Pennsylvania’s insurance market is a complex and dynamic landscape, offering a diverse range of coverage options to meet the unique needs of its residents and businesses. From auto and home insurance to health and life coverage, understanding the intricacies of this market is crucial for making informed decisions that protect your assets and financial well-being. This guide delves into the key aspects of Pennsylvania insurance, providing insights into its regulatory environment, available coverage options, and the crucial steps involved in finding the right policy for your specific circumstances.

Pennsylvania’s insurance industry is a significant contributor to the state’s economy, generating substantial revenue and employment opportunities. The state’s insurance department plays a vital role in ensuring consumer protection and maintaining a fair and competitive marketplace. However, navigating this landscape can be challenging, particularly for those unfamiliar with the intricacies of insurance regulations and coverage options. This comprehensive guide aims to demystify the process, empowering individuals and businesses to make informed choices and secure the right insurance coverage for their needs.

Pennsylvania Insurance Landscape

Pennsylvania boasts a robust and complex insurance market, with a significant economic impact and a substantial presence of major insurance companies. The state’s insurance industry is governed by a comprehensive regulatory framework, overseen by the Pennsylvania Insurance Department (PID).

Market Size and Key Players

The Pennsylvania insurance market is characterized by its size and the presence of numerous key players. According to the Pennsylvania Insurance Department, total direct written premiums in the state reached \$46.8 billion in 2022. The state’s insurance market is dominated by a diverse group of insurance companies, including national giants like State Farm, Geico, and Liberty Mutual, as well as regional and local insurers.

Challenges and Opportunities

The Pennsylvania insurance market faces several challenges, including:

- Rising healthcare costs, particularly in areas like prescription drugs and hospital services, are driving up premiums for health insurance plans.

- Increased frequency and severity of natural disasters, such as hurricanes and floods, pose significant risks to property insurers.

- The evolving nature of insurance risks, including cyberattacks and data breaches, requires insurers to adapt their products and services.

However, the state’s insurance market also presents opportunities for growth, such as:

- The increasing demand for insurance products and services, driven by factors like population growth and rising wealth.

- The potential for innovation in insurance products and services, particularly in areas like telematics and artificial intelligence.

- The increasing focus on customer experience and digitalization, offering opportunities for insurers to differentiate themselves.

Impact of Recent Legislation and Regulations

Recent legislation and regulations have significantly impacted the Pennsylvania insurance industry. For instance, the passage of the Affordable Care Act (ACA) in 2010 has led to significant changes in the health insurance market, including the expansion of Medicaid and the creation of health insurance marketplaces. The PID has also implemented several regulations in recent years, such as those related to data privacy and cybersecurity, to enhance consumer protection and ensure the financial stability of the insurance industry.

Types of Insurance in Pennsylvania

Pennsylvania residents have access to a wide range of insurance options to protect themselves and their assets. From safeguarding their vehicles and homes to securing their health and future, these insurance policies offer financial security and peace of mind.

Auto Insurance

Pennsylvania mandates auto insurance coverage for all drivers. The state’s minimum coverage requirements include:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. Pennsylvania requires at least $15,000 per person and $30,000 per accident for bodily injury liability, and $5,000 for property damage liability.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. The minimum requirement is $15,000 per person and $30,000 per accident.

Drivers can choose additional coverage options, such as:

- Collision Coverage: This covers repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events like theft, vandalism, or natural disasters.

- Medical Payments Coverage: This pays for medical expenses for you and your passengers, regardless of fault.

Home Insurance

Homeowners in Pennsylvania need insurance to protect their property against various risks.

- Dwelling Coverage: This covers the structure of your home, including the roof, walls, and foundation.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, appliances, and clothing.

- Liability Coverage: This protects you financially if someone is injured on your property or if you accidentally damage someone else’s property.

Homeowners can also purchase additional coverage options, such as:

- Flood Insurance: This protects your home from damage caused by flooding.

- Earthquake Insurance: This protects your home from damage caused by earthquakes.

Health Insurance

Health insurance in Pennsylvania is crucial for covering medical expenses.

- Individual Health Insurance: This is purchased by individuals or families directly from insurance companies.

- Employer-Sponsored Health Insurance: This is offered by employers to their employees.

- Medicaid: This is a government-funded health insurance program for low-income individuals and families.

- Medicare: This is a federal health insurance program for individuals aged 65 and older and people with certain disabilities.

Pennsylvania has a health insurance marketplace where individuals and families can compare and purchase plans.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death.

- Term Life Insurance: This provides coverage for a specific period, usually 10, 20, or 30 years.

- Whole Life Insurance: This provides permanent coverage for your entire life, as long as you pay the premiums.

- Universal Life Insurance: This provides flexible premiums and death benefits, allowing you to adjust your coverage over time.

Business Insurance

Business insurance protects businesses from various risks, including property damage, liability, and employee-related issues.

- General Liability Insurance: This protects your business from lawsuits if someone is injured on your property or if you damage someone else’s property.

- Property Insurance: This covers damage to your business property, including buildings, equipment, and inventory.

- Workers’ Compensation Insurance: This covers medical expenses and lost wages for employees who are injured or become ill on the job.

- Business Interruption Insurance: This covers lost income if your business is forced to shut down due to an insured event, such as a fire or natural disaster.

Finding the Right Insurance in Pennsylvania

Navigating the Pennsylvania insurance landscape can be overwhelming, especially for those unfamiliar with the various options and factors to consider. To ensure you’re adequately protected and getting the best value for your money, comparing insurance quotes from different providers is crucial.

Comparing Insurance Quotes

Comparing insurance quotes from multiple providers allows you to assess different coverage options, premiums, and policy terms. This process helps you identify the most suitable insurance policy that aligns with your specific needs and budget.

Factors to Consider When Choosing an Insurance Policy

When evaluating insurance policies, several factors should be considered to make an informed decision.

Coverage Limits

Coverage limits define the maximum amount your insurer will pay for covered losses. Higher coverage limits generally translate to higher premiums but provide greater financial protection in case of significant events.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you’ll bear a greater financial burden in case of a claim.

Premiums

Premiums are the regular payments you make to maintain your insurance policy. Factors influencing premiums include your coverage limits, deductibles, driving history, age, and location.

Finding the Most Suitable Insurance in Pennsylvania

To find the most suitable insurance in Pennsylvania, follow these steps:

Step 1: Identify Your Insurance Needs

Determine the types of insurance you require based on your personal or business needs. This could include auto insurance, homeowners insurance, renters insurance, health insurance, life insurance, or business insurance.

Step 2: Research Insurance Providers

Explore different insurance providers operating in Pennsylvania. Consider their reputation, financial stability, customer service, and policy offerings.

Step 3: Get Quotes from Multiple Providers

Contact several insurance providers and request personalized quotes based on your specific requirements.

Step 4: Compare Quotes and Coverage

Carefully compare the quotes you receive, focusing on coverage limits, deductibles, premiums, and policy terms.

Step 5: Choose the Best Policy

Select the insurance policy that offers the most comprehensive coverage, competitive premiums, and favorable terms that align with your budget and needs.

Step 6: Review and Understand Your Policy

Before signing up, thoroughly review the policy document and ensure you understand the coverage details, exclusions, and any other relevant terms.

Step 7: Keep Your Policy Up-to-Date

Regularly review your insurance policy and make adjustments as your circumstances change. This includes updating your coverage limits, deductibles, or contact information.

Insurance Regulations in Pennsylvania

Pennsylvania’s insurance industry operates under a comprehensive regulatory framework designed to protect consumers and ensure the financial stability of insurers. The Pennsylvania Insurance Department (PID) plays a pivotal role in overseeing the industry, enforcing regulations, and promoting fair and competitive practices.

Licensing Requirements

The PID establishes stringent licensing requirements for insurance companies, agents, and brokers operating in Pennsylvania. This ensures that only qualified individuals and entities are authorized to sell and administer insurance products within the state.

- Insurance companies must obtain a certificate of authority from the PID to operate in Pennsylvania. This process involves meeting specific capital and surplus requirements, demonstrating financial stability, and submitting a detailed business plan.

- Insurance agents and brokers must also obtain licenses from the PID. These licenses require passing examinations, completing continuing education courses, and meeting specific ethical standards.

Consumer Protection Laws

Pennsylvania has enacted numerous consumer protection laws to safeguard policyholders and ensure fair treatment. These laws address various aspects of insurance transactions, including:

- Unfair Trade Practices Act: This law prohibits insurance companies from engaging in deceptive or unfair practices, such as misrepresenting policy coverage or engaging in bait-and-switch tactics.

- Prompt Payment of Claims: Pennsylvania law mandates that insurance companies promptly investigate and pay valid claims. Failure to do so can result in penalties and legal action.

- Consumer Protection and Notice of Cancellation: These laws provide consumers with specific rights regarding policy cancellations, non-renewal, and changes to coverage. Insurance companies must provide clear and timely notification to policyholders.

Rate Setting Procedures

The PID oversees the rate-setting process for various insurance lines in Pennsylvania. This ensures that rates are fair, reasonable, and not excessive.

- Prior Approval: For some insurance lines, such as automobile and homeowners insurance, insurers must obtain prior approval from the PID before implementing new rates. This process involves submitting detailed justifications for the proposed rate changes.

- File and Use: For other lines, insurers are allowed to file rates with the PID and use them immediately. However, the PID reserves the right to review and disapprove rates if they are deemed unreasonable or discriminatory.

Role of the Pennsylvania Insurance Department

The PID plays a multifaceted role in regulating the insurance industry in Pennsylvania. Its primary responsibilities include:

- Licensing and Oversight: The PID licenses and oversees insurance companies, agents, and brokers, ensuring they meet regulatory requirements and operate ethically.

- Consumer Protection: The PID enforces consumer protection laws, investigates complaints, and provides resources and information to policyholders.

- Rate Regulation: The PID reviews and approves or disapproves rate filings, ensuring that rates are fair and reasonable.

- Financial Stability: The PID monitors the financial health of insurance companies, ensuring they have sufficient capital and reserves to meet their obligations.

- Market Conduct: The PID investigates allegations of unfair trade practices, deceptive advertising, and other market conduct violations.

Comparison with Other States

Pennsylvania’s regulatory environment is generally considered to be moderate in comparison to other states. Some states have stricter regulations, while others are more lenient.

- Stricter Regulations: States like California and New York have more stringent regulations, particularly in areas such as rate regulation and consumer protection.

- More Lenient Regulations: States like Texas and Florida have more lenient regulations, allowing insurers more flexibility in setting rates and managing their operations.

Insurance Claims in Pennsylvania

Filing an insurance claim in Pennsylvania can be a complex process, but understanding the steps involved and your rights as a policyholder can make it smoother. This section Artikels the claim filing process, provides tips for navigating the system, and explores common claim types.

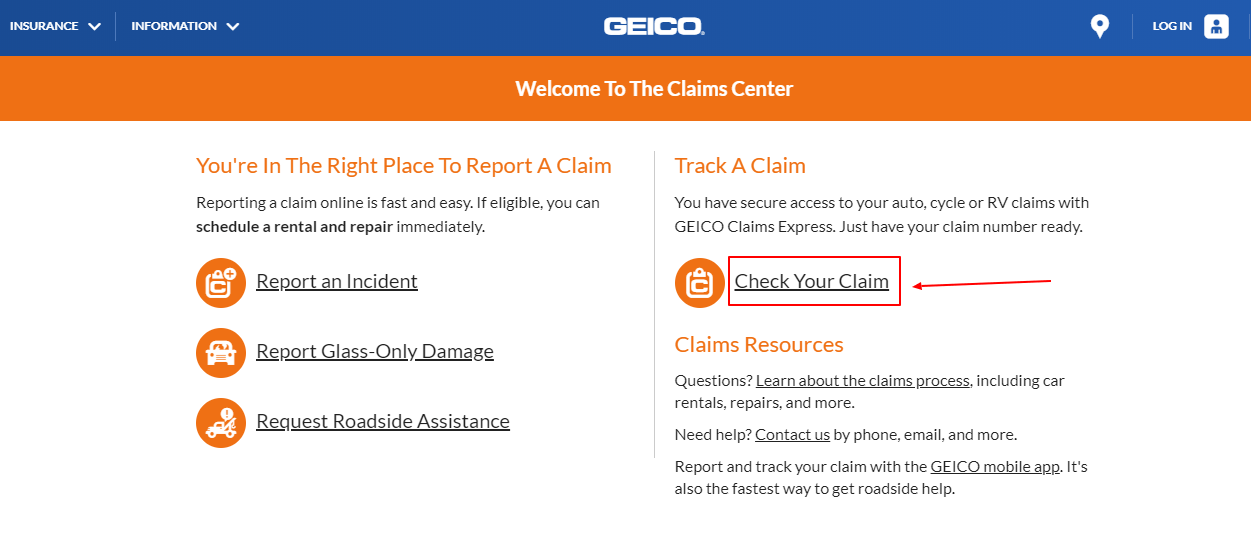

The Claims Filing Process

The process of filing an insurance claim in Pennsylvania typically involves the following steps:

- Contact your insurance company: Immediately report the incident to your insurance company by phone or online. This should be done as soon as possible after the event occurs.

- Provide necessary documentation: Your insurance company will request specific documentation to support your claim. This may include:

- Police report (for auto accidents or other incidents involving law enforcement)

- Medical records (for health insurance claims)

- Photos or videos of the damage

- Estimates for repairs or replacement

- Proof of ownership or residency

- Review and investigation: Your insurance company will review your claim and may conduct an investigation to verify the details and determine the extent of the damage or loss.

- Negotiate settlement: Once the investigation is complete, your insurance company will present you with a settlement offer. You have the right to negotiate this offer and may need to provide additional information or documentation.

- Receive payment: If you agree to the settlement offer, your insurance company will process the payment. This may be in the form of a check, direct deposit, or other payment method.

Timeline for Processing Claims

The time it takes to process an insurance claim in Pennsylvania can vary depending on the type of claim, the complexity of the case, and the efficiency of the insurance company. However, most insurance companies strive to process claims within a reasonable timeframe.

Tips for Navigating the Claims Process

Here are some tips for navigating the claims process and ensuring a smooth experience:

- Keep detailed records: Maintain records of all communication with your insurance company, including dates, times, and summaries of conversations.

- Be proactive: Follow up with your insurance company regularly to check on the status of your claim.

- Understand your policy: Carefully review your insurance policy to understand your coverage and any limitations or exclusions.

- Consider seeking professional help: If you are having difficulty navigating the claims process or resolving a dispute with your insurance company, consider seeking assistance from a lawyer or insurance broker.

Common Insurance Claims in Pennsylvania

Some common insurance claims filed in Pennsylvania include:

- Auto accidents: Pennsylvania is a “no-fault” state for auto insurance, meaning that your own insurance company will cover your medical expenses and lost wages, regardless of who was at fault. However, if your injuries exceed the limits of your personal injury protection (PIP) coverage, you may be able to file a claim against the at-fault driver’s insurance company.

- Home fires: Homeowners insurance policies typically cover damage caused by fire, smoke, and water. It is important to have adequate coverage to protect your home and belongings in the event of a fire.

- Medical expenses: Health insurance policies cover a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs. However, it is important to understand your policy’s coverage and any deductibles or co-pays that apply.

Insurance Industry Trends in Pennsylvania

The Pennsylvania insurance market is constantly evolving, driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. These trends are reshaping how insurance is purchased, delivered, and experienced, presenting both opportunities and challenges for insurers and consumers alike.

Technological Advancements in the Insurance Industry

The adoption of technology is transforming the Pennsylvania insurance landscape, impacting various aspects of the industry, from underwriting and claims processing to customer service and distribution.

- Insurtech: Insurtech companies are leveraging innovative technologies, such as artificial intelligence (AI), big data analytics, and blockchain, to disrupt traditional insurance models. These companies offer more efficient and personalized insurance solutions, often through online platforms and mobile apps.

- Digital Distribution: The rise of online insurance platforms has made it easier for consumers to compare quotes, purchase policies, and manage their insurance online. This shift towards digital distribution has increased competition and empowered consumers with greater choice and transparency.

- Data Analytics: Insurers are increasingly using data analytics to better understand risk profiles, personalize pricing, and improve customer service. This data-driven approach enables insurers to make more informed decisions and offer more tailored insurance solutions.

Impact of Technology on the Insurance Industry and Consumers

The technological advancements discussed above have a significant impact on both the insurance industry and consumers:

- Increased Efficiency and Cost Savings: Automation and digital processes streamline operations, reducing administrative costs and improving efficiency for insurers. This can lead to lower premiums for consumers.

- Enhanced Customer Experience: Consumers benefit from more convenient and personalized insurance experiences, with online platforms offering 24/7 access to information and services.

- Greater Competition: The emergence of insurtech companies and online platforms increases competition in the insurance market, leading to more choices and potentially lower prices for consumers.

Future Developments in the Pennsylvania Insurance Landscape

The Pennsylvania insurance landscape is expected to continue evolving, driven by technological advancements and changing consumer preferences.

- Growth of Insurtech: The insurtech sector is expected to continue expanding, with new players entering the market and existing companies developing innovative solutions. This will likely lead to greater competition and disruption in the traditional insurance industry.

- Increased Use of AI and Big Data: Insurers will continue to invest in AI and big data analytics to improve risk assessment, personalize pricing, and enhance customer service. This will likely lead to more customized insurance solutions and potentially more efficient claims processing.

- Focus on Cybersecurity: As insurance companies rely more heavily on technology, cybersecurity will become increasingly important. Insurers will need to invest in robust cybersecurity measures to protect sensitive customer data and ensure business continuity.

Insurance Resources in Pennsylvania

Navigating the complex world of insurance in Pennsylvania can be challenging, but numerous resources are available to assist individuals and businesses in making informed decisions. These resources provide guidance on understanding insurance policies, navigating claims processes, and advocating for consumer rights.

Pennsylvania Insurance Department

The Pennsylvania Insurance Department (PID) serves as the primary regulatory body for the insurance industry in the state. It plays a crucial role in protecting consumers by ensuring fair and competitive insurance markets. The PID offers a comprehensive range of services, including:

- Consumer Information: The PID provides extensive information about insurance products, consumer rights, and how to file complaints. It also offers educational materials and resources to help consumers understand insurance concepts and make informed choices.

- Licensing and Regulation: The PID licenses and regulates insurance companies, agents, and brokers operating in Pennsylvania. It sets standards for insurance products and ensures compliance with state laws and regulations.

- Claims Assistance: The PID provides assistance to consumers who are experiencing difficulties with insurance claims. It can help resolve disputes and ensure that consumers are treated fairly by insurance companies.

Consumer Advocacy Groups

Consumer advocacy groups play a vital role in protecting the interests of insurance consumers in Pennsylvania. They provide information, support, and legal assistance to individuals who have encountered problems with insurance companies.

- Pennsylvania Insurance Consumer Advocate: The Pennsylvania Insurance Consumer Advocate is an independent office that represents the interests of insurance consumers before the PID. It investigates consumer complaints and advocates for changes to insurance laws and regulations.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization of insurance commissioners that works to promote uniformity in insurance regulation across the United States. It provides information and resources for consumers on a wide range of insurance topics.

Industry Associations

Industry associations represent the interests of insurance companies and professionals in Pennsylvania. They provide a platform for networking, education, and advocacy on issues related to the insurance industry.

- Pennsylvania Insurance Federation: The Pennsylvania Insurance Federation is a trade association that represents the interests of insurance companies operating in the state. It advocates for sound insurance policies and regulations that protect consumers and promote a healthy insurance market.

- Independent Insurance Agents & Brokers of Pennsylvania: This association represents independent insurance agents and brokers who provide insurance products to individuals and businesses. It offers resources and support to its members, including education and training programs.

Key Resources for Pennsylvania Insurance

| Resource Type | Website Address | Key Information Offered |

|---|---|---|

| Pennsylvania Insurance Department | insurance.pa.gov | Consumer information, licensing and regulation, claims assistance |

| Pennsylvania Insurance Consumer Advocate | insurance.pa.gov/consumer-advocate | Consumer advocacy, complaint investigation, legislative advocacy |

| National Association of Insurance Commissioners (NAIC) | naic.org | Consumer information, industry news, regulatory updates |

| Pennsylvania Insurance Federation | painsurance.org | Industry news, advocacy, educational resources |

| Independent Insurance Agents & Brokers of Pennsylvania | iiapa.org | Agent and broker resources, education, networking opportunities |

Insurance and Disaster Preparedness in Pennsylvania

Pennsylvania, with its diverse geography, is susceptible to various natural disasters, including hurricanes, tornadoes, floods, and winter storms. These events can cause significant damage to property and disrupt lives, leading to substantial financial losses. Insurance plays a crucial role in mitigating the financial impact of such disasters, allowing individuals and businesses to recover and rebuild.

Insurance Policies for Disaster-Related Losses

Pennsylvania residents and businesses have access to various insurance policies designed to cover disaster-related losses. Understanding these policies and their coverage is essential for effective disaster preparedness.

- Homeowners Insurance: This policy provides coverage for damage to your home and personal belongings from a variety of perils, including natural disasters. It typically includes coverage for wind, hail, fire, and flood damage. However, flood coverage is often purchased as a separate policy through the National Flood Insurance Program (NFIP).

- Flood Insurance: The NFIP provides flood insurance for properties located in flood-prone areas. It is a separate policy from homeowners insurance and covers damage from flooding caused by overflowing rivers, streams, and other bodies of water. It is essential to consider flood insurance if your property is located in a high-risk flood zone, as standard homeowners insurance policies do not cover flood damage.

- Business Interruption Insurance: This policy protects businesses from financial losses incurred due to disruptions caused by natural disasters. It covers lost income, additional expenses, and other business-related costs associated with a disaster.

- Earthquake Insurance: While Pennsylvania is not considered a high-risk earthquake zone, it is still vulnerable to seismic activity. Earthquake insurance provides coverage for damage caused by earthquakes, which is not typically covered by standard homeowners or business insurance policies.

Preparing for Natural Disasters

Proactive preparation is crucial in minimizing the impact of natural disasters. Here are some tips for preparing for natural disasters and protecting your property from damage:

- Develop a Disaster Plan: Create a family emergency plan that Artikels evacuation routes, communication strategies, and meeting points. Include information about essential supplies, such as food, water, first-aid kits, and medications.

- Secure Your Property: Strengthen your home or business by securing loose objects, trimming trees near structures, and installing storm shutters. Ensure your roof is in good condition and consider installing a generator for power outages.

- Create an Emergency Kit: Assemble an emergency kit containing essential supplies such as food, water, flashlights, batteries, first-aid supplies, a whistle, a radio, and important documents like insurance policies, identification, and medical records.

- Stay Informed: Stay informed about weather forecasts and warnings issued by local authorities. Be aware of potential hazards in your area and follow instructions from emergency officials.

Insurance Coverage and Disaster Preparedness

Insurance plays a crucial role in mitigating the financial impact of natural disasters. However, it is important to understand the limitations of insurance policies and to take proactive steps to prepare for disasters.

By combining adequate insurance coverage with effective disaster preparedness measures, Pennsylvanians can enhance their resilience and minimize the disruption and financial losses associated with natural disasters.

Insurance and the Pennsylvania Economy

The insurance industry plays a vital role in the Pennsylvania economy, contributing significantly to job creation, tax revenue, and overall economic growth. By providing financial protection against risks, insurance companies enable businesses to operate with greater confidence, fostering investment and innovation.

Economic Impact of the Insurance Industry

The insurance industry in Pennsylvania has a significant economic impact, contributing to the state’s GDP, job creation, and tax revenue. The industry employs a substantial workforce, generating income and supporting local communities. Insurance companies also contribute to the state’s tax base through property taxes, premium taxes, and other levies.

- Job Creation: The insurance industry is a major employer in Pennsylvania, providing jobs in various sectors, including underwriting, claims processing, sales, and customer service. According to the Pennsylvania Insurance Department, the industry directly employs over 100,000 individuals in the state.

- Tax Revenue: Insurance companies contribute to the state’s tax revenue through various mechanisms. Premium taxes, levied on insurance premiums, are a significant source of income for the state government. Property taxes on insurance company offices and facilities also contribute to local tax revenue.

- GDP Contribution: The insurance industry contributes significantly to Pennsylvania’s GDP through its operations and investments. Insurance companies invest in real estate, infrastructure, and other sectors, contributing to economic growth.

Role of Insurance in Supporting Businesses

Insurance plays a crucial role in supporting businesses in Pennsylvania by mitigating risks and providing financial protection. Businesses rely on insurance to cover potential losses from various events, such as fire, theft, natural disasters, and liability claims.

- Risk Management: Insurance allows businesses to manage risks effectively by transferring the financial burden of potential losses to insurance companies. This enables businesses to operate with greater peace of mind, knowing that they are protected against unforeseen events.

- Access to Capital: Insurance can provide businesses with access to capital in the event of a loss. This can be crucial for businesses to recover from a disaster or to continue operations after an unexpected event.

- Business Continuity: Insurance helps businesses to maintain continuity of operations by providing financial resources to rebuild or replace damaged property or equipment. This ensures that businesses can continue to operate and serve their customers even after a major disruption.

Relationship Between Insurance and Key Industries

The insurance industry has a close relationship with various key industries in Pennsylvania, providing essential risk management and financial protection. These industries rely on insurance to mitigate risks and ensure their continued operation.

- Manufacturing: Manufacturing businesses in Pennsylvania face various risks, including property damage, product liability, and workers’ compensation. Insurance provides financial protection against these risks, enabling manufacturers to operate with greater confidence.

- Healthcare: The healthcare industry in Pennsylvania relies heavily on insurance to cover medical expenses and provide financial protection for healthcare providers. Insurance policies cover a wide range of healthcare risks, including malpractice claims and medical errors.

- Agriculture: Agriculture is a significant industry in Pennsylvania, and farmers face risks such as crop failure, livestock disease, and weather-related damage. Insurance provides financial protection against these risks, helping farmers to manage their operations and ensure their financial stability.

Outcome Summary

The Pennsylvania insurance market presents both challenges and opportunities for individuals and businesses. By understanding the key regulations, available coverage options, and the importance of comparing quotes, consumers can make informed decisions that provide the necessary protection for their assets and financial well-being. As technology continues to reshape the industry, staying informed about emerging trends and utilizing online platforms can help streamline the insurance process and access competitive rates. Navigating this complex landscape requires a proactive approach, but by leveraging the resources and information available, Pennsylvanians can confidently secure the insurance coverage they need to protect their future.