What is Auto Insurance?

Auto insurance is a contractual agreement between a vehicle owner and an insurance provider, designed to provide financial protection against various risks associated with owning and operating a motor vehicle. The primary purpose of auto insurance is to mitigate the financial burdens that can arise from accidents, theft, or damage to vehicles, thereby offering peace of mind for drivers. By paying a premium, insured individuals can transfer some of the risks associated with their vehicle to the insurance company.

Several types of auto insurance policies cater to different needs and circumstances. Liability insurance is the most common form, covering damages to other people’s property and medical expenses arising from an accident where the policyholder is at fault. Collision insurance pays for damages to the policyholder’s vehicle after an accident with another vehicle, regardless of who is at fault. Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, or natural disasters. Personal Injury Protection (PIP) offers medical coverage for the policyholder and their passengers, regardless of fault, ensuring that immediate medical expenses are covered following an accident.

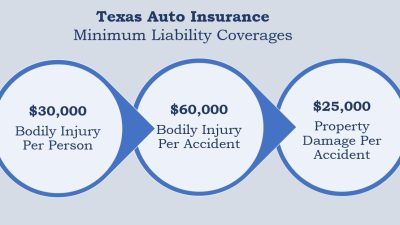

The legal requirements for auto insurance vary greatly by region. Many states or countries mandate that drivers maintain a minimum level of liability coverage. This requirement emphasizes the importance of safeguarding oneself and other road users from potential financial ruin resulting from accidents. Failing to meet these legal requirements can lead to severe penalties, including fines and the possibility of losing one’s driving privileges.

In the evolving landscape of vehicle ownership and road safety, understanding auto insurance and its critical role in protecting drivers is essential. This knowledge enables vehicle owners to make informed choices about the insurance coverage that best suits their needs, ultimately reducing financial risks associated with automobile ownership.

Types of Auto Insurance Coverage

Understanding the various types of auto insurance coverage is essential for vehicle owners looking to protect themselves and their assets. One of the most fundamental types is liability coverage, which is designed to protect policyholders against claims of bodily injury or property damage inflicted on others in an accident for which they are at fault. This coverage usually comes in two parts: bodily injury liability and property damage liability. The former covers medical expenses for injured parties, while the latter covers damage to another person’s vehicle or property.

Another significant coverage type is collision coverage. This is particularly valuable, as it assists in paying for repairs to the insured vehicle after an accident, regardless of who is at fault. Collision coverage is crucial for drivers who want peace of mind knowing that their own vehicle will be repaired without a large out-of-pocket expense, irrespective of the circumstances surrounding the accident.

Comprehensive coverage offers protection beyond collisions by covering non-collision-related incidents. This can include theft, vandalism, or damages resulting from natural disasters, such as floods or fires. As such, comprehensive coverage can provide vehicle owners with a broader safety net, ensuring they are safeguarded against unforeseen events that could otherwise lead to significant financial burdens.

Finally, uninsured/underinsured motorist coverage becomes critical in situations where an accident occurs with a driver who does not have adequate insurance to cover damages. This type of coverage helps ensure that individuals are protected financially, even if the responsible party lacks sufficient auto insurance. Understanding these various types of coverage allows vehicle owners to tailor their auto insurance policies to meet their specific needs and financial circumstances, creating a customized approach to risk management in vehicular operations.

Factors That Affect Auto Insurance Premiums

When it comes to auto insurance, understanding the various factors that contribute to the determination of premiums is essential for policyholders. Insurance companies analyze a wide range of criteria to establish the risk associated with insuring a driver and their vehicle. The first significant factor is the driver’s personal details, which include their age, gender, and driving history. Younger drivers, for instance, often face higher premiums due to a lack of experience on the road, while older, more experienced drivers may benefit from lower rates.

Another key element is the type of vehicle being insured. Insurance premiums can vary considerably depending on the make and model of a car. High-performance vehicles or those with a greater likelihood of theft can lead to elevated insurance rates. In contrast, vehicles that are known for their safety features and low repair costs may be subject to lower premiums. Therefore, selecting a vehicle with a good safety record can be a meaningful way to influence auto insurance costs.

Location also plays a crucial role in determining insurance rates. Drivers residing in urban areas typically face higher premiums due to a greater likelihood of accidents and theft compared to those in rural locations. Furthermore, the competition within the insurance market, as well as state regulations, significantly impacts premium costs. Regions with more insurance providers generally offer competitive rates, benefiting consumers. Lastly, an individual’s credit score can also influence their auto insurance premium. Insurers often utilize credit history as an indicator of risk, whereby those with better credit scores may qualify for lower rates.

By understanding these factors, drivers can make informed decisions that may help in reducing their auto insurance premiums. Knowledge of personal choices and external influences provides a path towards better financial management in terms of auto insurance coverage.

How to Choose the Right Auto Insurance Policy

Selecting the appropriate auto insurance policy can be a challenging task, given the various options available in the market. To begin with, one must assess their individual coverage needs based on personal circumstances. For instance, consider factors such as the type of vehicle, driving habits, and whether the car is financed or leased. A comprehensive understanding of one’s unique situation will help in identifying suitable coverage levels.

Once the coverage needs have been established, the next step is to compare quotes from different insurers. It is advisable to gather multiple quotes to ensure a comprehensive view of available options. This can be accomplished using online tools or by consulting with insurance agents. Keep in mind that the cheapest option is not always the best. It is essential to evaluate what is included in each insurance quote, as discrepancies in coverage can lead to unforeseen expenses in the future.

Moreover, understanding the policy details and fine print is crucial. Auto insurance policies often contain jargon and terminology that may be confusing. Therefore, take the time to read and comprehend the terms, conditions, limits, and exclusions listed in the policy documents. This will help in knowing what is covered and what is not, ensuring that there are no unpleasant surprises at the time of a claim.

Customer service ratings should also be considered when choosing an auto insurance provider. A company that offers excellent customer support can make a significant difference in the claims process. Look at customer reviews and ratings to gauge experiences from other policyholders. Additionally, balancing premiums with coverage quality is vital. It may be beneficial to seek professional advice to understand the potential risks and rewards associated with various policies. Ultimately, thorough research and self-advocacy are essential for achieving optimal policy selection. Taking the time to inform oneself will lead to a more satisfying auto insurance experience.