Okay, let’s craft a killer opening paragraph for your SEO-friendly article about “suresave travel insurance Australia” – one that’s both informative & engaging. Remember, we’re aiming for that top search engine spot! Here we go:

Planning your dream Aussie adventure? Awesome! But before you pack your thongs & snag that perfect flight, there’s something crucial you NEED to consider: travel insurance. Australia, with its stunning landscapes & vibrant cities, is a traveller’s paradise, but unforeseen events can happen, right? From lost luggage woes to unexpected medical emergencies; a well-chosen travel insurance policy is your safety net. That’s where SureSave Travel Insurance steps in. It’s not just another insurance company; it’s your trusty companion on the journey, offering a wide range of comprehensive cover options to suit all budgets & travel styles, no matter how adventurous you are.

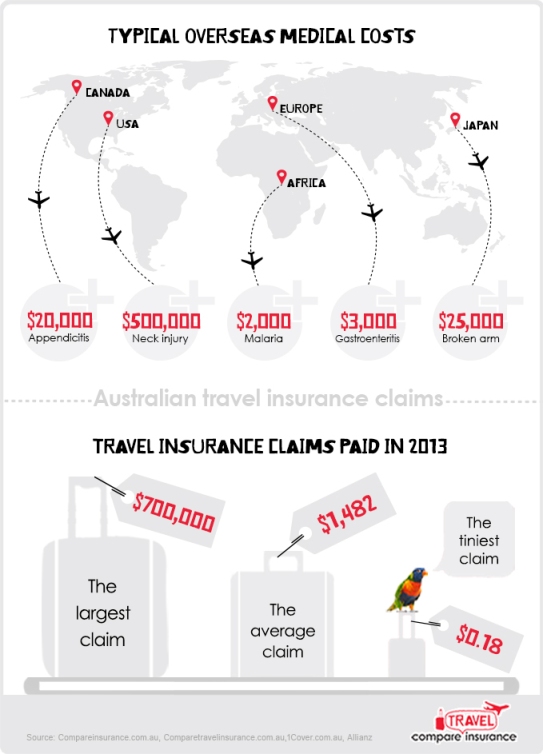

We’re talking serious protection, folks. Forget flimsy policies with endless exclusions. SureSave prides itself on providing clear, straightforward cover. Think comprehensive medical emergency cover in Australia & overseas – you don’t want to be facing hefty medical bills halfway through your Outback road trip, do you? They’ve got you covered. Plus, they offer baggage & personal liability cover. Imagine losing your camera, packed with irreplaceable memories of your trip! SureSave helps soften the blow. We’re also discussing cancellation cover – because life throws curveballs. What happens if a family emergency strikes just days before departure? With SureSave, you won’t lose out on the thousands you invested in your flight tickets and accommodation; you get help to avoid a total disaster, a nightmare trip ruined!

But it’s not just about the practical stuff; it’s also about peace of mind. Knowing you have robust protection allows you to fully immerse yourself in your Aussie holiday, exploring, hiking, surfing; worry-free. Spend less time fretting about “what ifs” and more time exploring the unique delights this stunning country has to offer! So before you jump on that plane, before you even begin daydreaming of kangaroos, dig deep to explore exactly what level of cover best suits you & your needs; how many activities do you plan on undertaking? That incredible hike in the Blue Mountains? The diving trip in the Great Barrier Reef? Your dream travel insurance policy should take those details seriously! Let’s unpack all you need to know about SureSave travel insurance. We will dive deep into their different policies, highlighting their key benefits. Plus, we’ll offer insider tips & advice on how to find the perfect plan to protect your trip! Ready to learn more ? Let’s dive right in.

Suresave Travel Insurance Australia: Your Ultimate Guide

Related Post : white warren cashmere travel wrap

Planning a trip Down Under or venturing further afield from Australia? Securing thorough travel insurance is a must. This guide dives deep into Suresave Travel Insurance, helping you understand its offerings and determine if it’s the right fit for your next adventure.

What is Suresave Travel Insurance?

Suresave offers a scope of travel insurance plans designed to protect Australian travellers from unexpected events during their trips. They offer coverage for various situations, aiming to minimize financial burdens and offer peace of mind while you explore.

Understanding Suresave’s Coverage Options

Suresave offers a variety of coverage options, catering to varied needs and budgets. Understanding these options is key to choosing the right plan for your specific circumstances. Their policies generally include coverage for medical emergencies, baggage loss or delay, trip cancellations, and more. However, it’s crucial to carefully review the policy wording to grasp the full extent of coverage.

Suresave vs. Other Australian Travel Insurers: A Comparison

Suresave competes with several other travel insurance offerrs in Australia. To make an informed decision, compare Suresave’s policies, prices, and customer reviews against those of competitors like Cover-More, Allianz, and RACV. Consider factors such as the level of coverage, the claims process, and customer service when making your comparison.

Is Suresave Travel Insurance Right for Me?

Whether Suresave is the right choice depends on your individual travel plans and risk tolerance. If you’re planning a short trip with minimal activities, a basic plan might suffice. For adventurous travellers engaging in high-risk activities or those with pre-existing medical conditions, a more thorough plan is recommended.

Choosing the Right Suresave Plan

Suresave offers varied plan types, including single trip, multi-trip, and backpacking policies. Single trip covers one specific journey, multi-trip caters to frequent travellers, and backpacking policies address the needs of those on extended, adventurous trips.

Types of Suresave Travel Insurance Policies

- Single Trip: Ideal for one-off vacations.

- Multi-Trip: optimal for frequent travellers throughout the year.

- Backpacking: Designed for longer trips with potentially higher risk activities.

Factors to Consider When Choosing a Suresave Plan

Several factors influence your Suresave plan selection:

- Trip Length: Longer trips require more extensive coverage.

- Destination: Risk levels vary by location.

- Activities: High-risk activities often need specific add-ons.

Understanding Exclusions and Limitations in Suresave Policies

Like all insurance policies, Suresave has exclusions and limitations. Carefully review the policy document to understand what’s not covered. This prevents unexpected surprises during a claim.

Suresave Policy attributes and benefits

Suresave policies often include attributes like 24/7 emergency assistance, worldwide coverage, and options for adding extra benefits. Check the specifics of your chosen plan.

What Activities are Covered by Suresave Travel Insurance?

Coverage for activities varies depending on the policy. Some plans might exclude extreme sports, while others offer coverage with additional premiums. Clarify this with Suresave before your trip.

Medical Emergency Coverage with Suresave: Details and Limits

Suresave offers medical emergency coverage, but it’s essential to understand the limits and conditions. Check the policy for details on coverage amounts and exclusions.

Baggage Loss and Delay Coverage Explained

Suresave typically covers baggage loss and delays up to a specified limit. Understand the claim process and required documentation.

Cancellation and Interruption Coverage Under Suresave

This coverage protects you against financial losses if your trip is cancelled or interrupted due to unforeseen circumstances. Ensure you understand the specific reasons for coverage.

Emergency Assistance Services offerd by Suresave

Suresave likely offers 24/7 emergency assistance services, including medical advice, emergency contact, and support.

How to Get a Suresave Travel Insurance Quote

Getting a quote is typically straightforward through their website or a travel agent. offer accurate information for an accurate quote.

Step-by-Step Guide to Getting a Quote Online

Visit the Suresave website, input your trip details, and compare plans.

Factors Affecting the Cost of Suresave Travel Insurance

Factors influencing cost include trip length, destination, age, activities, and level of coverage.

Comparing Quotes from varied offerrs

Compare quotes from several offerrs to ensure you’re getting the optimal value for your needs.

Making a Claim with Suresave Travel Insurance

If you need to make a claim, follow the steps outlined in your policy documents.

Step-by-Step Guide to Filing a Claim

Gather necessary documents, complete the claim form, and submit it as instructed.

Required Documentation for a Suresave Claim

Keep all pertinent documentation such as receipts, medical reports, and police reports.

Claim Processing Time with Suresave

Processing times vary; check the policy for estimated timescales.

Understanding Claim Denials and Appeals

If your claim is denied, understand the reasons and explore appeal options.

Suresave Travel Insurance Reviews and Testimonials

study online reviews to gain insights from other travellers’ experiences.

Positive and Negative Customer Experiences

Read both positive and negative reviews to get a balanced perspective.

Comparison of Reviews with Other Travel Insurers in Australia

Compare Suresave reviews with competitors to assess their relative performance.

Where to Find Authentic Suresave Customer Reviews

Look for reviews on independent review sites and forums.

Frequently Asked querys about Suresave Travel Insurance

What if I need to extend my trip? Can I adjust my Suresave policy?

Contact Suresave to discuss policy adjustments.

Does Suresave cover pre-existing medical conditions?

Coverage for pre-existing conditions may vary. Check policy details.

What are the age limits for Suresave Travel Insurance?

Age limits might apply; check the policy for specifics.

What happens if I cancel my trip before departure?

Cancellation coverage depends on the reasons for cancellation. Check your policy.

Can I purchase Suresave Travel Insurance at the Airport?

This may be possible; check availability with the airport or Suresave.

Conclusion: Is Suresave the Right Travel Insurance for Your Next Trip?

Ultimately, the right travel insurance depends on your individual needs. Carefully compare Suresave with other offerrs and select the plan that optimal protects you.