Navigating the world of car insurance can feel like driving through a maze. With countless providers, coverage options, and ever-changing rates, finding the best deal can seem daunting. But fear not, the key to securing the most competitive car insurance quotes lies in understanding the process and employing smart strategies.

This guide delves into the intricacies of getting car insurance quotes, equipping you with the knowledge to make informed decisions. We’ll explore the various types of coverage, the factors influencing premiums, and the best ways to compare quotes from multiple providers. Whether you’re a seasoned driver or a new car owner, this comprehensive guide will empower you to secure the right insurance at the right price.

Understanding Car Insurance Quotes

Obtaining car insurance quotes is a crucial step in securing financial protection for your vehicle and yourself in case of an accident. Understanding the intricacies of car insurance quotes, including the various coverage options and factors influencing premiums, is essential for making informed decisions.

Types of Car Insurance Coverage

The different types of car insurance coverage available offer varying levels of protection, each designed to address specific risks.

- Liability Coverage: This fundamental coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers legal expenses, medical bills, and property damage up to the limits specified in your policy.

- Collision Coverage: Collision coverage reimburses you for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is typically optional, but it is recommended for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional but can be crucial for safeguarding your investment.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage up to the limits of your policy.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. PIP is mandatory in some states.

Factors Influencing Car Insurance Premiums

Numerous factors contribute to the cost of car insurance premiums, influencing the price you pay for coverage.

- Driving History: Your driving record is a primary factor, with a clean record resulting in lower premiums. Accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Vehicle Type and Value: The make, model, year, and value of your vehicle play a significant role. Luxury cars or high-performance vehicles are typically more expensive to insure due to higher repair costs and potential for greater damage.

- Location: Your geographic location influences premiums due to factors such as traffic density, crime rates, and weather conditions. Urban areas with heavy traffic and higher crime rates generally have higher insurance rates.

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. Gender can also influence rates, with males historically paying slightly higher premiums than females.

- Credit Score: In many states, insurance companies use your credit score as a proxy for risk assessment. A higher credit score generally indicates lower risk and can lead to lower premiums.

- Coverage Options: The type and amount of coverage you choose will directly impact your premium. Selecting higher coverage limits or adding optional coverage, such as collision or comprehensive, will increase your costs.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, as you are assuming more financial responsibility.

- Discounts: Insurance companies offer various discounts to lower premiums, such as good student discounts, safe driver discounts, multi-car discounts, and loyalty discounts.

Comparing Quotes from Multiple Insurance Providers

It is crucial to compare quotes from multiple insurance providers before settling on a policy. Each insurer uses its own proprietary algorithms and risk assessment models, resulting in varying premium quotes.

Comparing quotes from at least three to five insurers can help you find the most competitive rates and ensure you are getting the best value for your money.

Online Quote Generators

Online quote generators have revolutionized the process of obtaining car insurance quotes, offering a convenient and efficient way to compare various insurance options. By leveraging the power of technology, these platforms streamline the quote request process, allowing users to receive multiple quotes within minutes.

Advantages of Online Quote Generators

Online quote generators offer numerous advantages for car insurance seekers, making the process more accessible and convenient.

- Convenience and Accessibility: Online quote generators are accessible from anywhere with an internet connection, eliminating the need for phone calls or physical visits to insurance agencies. Users can request quotes at their convenience, anytime and anywhere.

- Speed and Efficiency: The online process significantly reduces the time required to obtain quotes. Users can typically receive multiple quotes within minutes, allowing for quick comparisons and decision-making.

- Transparency and Comparability: Online quote generators provide transparent and comprehensive information about different insurance options, allowing users to compare prices, coverage, and features side-by-side.

- Personalized Quotes: By providing their personal information, users can receive customized quotes based on their specific needs and driving profile. This ensures that the quotes are tailored to their individual circumstances.

Steps Involved in Obtaining a Quote

The process of obtaining a car insurance quote through an online platform is generally straightforward and user-friendly.

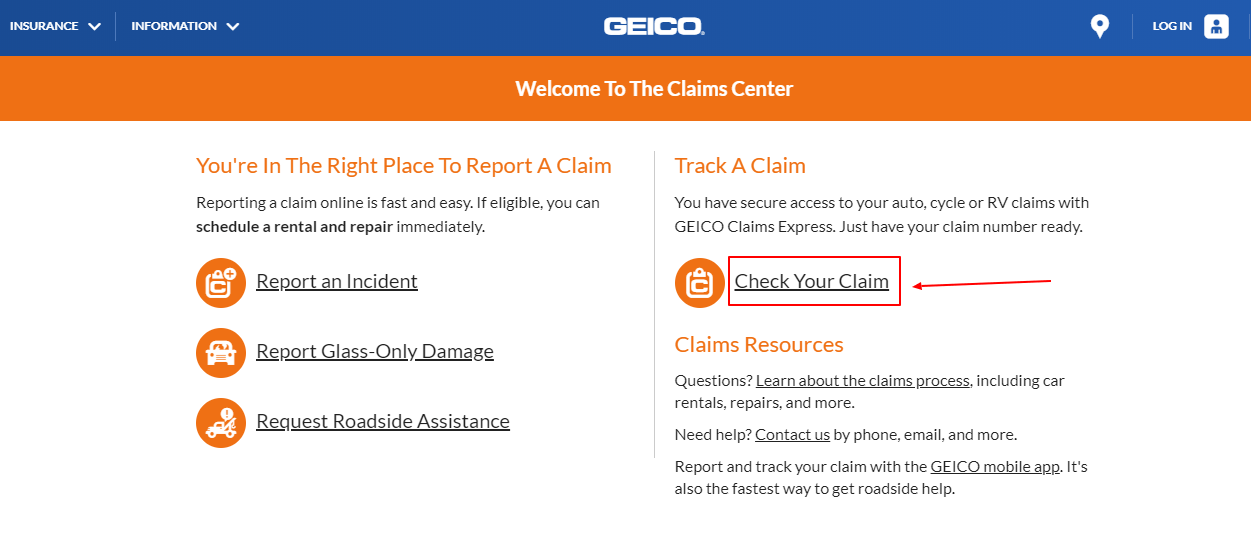

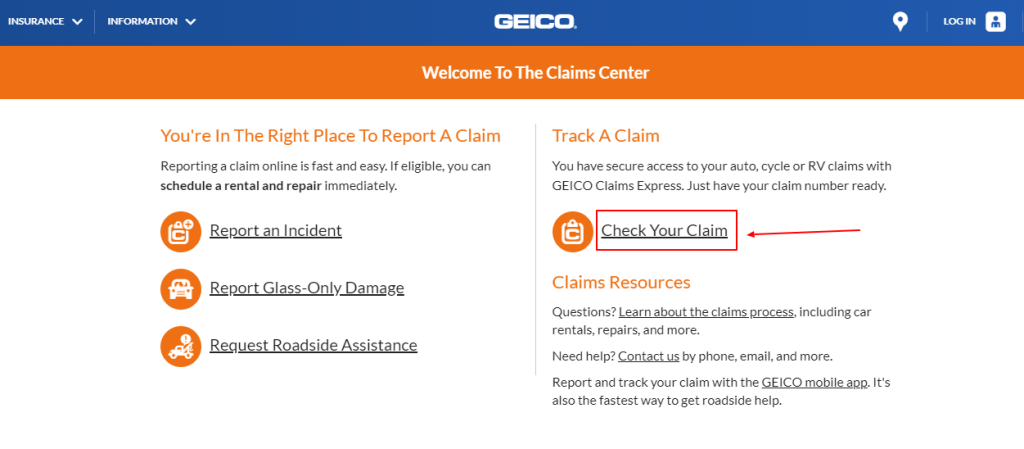

- Visit the Website: Start by visiting the website of the online quote generator or the insurance company’s website.

- Provide Basic Information: The platform will typically ask for basic information about you and your vehicle, such as your name, address, date of birth, driving history, vehicle make and model, and desired coverage levels.

- Submit Your Request: Once you have provided the necessary information, submit your request for a quote.

- Review Quotes: The online platform will generate multiple quotes from different insurance companies based on your criteria. Review the quotes carefully, comparing prices, coverage options, and other factors.

- Choose a Policy: Once you have selected the policy that best suits your needs, you can proceed with the purchase process, which may involve providing additional information and payment details.

Key Information Required for a Quote Request

To generate an accurate and personalized car insurance quote, online platforms typically require the following information:

- Personal Information: This includes your name, address, date of birth, and contact details.

- Driving History: Your driving history, including any accidents, violations, or claims, is crucial for determining your risk profile.

- Vehicle Information: The make, model, year, and VIN of your vehicle are essential for assessing its value and risk.

- Desired Coverage Levels: Specify the type and level of coverage you require, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Other Factors: Some platforms may ask for additional information, such as your occupation, marital status, and driving habits.

Insurance Provider Comparisons

Choosing the right car insurance provider can be a daunting task, as many options exist, each with its own set of features, pricing, and customer service standards. Comparing different providers allows you to find the best fit for your needs and budget.

Comparing Insurance Providers

Comparing insurance providers involves analyzing various factors, including coverage options, pricing, discounts, customer service, and claims handling processes. To facilitate this comparison, the following table summarizes key features of some leading insurance providers:

| Provider | Coverage Options | Pricing | Discounts | Customer Service | Claims Handling |

|---|---|---|---|---|---|

| Provider A | Comprehensive, collision, liability, uninsured/underinsured motorist | Competitive rates, discounts for good driving records, multiple car policies | Safe driver, good student, multi-car, loyalty | 24/7 customer support, online portal, mobile app | Fast and efficient claims processing, dedicated claims adjusters |

| Provider B | Comprehensive, collision, liability, rental car reimbursement | Lower premiums for basic coverage, higher deductibles | Safe driver, good student, multi-car, bundling | Online resources, phone support, limited in-person services | Streamlined claims process, online claims filing |

| Provider C | Comprehensive, collision, liability, roadside assistance | Higher premiums, specialized coverage options | Safe driver, good student, multi-car, loyalty | Excellent customer service, personalized support | Dedicated claims teams, fast claims resolution |

| Provider D | Comprehensive, collision, liability, accident forgiveness | Competitive rates, personalized quotes | Safe driver, good student, multi-car, bundling | 24/7 customer support, online portal, mobile app | Efficient claims process, online claims tracking |

Understanding Policy Terms and Conditions

Car insurance policies are legal contracts outlining the terms and conditions under which an insurance company agrees to provide coverage for your vehicle. It’s essential to understand these terms to ensure you’re adequately protected and avoid any surprises when you need to file a claim.

Key Terms and Conditions

Understanding the key terms and conditions within your car insurance policy is crucial for making informed decisions and maximizing your coverage. Here are some of the most important terms to familiarize yourself with:

- Deductible: This is the amount you’ll pay out of pocket for each claim before your insurance kicks in. A higher deductible typically leads to lower premiums, while a lower deductible means higher premiums.

- Coverage Limits: These are the maximum amounts your insurance company will pay for covered losses. They vary depending on the type of coverage and your policy.

- Exclusions: These are specific events or situations that are not covered by your policy. It’s essential to review the exclusions carefully to understand what your policy doesn’t cover.

- Premium: This is the regular payment you make to maintain your car insurance coverage.

- Liability Coverage: This protects you from financial responsibility if you cause an accident that injures someone or damages their property. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or an object, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to cover your losses.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault, in the event of an accident.

- Personal Injury Protection (PIP): This coverage, common in no-fault states, covers medical expenses and lost wages for you and your passengers, regardless of fault.

Importance of Reading and Understanding Policy Documents

Thoroughly reading and understanding your car insurance policy document is essential for several reasons:

- Avoid Surprises: It helps you understand the coverage you have and what you’re responsible for in the event of an accident or claim.

- Make Informed Decisions: Knowing your policy terms allows you to make informed decisions about your coverage, deductibles, and premiums.

- Ensure Adequate Protection: It helps you determine if your policy provides sufficient coverage for your needs and adjust it accordingly.

- Prevent Disputes: Understanding your policy terms can help avoid disputes with your insurance company when you file a claim.

Implications of Not Meeting Policy Requirements

Failing to meet the requirements Artikeld in your car insurance policy can have serious consequences:

- Claim Denial: Your insurance company may deny your claim if you don’t meet the policy’s terms and conditions.

- Increased Premiums: Not meeting policy requirements can lead to higher premiums in the future.

- Policy Cancellation: In some cases, failing to meet policy requirements can result in your policy being canceled.

- Legal Liability: If you’re involved in an accident and don’t meet the policy requirements, you could be held personally liable for damages and injuries.

Getting Quotes Over the Phone or in Person

While online quote generators offer a convenient way to gather car insurance estimates, speaking with an insurance agent directly can provide valuable insights and personalized recommendations. This approach allows you to delve deeper into policy details, explore potential discounts, and receive tailored advice based on your individual circumstances.

Phone Calls

Phone calls offer a quick and efficient way to connect with an insurance agent. You can typically obtain a quote within minutes, and agents are readily available to answer questions and clarify any doubts you might have.

Benefits of Phone Calls

- Convenience: You can call from the comfort of your home or office, saving time and effort compared to in-person visits.

- Accessibility: Insurance companies often have extended business hours, making it easier to reach an agent at a time that suits you.

- Speed: Quotes are typically generated quickly, allowing you to compare different options efficiently.

Drawbacks of Phone Calls

- Limited Information: Phone calls may not allow for a comprehensive discussion of all policy details, especially complex aspects like coverage limits or optional add-ons.

- Lack of Visual Aids: It can be challenging to understand specific policy terms and conditions without visual aids or written documents.

- Potential for Miscommunication: Verbal communication can sometimes lead to misunderstandings, especially when discussing technical insurance terms.

In-Person Meetings

In-person meetings with insurance agents offer a more personalized and interactive experience. This approach allows for a thorough discussion of your needs and preferences, ensuring a comprehensive understanding of your insurance options.

Benefits of In-Person Meetings

- Detailed Explanation: Agents can provide detailed explanations of policy terms and conditions, using visual aids and written materials to enhance comprehension.

- Personalized Advice: You can receive tailored recommendations based on your specific circumstances, including driving history, vehicle usage, and risk factors.

- Trust and Confidence: Meeting face-to-face can build trust and confidence, making you feel more comfortable discussing sensitive financial matters.

Drawbacks of In-Person Meetings

- Time Commitment: In-person meetings require a significant time investment, especially if you need to travel to an agent’s office.

- Scheduling Challenges: Finding a time that works for both you and the agent can be challenging, particularly if you have a busy schedule.

- Limited Availability: Insurance agents may have limited availability, especially during peak hours or holidays.

Tips for Effective Communication with Insurance Agents

- Be Prepared: Gather all relevant information, such as your driver’s license, vehicle registration, and previous insurance policies.

- Ask Questions: Don’t hesitate to ask clarifying questions about policy terms, coverage limits, or any other aspects you don’t understand.

- Be Specific: Clearly articulate your needs and expectations, including your driving history, vehicle usage, and desired coverage levels.

- Compare Quotes: Don’t rely on just one quote. Compare prices and coverage options from multiple insurance providers to ensure you’re getting the best deal.

- Read the Fine Print: Carefully review the policy documents before signing anything to ensure you fully understand the terms and conditions.

Factors Affecting Quote Accuracy

Getting an accurate car insurance quote is crucial for making informed decisions about your coverage. Several factors can influence the price you are offered, and understanding these factors can help you secure the best possible rate.

Driving History

Your driving history is a major factor in determining your insurance premium. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher rates. Insurance companies use this data to assess your risk of future claims, and a history of risky driving behavior suggests a higher likelihood of future incidents.

Vehicle Details

The type of vehicle you drive also plays a significant role in your insurance quote. Factors such as the make, model, year, and safety features of your car can impact the cost of your insurance. For example, newer vehicles with advanced safety features tend to have lower premiums than older cars with fewer safety features. This is because newer cars are generally safer and less likely to be involved in accidents.

Location

Your location can also influence your car insurance premiums. Insurance companies consider factors such as the population density, crime rate, and frequency of accidents in your area when setting rates. Areas with higher crime rates and more accidents tend to have higher insurance premiums. This is because there is a higher risk of your vehicle being stolen or damaged in these areas.

Understanding Coverage Options

Car insurance policies offer a range of coverage options, each designed to protect you financially in different scenarios. Understanding these options is crucial for choosing the right level of protection and ensuring you’re adequately covered in the event of an accident or other unforeseen circumstances.

Liability Coverage

Liability coverage is essential for any car owner. It protects you financially if you’re at fault in an accident that causes injury or damage to others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by your negligence. It is typically expressed as a per-person limit and a per-accident limit, such as $100,000/$300,000, meaning up to $100,000 per person injured and up to $300,000 for all injuries in a single accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property damaged in an accident caused by your negligence. It is typically expressed as a single limit, such as $50,000, meaning up to $50,000 for all property damage in a single accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This coverage is optional, but it’s often required by lenders if you have a car loan.

- Deductible: This is the amount you pay out-of-pocket before your insurance company covers the rest of the repair costs. A higher deductible typically results in lower premiums.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than an accident, such as theft, vandalism, fire, hail, or a collision with an animal. Like collision coverage, it’s optional but often required by lenders.

- Deductible: Similar to collision coverage, you’ll pay a deductible before your insurance company covers the remaining costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Bodily Injury Coverage: This coverage pays for your medical expenses and other damages if you’re injured by an uninsured or underinsured driver.

- Property Damage Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by an uninsured or underinsured driver.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who’s at fault in an accident. This coverage is mandatory in some states.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, pays for your medical expenses, regardless of who’s at fault in an accident. It’s typically a lower limit than PIP coverage and may not cover lost wages.

Other Coverage Options

In addition to the core coverage options mentioned above, car insurance policies may offer additional coverage options, such as:

- Rental Car Coverage: Pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides coverage for services such as towing, flat tire changes, and jump starts.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your car loan if your vehicle is totaled.

Choosing the Right Insurance Provider

Once you’ve gathered quotes from multiple insurers, the next step is to carefully compare the features and benefits they offer. This involves evaluating the overall value proposition of each provider to determine the best fit for your individual needs and budget.

Comparing Features and Benefits

To make an informed decision, it’s essential to analyze the features and benefits offered by different insurance providers. This includes:

- Coverage options: Each insurer may have varying levels of coverage, such as comprehensive, collision, liability, and personal injury protection. Compare the specific coverage options offered by each provider to ensure they meet your needs.

- Deductibles and premiums: Carefully review the deductibles and premiums associated with each policy. Lower deductibles often translate to higher premiums, and vice versa. Find the balance that best aligns with your risk tolerance and financial situation.

- Discounts: Many insurers offer discounts for safe driving records, good credit scores, multiple policies, and other factors. Compare the available discounts to see which provider offers the most significant savings.

- Customer service: Consider the reputation and track record of each insurer’s customer service. Look for providers with positive customer reviews and a history of prompt and efficient claim handling.

- Financial stability: Evaluate the financial strength of each insurance company. A financially stable insurer is less likely to experience difficulties in paying claims in the future. You can research a company’s financial stability through credit rating agencies like A.M. Best or Standard & Poor’s.

Considering Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the experiences of other policyholders. Reputable websites like J.D. Power and Consumer Reports offer comprehensive reviews and ratings of insurance companies. By reviewing customer feedback, you can gain a better understanding of a provider’s strengths and weaknesses, including areas such as customer service, claims handling, and overall satisfaction.

Tips for Selecting a Provider

When selecting an insurance provider, keep the following tips in mind:

- Consider your individual needs: Your specific needs and preferences will influence the best provider for you. For example, if you have a new car, you may prioritize comprehensive coverage. If you have a history of accidents, you may need a provider with a lenient claims process.

- Get multiple quotes: Don’t settle for the first quote you receive. Obtain quotes from several insurers to compare pricing and coverage options.

- Ask questions: Don’t hesitate to ask questions about the policy terms, coverage details, and claims process. A reputable insurer will be happy to answer your questions and provide clear explanations.

- Read the policy carefully: Before signing up, carefully review the policy documents to ensure you understand the coverage, exclusions, and limitations.

Negotiating Quotes

While car insurance quotes are generally non-negotiable, there are still strategies you can employ to potentially lower your premiums. This involves understanding the factors that influence your quote and leveraging them to your advantage.

Discounts and Coverage Options

Discounts are a significant avenue for negotiating car insurance quotes. Insurance companies offer a variety of discounts based on factors such as:

- Good driving record: A clean driving history with no accidents or violations can earn you substantial discounts.

- Safety features: Vehicles equipped with anti-theft devices, airbags, and other safety features are often eligible for discounts.

- Bundling policies: Combining your car insurance with other insurance policies, like homeowners or renters insurance, can lead to significant savings.

- Paying in full: Some insurers offer discounts for paying your premium in full upfront rather than in installments.

- Membership affiliations: Belonging to certain organizations or professional groups may qualify you for discounts.

- Driving habits: Some insurers offer discounts for low mileage drivers or those who participate in telematics programs that monitor their driving behavior.

Additionally, you can explore different coverage options to potentially reduce your premiums. For example, increasing your deductible, which is the amount you pay out-of-pocket before your insurance kicks in, can lower your premium. However, it’s crucial to balance the potential savings with your risk tolerance.

Understanding the Renewal Process

Renewing your car insurance policy is a routine process that ensures you maintain continuous coverage. This typically involves contacting your insurer and providing updated information, like changes in your driving record or vehicle details.

Factors Affecting Renewal Premiums

Renewal premiums can fluctuate based on several factors. Your insurer will consider your driving history, claims history, vehicle details, and the coverage you choose. For example, if you’ve had a recent accident or received a traffic violation, your premium may increase. Conversely, maintaining a clean driving record and opting for a higher deductible could lead to lower premiums.

Tips for a Smooth Renewal Process

- Review your policy details: Before your renewal date, thoroughly examine your current policy to ensure the coverage aligns with your needs. If you’ve made any significant changes, such as adding a new driver or vehicle, update your policy accordingly.

- Compare quotes from different insurers: Don’t automatically renew with your existing insurer. Compare quotes from other providers to see if you can find a better deal. Consider factors like price, coverage, and customer service.

- Communicate with your insurer: If you anticipate any changes in your driving habits or vehicle usage, inform your insurer. For instance, if you’re planning to drive less due to a new job, they may offer a lower premium based on reduced risk.

- Renew early: To avoid potential gaps in coverage, renew your policy well before your current policy expires. This allows sufficient time for any necessary adjustments and avoids last-minute rush.

Exploring Alternative Insurance Options

While traditional car insurance providers offer a wide range of coverage options, innovative alternatives are emerging to cater to specific needs and preferences. These options often provide greater flexibility and potential savings, making them attractive to certain drivers.

Peer-to-Peer Insurance

Peer-to-peer (P2P) insurance, also known as community-based insurance, allows individuals to share risk and costs with other drivers within a community or group.

- How P2P Insurance Works: P2P platforms connect drivers who are willing to share risk and potentially pay lower premiums. Members contribute to a pool of funds, which is used to cover claims.

- Potential Benefits:

- Lower premiums: P2P insurance can potentially offer lower premiums than traditional insurers, especially for drivers with good driving records.

- Community focus: P2P insurance fosters a sense of community among members, who can share experiences and support each other.

- Potential Drawbacks:

- Limited availability: P2P insurance is still a relatively new concept and may not be available in all regions.

- Risk of higher claims: If there are a high number of claims within a P2P group, members may have to pay higher premiums.

- Limited coverage options: P2P insurance providers may offer fewer coverage options than traditional insurers.

Usage-Based Insurance

Usage-based insurance (UBI) programs, also known as pay-per-mile insurance, adjust premiums based on driving behavior and mileage.

- How UBI Works: UBI programs use telematics devices or smartphone apps to track driving habits, such as speed, braking, and mileage. Premiums are adjusted based on these data points.

- Potential Benefits:

- Lower premiums: Drivers with safe and efficient driving habits can potentially earn lower premiums through UBI programs.

- Personalized feedback: UBI programs provide insights into driving behavior, enabling drivers to improve their habits and potentially save money.

- Potential Drawbacks:

- Privacy concerns: Some drivers may be concerned about the privacy implications of having their driving data tracked.

- Limited availability: Not all insurance providers offer UBI programs, and eligibility criteria may vary.

- Potential for increased premiums: If driving habits are deemed risky or inefficient, premiums may increase.

Final Thoughts

Armed with this knowledge, you can confidently embark on your car insurance journey. Remember, securing the best quotes requires research, comparison, and a willingness to negotiate. By taking the time to understand the process and leverage available resources, you can find the perfect car insurance policy to safeguard your vehicle and your peace of mind.