task. By employing some strategic approaches, residents can significantly reduce their premiums while ensuring they maintain adequate coverage. One effective strategy is bundling policies. Many insurance companies offer discounts for customers who combine their car insurance with other policies, such as homeowners or renters insurance. This not only simplifies your billing but can lead to substantial savings on your overall premiums.

Another key approach is to take advantage of discounts offered for safe driving. Many insurance providers offer lower rates to drivers with clean driving records, so maintaining a history free of accidents and violations is essential. Additionally, some companies may provide incentives to those who complete defensive driving courses. These courses can help improve your driving skills and may also lead to reduced insurance costs.

Usage-based insurance programs represent another growing option in the Colorado car insurance market. These programs adjust your premiums based on your actual driving behavior, such as miles driven and driving habits. This could be a beneficial choice for those who drive less frequently or practice safe driving. By monitoring your driving and utilizing these programs, you can see a tangible decrease in your car insurance costs.

Regularly reviewing and adjusting your coverage limits is also crucial. Over time, your needs may change, and your insurance policy should reflect that. By maintaining appropriate limits tailored to your current situation, you can avoid overpaying for unnecessary coverage. Lastly, it is essential to shop around for car insurance quotes annually. Comparing different insurers can uncover better rates and potential discounts, ensuring you receive the best value for your insurance premiums.

By implementing these strategies, Colorado residents can effectively lower their car insurance costs while enjoying peace of mind regarding their coverage.