In the fast-paced digital age, our smartphones are more than just communication devices; they’re essential tools for work, entertainment, and personal connection. But what happens when your precious phone meets an untimely demise? T-Mobile offers insurance plans to help you navigate such unfortunate situations, but the process can be confusing, especially when it comes to understanding your claim number. This comprehensive guide will demystify T-Mobile insurance claims, providing a clear roadmap for filing, tracking, and resolving your claim, with a special focus on the importance of your claim number.

From understanding the different insurance plans and their coverage to deciphering claim status updates and navigating potential denials, this guide will equip you with the knowledge and tools to confidently navigate the T-Mobile insurance claims process. Whether you’ve experienced a cracked screen, accidental water damage, or theft, this guide will provide you with the information you need to ensure a smooth and successful claim resolution.

Understanding T-Mobile Insurance

T-Mobile offers insurance plans to protect your mobile devices against damage, theft, and other unforeseen events. These plans provide peace of mind, ensuring you can replace or repair your device if something happens.

Types of T-Mobile Insurance Plans

T-Mobile offers two main insurance plans:

- T-Mobile JUMP! Protection: This plan provides comprehensive coverage for your device against accidental damage, theft, and malfunctions. It also includes a deductible that you need to pay before T-Mobile covers the remaining cost of repairs or replacement.

- T-Mobile Insurance: This plan provides coverage for accidental damage and theft but does not cover malfunctions. It typically has a lower deductible compared to JUMP! Protection.

Coverage Provided by T-Mobile Insurance Plans

- Accidental Damage: Covers damage caused by drops, spills, or other accidents.

- Theft: Covers theft of your device, but may require you to file a police report.

- Malfunctions: Covered by JUMP! Protection but not by T-Mobile Insurance. This covers device malfunctions due to manufacturing defects or software issues.

Costs Associated with T-Mobile Insurance Plans

The cost of T-Mobile insurance plans varies depending on the type of plan, the device being insured, and the coverage level selected.

- T-Mobile JUMP! Protection: The cost typically ranges from $10 to $15 per month.

- T-Mobile Insurance: The cost typically ranges from $5 to $10 per month.

Claim Filing Process

Filing a claim with T-Mobile insurance is a straightforward process designed to ensure a smooth experience for customers. Whether you’re dealing with a damaged or lost device, the process is designed to be efficient and customer-friendly.

Steps Involved in Filing a Claim

T-Mobile’s insurance claim process involves a series of steps to ensure a complete and accurate assessment of the situation.

- Report the Incident: The first step is to report the incident to T-Mobile. This can be done by calling their customer service line or through their online portal. Be prepared to provide details about the incident, including the date, time, and location of the damage or loss.

- Provide Claim Information: Once you’ve reported the incident, T-Mobile will guide you through the process of filing a claim. This will involve providing details about your device, the nature of the damage, and any relevant documentation.

- Choose a Claim Method: T-Mobile offers multiple options for filing a claim, including online, by phone, or through their mobile app. Choose the method that best suits your preferences and circumstances.

- Review and Submit: After providing all the necessary information, review your claim details carefully before submitting it. This ensures accuracy and helps prevent any delays in processing.

- Claim Processing: Once your claim is submitted, T-Mobile will begin the processing phase. This may involve reviewing your documentation, contacting you for further information, or scheduling a device inspection.

- Claim Approval or Denial: After reviewing your claim, T-Mobile will notify you of their decision. If approved, they will Artikel the next steps, including the replacement or repair process.

Contacting T-Mobile Customer Support

T-Mobile offers multiple channels for customers to seek assistance with insurance claims.

- Phone Support: Contact their dedicated customer service line at [phone number] for immediate assistance.

- Online Chat: Access live chat support through their website for real-time assistance.

- Mobile App: T-Mobile’s mobile app provides a convenient platform for managing claims and communicating with customer support.

- Social Media: Reach out to T-Mobile on their social media channels for inquiries and support.

Required Documentation for Submitting a Claim

To ensure a smooth claim process, it’s essential to have the following documentation readily available:

- Proof of Purchase: Provide a copy of your device’s purchase receipt or proof of ownership.

- Device IMEI Number: The IMEI number uniquely identifies your device and is crucial for claim processing.

- Police Report (if applicable): If your device was stolen, a police report is required to support your claim.

- Photos of Damage: Capture clear photos of any damage to your device to document the extent of the issue.

Claim Number Importance

Your T-Mobile insurance claim number is a crucial identifier, acting as a unique key to your specific claim. It’s the primary tool for tracking the progress of your claim, ensuring its proper processing and facilitating communication between you and T-Mobile insurance.

Claim Number Tracking

The claim number is the cornerstone of the T-Mobile insurance claim process. It’s used to:

* Identify your claim: Each claim is assigned a unique number, making it easy to differentiate from others.

* Track progress: The claim number allows T-Mobile insurance to track the status of your claim, from initial filing to resolution. This helps in monitoring the progress of repair, replacement, or reimbursement.

* Facilitate communication: When you contact T-Mobile insurance regarding your claim, you’ll be asked for your claim number. This helps them quickly access your information and provide updates.

Claim Number Storage and Access

Keeping your claim number safe and accessible is vital for smooth claim management. Here are some tips:

* Record it in a safe place: Note it down in a notebook, your phone’s notes app, or a dedicated file. Avoid storing it only on a device that could be lost or damaged.

* Keep it readily accessible: Ensure you can easily access the number when needed.

* Share it with others: If you’re sharing your claim details with family or friends, provide them with the claim number for reference.

* Don’t share it publicly: Never post your claim number on social media or in public forums.

* Contact T-Mobile insurance if lost: If you lose your claim number, contact T-Mobile insurance to retrieve it. They can help you locate it or issue a new one.

Claim Status Tracking

Once you’ve filed your claim, you’ll want to stay informed about its progress. T-Mobile offers several ways to track your claim status, ensuring you’re in the loop throughout the process.

Claim Status Updates

T-Mobile provides regular updates on the status of your claim. These updates can include:

- Claim Received: This update confirms that T-Mobile has received your claim and is starting to process it.

- Claim Under Review: This means T-Mobile is reviewing the details of your claim and may be requesting additional information from you.

- Claim Approved: This update indicates that your claim has been approved, and T-Mobile will be proceeding with the repair or replacement of your device.

- Device Shipped: This update informs you that your replacement device has been shipped and provides you with a tracking number.

- Claim Closed: This update indicates that your claim has been successfully processed and closed.

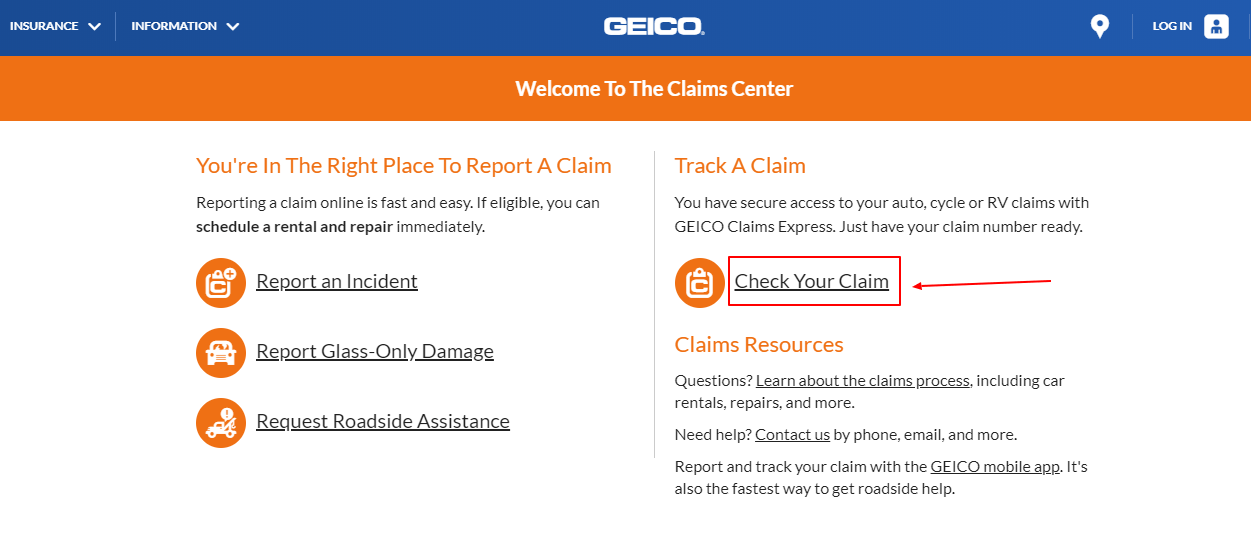

Checking Claim Status

You can check the status of your claim online or through the T-Mobile app.

Online

To check your claim status online, visit the T-Mobile website and sign in to your account. You can then access the “Insurance” section and find your claim details.

T-Mobile App

You can also check your claim status through the T-Mobile app. Simply log in to your account and navigate to the “Insurance” section.

Addressing Delays or Issues

If you experience delays or issues with your claim, you can contact T-Mobile’s customer service for assistance. They can help you track the status of your claim, resolve any issues, and provide guidance on next steps.

Claim Denial Reasons

T-Mobile insurance, like any insurance policy, has specific terms and conditions that dictate when a claim can be approved or denied. Understanding these criteria is crucial to avoid potential claim denials.

Claims may be denied for various reasons, including but not limited to:

Pre-Existing Conditions

T-Mobile insurance generally doesn’t cover pre-existing damage. This means if your device was already damaged before you purchased the insurance, you might not be able to file a claim for that specific damage.

Improper Device Handling

If your device is damaged due to negligence or improper handling, your claim may be denied. This includes:

- Dropping the device

- Exposing the device to water or other liquids

- Using the device in an environment that is not recommended by the manufacturer

Fraudulent Claims

Submitting a claim for damage that did not occur or exaggerating the extent of the damage is considered fraud and will lead to claim denial. This can also result in the cancellation of your insurance policy.

Exceeding Coverage Limits

Each T-Mobile insurance policy has a coverage limit, which specifies the maximum amount the insurance will pay for repairs or replacements. If the cost of repair or replacement exceeds this limit, you may be responsible for the remaining amount.

Uncovered Events

T-Mobile insurance policies typically exclude certain events from coverage. These events may include, but are not limited to:

- Loss or damage due to theft or robbery

- Damage caused by natural disasters like earthquakes or floods

- Damage caused by war or terrorism

Late Claim Filing

Most insurance policies, including T-Mobile insurance, have a time limit for filing claims. If you fail to file a claim within the specified timeframe, your claim may be denied.

Appeal Process

If your claim is denied, you have the right to appeal the decision. The appeal process typically involves submitting additional documentation or information to support your claim. T-Mobile will review the appeal and provide a final decision.

Preventing Claim Denials

To avoid claim denials, it’s crucial to understand the terms and conditions of your T-Mobile insurance policy and adhere to the guidelines.

- Read your insurance policy carefully to understand what is covered and what is not.

- Keep your device protected with a case and screen protector.

- Avoid using your device in environments that could cause damage, such as near water or in extreme temperatures.

- File your claim promptly after an incident occurs.

- Be honest and accurate when filing your claim.

Claim Resolution Timeline

T-Mobile strives to resolve insurance claims promptly, but the timeline can vary depending on the complexity of the claim and the specific circumstances. Several factors influence the claim resolution process, impacting the time it takes to receive a decision or compensation.

Factors Influencing Claim Resolution

Understanding the factors that can influence the claim resolution process is crucial for managing expectations and knowing what to expect during the claim resolution period.

- Type of Claim: Claims involving simple repairs or replacements tend to be resolved faster than those involving more complex issues like data recovery or device theft.

- Device Model: Claims for newer or more expensive devices might require additional verification or processing steps, potentially extending the resolution timeline.

- Claim Documentation: Providing complete and accurate documentation, including photos, receipts, and police reports (if applicable), can expedite the claim process.

- Communication: Promptly responding to T-Mobile’s requests for information or clarifications can prevent delays in processing the claim.

- Claim Volume: During peak periods or after major events, there might be an increased volume of claims, potentially impacting the resolution timeline.

Timeline Expectations

It is important to understand the potential timeframe for claim resolution. While T-Mobile aims to resolve claims within a reasonable timeframe, it’s crucial to be aware of the potential variations.

- Simple Repairs or Replacements: These claims can be resolved within a few days to a week, depending on the availability of replacement devices or repair parts.

- Complex Claims: Claims involving data recovery, device theft, or other complex issues might take several weeks or even months to resolve, as they require thorough investigation and potentially external communication with authorities.

Claim Payment Options

T-Mobile offers several payment options for successful insurance claims. The payment method chosen will depend on the specific circumstances of the claim and the customer’s preference.

Payment Methods

T-Mobile insurance claims can be paid out in various ways. The most common options include:

- Direct Deposit: This is the most convenient and efficient payment method. Funds are directly deposited into the customer’s bank account, typically within 3-5 business days after the claim is approved.

- Check by Mail: T-Mobile can send a check to the customer’s mailing address. This method may take longer, as it involves processing and mailing the check. The typical processing time is 7-10 business days.

- T-Mobile Prepaid Card: For claims involving smaller amounts, T-Mobile may issue a prepaid card. This option allows the customer to withdraw the funds or use the card for purchases. The processing time for prepaid cards is generally faster than checks, typically within 3-5 business days.

Processing Time

The processing time for claim payments can vary depending on the complexity of the claim and the chosen payment method. Generally, direct deposit and prepaid cards are processed faster than checks.

Fees and Deductions

T-Mobile insurance claims may be subject to certain fees and deductions. These can include:

- Deductible: This is a fixed amount that the customer is responsible for paying before T-Mobile insurance covers the remaining costs.

- Co-payment: This is a percentage of the repair or replacement cost that the customer is responsible for paying.

- Processing Fees: T-Mobile may charge a small processing fee for certain payment methods, such as check processing.

It’s important to review the T-Mobile insurance policy carefully to understand the specific fees and deductions that apply to your claim.

Insurance Coverage Exclusions

T-Mobile insurance, like most insurance policies, has limitations and exclusions. Understanding these limitations is crucial to ensure you’re aware of what is and isn’t covered. It’s essential to carefully review the policy terms and conditions to understand the scope of coverage.

Common Exclusions

Knowing the common exclusions helps prevent disappointment when filing a claim. Here are some examples of events that are generally not covered by T-Mobile insurance:

- Pre-existing Damage: If your device was already damaged before purchasing the insurance, T-Mobile insurance will not cover the existing damage.

- Cosmetic Damage: Scratches, dents, or minor wear and tear are typically not covered.

- Loss due to negligence: If you lose your device due to negligence, such as leaving it unattended in a public place, it may not be covered.

- Damage caused by misuse: T-Mobile insurance generally won’t cover damage caused by misuse, such as dropping your device in water or subjecting it to extreme temperatures.

- Damage caused by natural disasters: Damage caused by natural disasters like earthquakes, floods, or tornadoes may not be covered.

- Loss due to war or terrorism: Damage or loss caused by war or terrorism is typically excluded from coverage.

- Loss due to unauthorized access: Damage or loss due to unauthorized access to your device, such as hacking, is generally not covered.

Checking Eligibility

To ensure your claim is eligible, it’s essential to carefully review your policy documents. The specific exclusions and limitations may vary based on your plan and the terms and conditions in effect at the time of the claim.

Customer Support Resources

Navigating the complexities of T-Mobile insurance can sometimes require assistance. Fortunately, T-Mobile provides various customer support resources to address your inquiries and concerns.

Contact Information

T-Mobile’s insurance department offers dedicated support channels for customers seeking information or assistance with their insurance claims.

- Phone Number: 1-800-937-8997 (available 24/7)

- Website: https://www.t-mobile.com/insurance

- Email: insurance@t-mobile.com

- Live Chat: Available on the T-Mobile website during business hours.

T-Mobile Insurance Policies and FAQs

T-Mobile provides comprehensive documentation and frequently asked questions (FAQs) to ensure customers have access to clear and concise information about their insurance coverage.

- T-Mobile Insurance Policy: A detailed document outlining the terms and conditions of your insurance plan, including coverage details, exclusions, and claim procedures. You can access this document on the T-Mobile website or by contacting customer support.

- T-Mobile Insurance FAQs: A compilation of common questions and answers related to T-Mobile insurance, covering topics such as coverage, claims, and payment options. This resource can be found on the T-Mobile website or by contacting customer support.

Social Media

T-Mobile utilizes social media platforms to engage with customers and address inquiries.

- Twitter: @TMobileHelp

- Facebook: https://www.facebook.com/TMobile

T-Mobile Stores

T-Mobile stores offer in-person support for customers seeking assistance with their insurance claims.

- Store Locator: https://www.t-mobile.com/stores

T-Mobile Insurance Alternatives

While T-Mobile’s insurance offers a convenient option for protecting your smartphone, other providers offer varying coverage options and pricing structures. Evaluating these alternatives can help you find the best fit for your needs and budget.

Comparison with Other Mobile Phone Insurance Providers

A comparison of T-Mobile insurance with other prominent providers reveals diverse coverage features and pricing models.

- Asurion: Asurion is a leading provider of mobile phone insurance, often partnered with carriers like T-Mobile. Their plans typically offer comprehensive coverage for accidental damage, theft, and mechanical failures. However, they might have higher deductibles compared to T-Mobile’s plans.

- SquareTrade: SquareTrade specializes in extended warranties and device protection plans. They offer plans with varying levels of coverage, including accidental damage, theft, and even liquid damage. Their pricing can be competitive, with options for different device ages and usage levels.

- AppleCare+: For Apple device owners, AppleCare+ provides extended warranty and accidental damage coverage. While it’s specifically designed for Apple products, it offers comprehensive protection and direct support from Apple. However, it’s generally more expensive than other insurance options.

- Other Carriers’ Insurance: Carriers like Verizon, AT&T, and Sprint also offer insurance plans for their customers. These plans may have similar features to T-Mobile’s offerings, with variations in coverage and pricing based on the carrier’s policies.

Advantages and Disadvantages of Different Insurance Options

Understanding the advantages and disadvantages of each insurance option can help you make an informed decision.

- Convenience: T-Mobile’s insurance is convenient for existing customers, as it’s integrated with their service. However, other providers may offer more flexible plans or coverage options.

- Pricing: T-Mobile’s insurance may be competitively priced, but other providers might offer lower deductibles or more comprehensive coverage at a similar price point.

- Coverage: Some providers offer more comprehensive coverage, such as protection against liquid damage or extended warranties.

- Claims Process: The claims process can vary significantly between providers. Some may offer faster processing times or more straightforward procedures.

Factors to Consider When Choosing a Mobile Phone Insurance Plan

Several factors influence the decision of choosing a mobile phone insurance plan.

- Device Value: The value of your smartphone significantly impacts the cost of insurance and the potential benefits.

- Usage Habits: Consider your usage habits, such as the frequency of accidental damage or potential theft risks.

- Coverage Needs: Determine the specific coverage you require, such as accidental damage, theft, or mechanical failures.

- Deductibles: Compare deductibles across different providers and choose a plan with a deductible you’re comfortable with.

- Customer Service: Evaluate the customer service reputation of each provider and consider the ease of filing claims and resolving issues.

End of Discussion

Understanding your T-Mobile insurance claim number is crucial for navigating the claims process efficiently and effectively. By understanding the significance of this number, tracking your claim status, and being aware of potential claim denial reasons, you can increase your chances of a successful and timely claim resolution. Remember, T-Mobile offers various resources and support channels to assist you throughout the process, so don’t hesitate to reach out if you have any questions or need assistance.