Hunting for the perfect Texas auto insurance quote? Whoa, hold your horses! Finding the right coverage shouldn’t feel like navigating a maze in a dust storm. It’s a jungle out there, brimming with confusing jargon & endless options. You need a clear path, a trusty compass, & maybe even a camel (just kidding… mostly). This guide is your desert oasis. We’ll cut through the clutter & help you find the best Texas auto insurance quote tailored to your needs, whether you’re a seasoned driver cruising down I-35 or a fresh-faced newbie just getting your license.

First things first: forget everything you think you know about auto insurance comparisons. Forget the tedious hours spent sifting through websites cluttered with small print. Think less headache, more “yeehaw!” because we’re making it easy. We’re here to tell you, straight up, how to snag the perfect quote – no hidden fees, no fine print traps, no sneaky surprises lurking around the corner like a tumbleweed in a wild west shootout!

We’ll spill the beans on how to navigate those comparison websites (trust us, some are WAY better than others). We’ll highlight the must-have coverage options – no, really, this part’s important. You can’t just wing it in the Lone Star State. We’ll dive into the factors influencing your rates. Think driving history, location, car type, age… everything! Understanding these factors gives you the power. You’ll know exactly what to tweak for better prices – it’s all about leverage!

Finding a cheap auto insurance quote isn’t about compromising on coverage, it’s about being smart. Being a savvy shopper means knowing where to look and what to ask for. Are you a responsible driver? Excellent! Let’s leverage that good driving record. Do you drive a fuel-efficient car? High five! Use that to your advantage. Are you willing to bundle your home & auto insurance? Bingo! We’ll help you strategize so you score a lower price without sacrificing the quality of your protection – that’s the key.

Stop wasting time jumping from site to site. This isn’t a treasure hunt, folks! Our guide helps you unearth the secrets to bagging a phenomenal Texas auto insurance quote that fits your budget & lifestyle perfectly. So buckle up, cowboy, because finding the right insurance doesn’t have to be a wild ride – it can be smooth sailing from now on. This is your ultimate how-to guide. It’s concise, to the point and gives you power to control your car insurance payments. Read on to discover everything you need to know.

Getting the optimal Texas Auto Insurance Quote: A thorough Guide

Finding the right Texas auto insurance can feel overwhelming. With so many companies and coverage options, securing the optimal quote requires understanding your needs and the Texas auto insurance landscape. This guide will walk you through the process, helping you navigate the complexities and find affordable, reliable car insurance.

Understanding Texas Auto Insurance Requirements

Texas requires all drivers to carry a minimum level of liability car insurance. This is crucial for protecting yourself financially if you cause an accident.

What is the minimum car insurance coverage required in Texas?

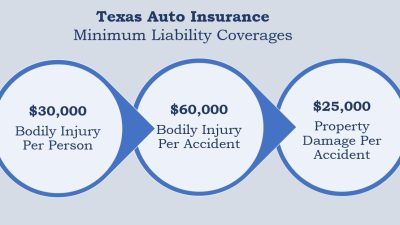

The minimum requirement in Texas is 30/60/25 liability coverage. This means $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. However, this minimum might not be sufficient to cover significant damages in a serious accident.

What are the varied types of car insurance coverage?

- Liability: Covers damages and injuries you cause to others.

- Collision: Covers damage to your vehicle, regardless of fault.

- thorough: Covers damage to your vehicle from non-collision events (theft, vandalism, weather).

- Uninsured/Underinsured Motorist: Protects you if you’re hit by an uninsured or underinsured driver.

How do I select the right coverage levels?

Consider your assets, financial situation, and risk tolerance when selecting coverage levels. Higher coverage offers greater protection but comes with higher premiums. Consult with an insurance agent to determine the optimal fit for your individual circumstances.

What are the penalties for driving without insurance in Texas?

Driving without insurance in Texas is illegal and carries significant penalties, including fines, license suspension, and even jail time.

Finding the Perfect Texas Auto Insurance Quote for You

Getting quotes is the next step. Several methods are available.

How to get a Texas auto insurance quote online?

Many companies offer online quote tools. Simply input your information for a quick estimate.

What information do insurance companies need?

Insurers need details about your driving history, vehicle information (year, make, model), address, and personal details.

How do comparison websites work?

Comparison websites allow you to see quotes from multiple insurers side-by-side. While reliable, they may not list every company.

Should I contact insurance companies directly?

Directly contacting insurers allows for personalized service and detailed descriptions of policies.

What factors affect my car insurance premium?

Age, driving record, credit score (in some cases), location, and vehicle type all influence your premium.

Deciphering Your Texas Auto Insurance Quote

Understanding your quote is essential.

What does each part of my car insurance quote mean?

Your quote outlines coverage details, premiums, deductibles, and payment options.

Understanding deductibles and premiums:

Deductibles are the amount you pay out-of-pocket before your insurance kicks in; premiums are your regular payments.

How can I lower my Texas auto insurance costs?

Discounts for safe driving, bundling policies, and maintaining a good driving record can significantly reduce costs.

What are common add-ons?

Roadside assistance and rental car reimbursement are valuable add-ons to consider.

Choosing the Right Texas Auto Insurance Company

Thorough study is key.

How do I compare varied auto insurance companies?

Compare coverage options, customer service ratings, and financial stability.

What are some top-rated companies?

study and compare several companies to find what optimal suits your needs.

Reading and understanding insurance company reviews:

Online reviews and ratings offer valuable insights into customer experiences.

What querys should I ask?

Ask about coverage details, claims processes, and customer service availability.

Maintaining Your Texas Auto Insurance Policy

Keeping your policy current is vital.

How to update my information?

Notify your insurer promptly of any address changes, new vehicles, or other pertinent updates.

What to do if I need to file a claim?

Report accidents promptly to your insurance company, following their instructions carefully.

Understanding your policy documents and renewal process:

Review your policy documents regularly, understanding renewal dates and processes.

How to cancel your Texas auto insurance policy:

Follow your insurer’s cancellation procedures; ensure you have suitable replacement coverage.

Texas Specific Auto Insurance Considerations

Texas has unique facets to consider.

Does Texas have a points system?

Yes, traffic violations outcome in points on your driving record, impacting your insurance premiums.

How does location impact my quote?

Urban areas tend to have higher premiums than rural areas due to boostd accident rates.

Are there specific discounts for Texas residents?

Good student discounts and others may be available.

Texas laws regarding SR-22 insurance:

SR-22 insurance is required for certain high-risk drivers.

Conclusion: Securing Affordable and Reliable Texas Auto Insurance

Finding the right Texas auto insurance involves careful planning and study. By understanding your needs, comparing quotes, and choosing wisely, you can secure affordable and reliable protection for yourself and your vehicle. Remember, driving without insurance is a serious offense in Texas, so obtaining adequate coverage is crucial.