Erie Insurance, a name synonymous with regional insurance dominance, has carved a unique path in the competitive landscape. While its reach may not span the globe, its unwavering commitment to customer service and financial stability has garnered a loyal following. This deep dive into Erie Insurance.com will explore the company’s history, market presence, and unique strengths, revealing why it continues to thrive in a rapidly evolving industry.

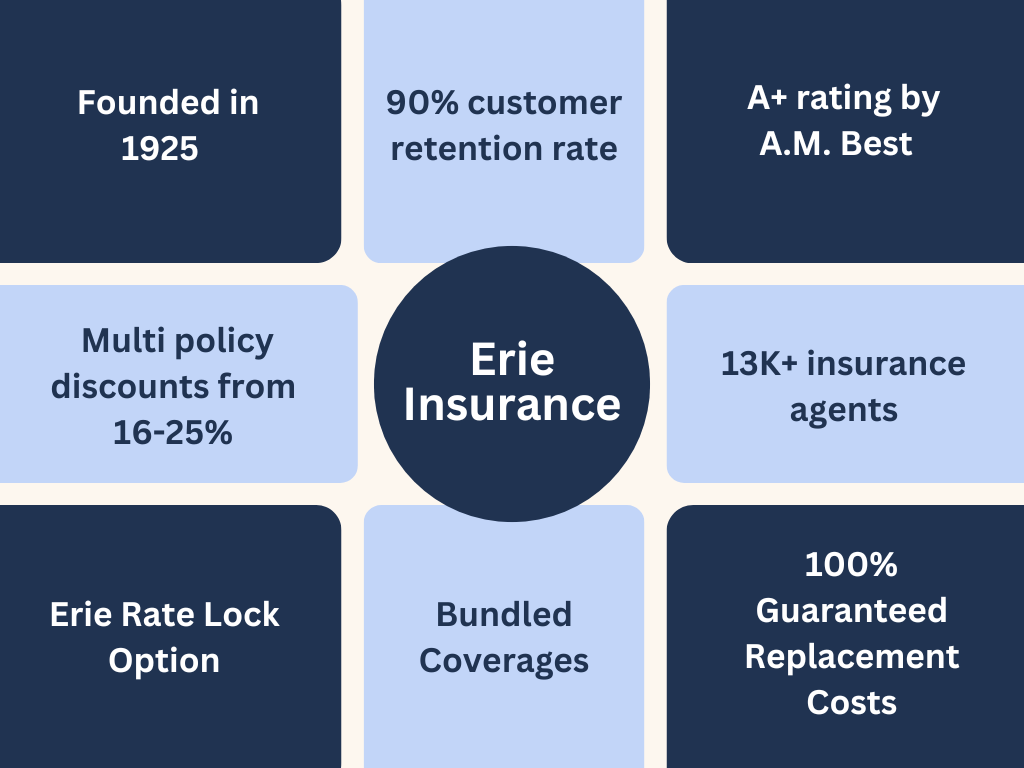

Founded in 1925, Erie Insurance has grown from a small Pennsylvania-based company into a regional powerhouse, offering a wide range of insurance products. Its focus on personal lines, including auto, home, and life insurance, has solidified its position as a trusted provider in its core markets. Erie Insurance’s commitment to its customers is evident in its high customer satisfaction ratings and strong financial performance, making it a compelling choice for individuals seeking reliable insurance coverage.

Erie Insurance Overview

Erie Insurance is a leading property and casualty insurance provider in the United States, with a rich history dating back to 1925. Founded in Erie, Pennsylvania, the company has grown significantly over the years, expanding its reach across multiple states and establishing itself as a trusted name in the insurance industry.

History and Founding

Erie Insurance was founded in 1925 by H.O. Hirt, a local businessman who recognized the need for a reliable insurance provider in the Erie area. The company began as a small, regional insurer, focusing on providing auto insurance to residents of northwestern Pennsylvania. Hirt’s vision was to build a company that prioritized customer service and offered competitive rates, principles that continue to guide Erie Insurance today.

Mission, Vision, and Core Values

Erie Insurance’s mission is to provide quality insurance products and services that meet the needs of its customers while maintaining a strong commitment to financial stability. The company’s vision is to be the leading provider of insurance solutions in its markets, known for its exceptional customer service, innovative products, and strong financial performance.

Erie Insurance’s core values are reflected in its commitment to:

- Customer Focus: Placing customers at the heart of all business decisions and striving to provide exceptional service and support.

- Integrity: Operating with honesty, fairness, and ethical behavior in all business dealings.

- Financial Strength: Maintaining a strong financial position to ensure the company’s long-term stability and ability to meet its obligations to policyholders.

- Employee Development: Investing in its employees and creating a positive and supportive work environment.

- Community Involvement: Supporting the communities where Erie Insurance operates through charitable contributions and volunteerism.

Key Products and Services

Erie Insurance offers a comprehensive range of insurance products and services, including:

- Auto Insurance: Providing coverage for personal vehicles, including liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Homeowners Insurance: Protecting homeowners from various risks, such as fire, theft, and natural disasters.

- Renters Insurance: Offering coverage for renters’ personal property and liability protection.

- Business Insurance: Providing insurance solutions for small businesses, including property, liability, and workers’ compensation coverage.

- Life Insurance: Offering various life insurance products, such as term life, whole life, and universal life insurance.

Erie Insurance also offers a range of services to its policyholders, including:

- 24/7 Claims Service: Providing prompt and efficient claims handling support.

- Online Account Management: Allowing policyholders to manage their policies, pay premiums, and access policy documents online.

- Mobile App: Providing convenient access to insurance information and services on mobile devices.

- Dedicated Customer Service Representatives: Offering personalized assistance and support to policyholders.

Target Audience and Market Presence

Erie Insurance, a regional insurance company, targets a specific demographic and geographical market. The company’s strategy centers on building strong relationships with its policyholders and providing personalized insurance solutions.

Geographic Regions

Erie Insurance operates primarily in the Mid-Atlantic and Northeast regions of the United States. The company has a strong presence in Pennsylvania, New York, Ohio, Maryland, Virginia, West Virginia, North Carolina, Indiana, Illinois, and Kentucky. Erie Insurance’s geographic focus allows it to tailor its products and services to the specific needs of these regions.

Market Share

Erie Insurance holds a significant market share in its core operating regions. However, its national market share is relatively small compared to major national insurance companies. For instance, in 2022, Erie Insurance ranked 12th in terms of direct written premiums among the top 25 property and casualty insurers in the U.S., according to the National Association of Insurance Commissioners (NAIC).

Erie Insurance’s market share is estimated to be around 1.5% of the total U.S. property and casualty insurance market.

While Erie Insurance faces competition from national players like State Farm, Geico, and Allstate, it differentiates itself through its focus on customer service, personalized solutions, and a strong regional presence.

Financial Performance and Stability

Erie Insurance has a strong track record of financial performance, characterized by consistent profitability and steady growth. The company’s financial stability is reflected in its robust capital position and favorable credit ratings.

Recent Financial Performance

Erie Insurance’s recent financial performance has been marked by consistent profitability and revenue growth. The company’s net income has increased steadily in recent years, driven by strong underwriting results and disciplined expense management. In 2022, Erie Insurance reported net income of $1.1 billion, representing a 14% increase from the previous year. The company’s revenue also grew significantly, reaching $7.5 billion in 2022, a 9% increase from the previous year.

Financial Stability and Credit Rating

Erie Insurance is considered a financially stable company with a strong capital position. The company maintains a high level of capital reserves, which provide a buffer against potential losses and support its long-term growth strategy. Erie Insurance’s financial strength is reflected in its credit ratings, which are consistently high. For example, A.M. Best, a leading credit rating agency, assigns Erie Insurance a financial strength rating of A+ (Superior) and a long-term issuer credit rating of a+ (Strong). These ratings indicate Erie Insurance’s strong financial position and its ability to meet its financial obligations.

Significant Financial Trends and Challenges

Erie Insurance faces several significant financial trends and challenges, including:

- Rising claims costs: The insurance industry is experiencing rising claims costs due to factors such as inflation, increased litigation, and severe weather events. Erie Insurance is not immune to these trends, and it is actively managing its claims costs through a combination of strategies, including pricing adjustments and claims management initiatives.

- Competition: The insurance industry is highly competitive, with a large number of players vying for market share. Erie Insurance faces competition from both national and regional insurers, as well as from newer entrants such as insurtech companies. The company is responding to this competition by investing in technology and innovation to improve its products and services and enhance customer experience.

- Regulatory changes: The insurance industry is subject to a complex and evolving regulatory environment. Erie Insurance must navigate these changes, which can impact its operations and profitability. The company is actively engaged with regulators to ensure that its operations comply with all applicable rules and regulations.

Customer Service and Reviews

Erie Insurance has built a reputation for strong customer service, a key factor in its enduring success. This reputation is based on a combination of proactive customer care strategies, a focus on building long-term relationships, and a commitment to resolving issues quickly and efficiently.

Customer Service Practices

Erie Insurance emphasizes personalized service and building strong relationships with its policyholders. This approach is evident in several key practices:

- Local Agents: Erie Insurance operates through a network of independent agents who are deeply embedded in their communities. This local presence allows agents to provide personalized service and build strong relationships with policyholders.

- 24/7 Customer Support: Erie Insurance offers 24/7 customer support through phone, email, and online chat, ensuring that policyholders can access assistance whenever they need it.

- Claims Handling: Erie Insurance aims to process claims quickly and efficiently. The company offers a variety of options for filing claims, including online, by phone, or through an agent. Policyholders can track the status of their claims online.

Customer Reviews and Feedback

Customer reviews and feedback are essential for understanding Erie Insurance’s performance and identifying areas for improvement. Reviews from various sources provide insights into customer experiences:

- J.D. Power: Erie Insurance has consistently ranked highly in J.D. Power’s customer satisfaction surveys. For example, in the 2023 U.S. Auto Insurance Satisfaction Study, Erie Insurance ranked second overall.

- Consumer Reports: Consumer Reports has also given Erie Insurance high ratings for customer satisfaction. In its 2023 Auto Insurance Ratings, Erie Insurance received a score of 80 out of 100, placing it among the top-performing insurers.

- Online Reviews: Online review platforms like Google Reviews, Yelp, and Trustpilot provide a diverse range of customer feedback. While reviews can be subjective, they offer valuable insights into specific experiences and areas where Erie Insurance can improve.

Customer Satisfaction Ratings Compared to Competitors

Comparing Erie Insurance’s customer satisfaction ratings to its competitors is essential for understanding its relative performance.

- J.D. Power: In the 2023 U.S. Auto Insurance Satisfaction Study, Erie Insurance outperformed national giants like Geico, Progressive, and State Farm. This indicates that Erie Insurance’s customer service practices are highly regarded compared to its major competitors.

- Consumer Reports: Consumer Reports also highlights Erie Insurance’s strong customer satisfaction ratings compared to other insurers. While specific rankings can fluctuate, Erie Insurance consistently ranks among the top performers in the industry.

Digital Presence and Online Experience

Erie Insurance, a regional insurance provider with a strong foothold in the Northeast and Midwest, has made strides in bolstering its digital presence to cater to the evolving needs of its customer base. The company’s website and mobile app offer a suite of functionalities designed to streamline interactions and enhance the overall customer experience.

Website Functionality

Erie Insurance’s website is a comprehensive online platform that provides a wide array of services, including:

- Requesting Quotes: Users can obtain personalized quotes for various insurance products, including auto, home, business, and life insurance, through an intuitive online form.

- Managing Policies: Policyholders can access and manage their insurance policies online, including viewing policy details, making payments, and reporting claims.

- Finding Agents: The website features a search tool that allows users to locate Erie Insurance agents in their area based on location, specialty, and other criteria.

- Accessing Resources: Erie Insurance provides a wealth of online resources, including articles, FAQs, and videos, to help customers understand their insurance coverage and navigate various insurance-related topics.

Mobile App Functionality

Erie Insurance’s mobile app, available for both iOS and Android devices, offers a user-friendly interface that mirrors the functionality of the website. Key features include:

- Policy Management: Policyholders can access and manage their policies on the go, including viewing policy details, making payments, and reporting claims.

- Roadside Assistance: The app allows users to request roadside assistance services, such as towing, jump-starts, and tire changes, directly through their mobile device.

- Claims Reporting: Policyholders can report claims through the app, providing photos and details of the incident.

- Agent Locator: The app features a built-in agent locator tool, allowing users to find nearby Erie Insurance agents.

User Experience and Navigation

Erie Insurance’s digital platforms are generally well-received for their user-friendliness and intuitive navigation. The website and app are designed with a clean and modern layout, making it easy for users to find the information they need. The company has also implemented a number of features to enhance accessibility, such as a text-to-speech function and the ability to adjust font size.

Social Media Presence and Engagement

Erie Insurance maintains an active presence on various social media platforms, including Facebook, Twitter, and Instagram. The company uses these channels to engage with customers, share industry news, and promote its products and services. Erie Insurance’s social media strategy is characterized by a focus on community engagement, with the company often participating in local events and supporting charitable causes.

Claims Process and Customer Support

Erie Insurance’s claims process and customer support are critical aspects of its service offerings. Understanding how these processes work and the level of support provided can be crucial for potential customers.

Filing a Claim

Erie Insurance provides multiple channels for filing a claim, catering to diverse customer preferences. Customers can file a claim online through their website, by phone, or through their mobile app. The process typically involves providing details about the incident, such as the date, time, and location, as well as information about the involved parties and the extent of damages. Erie Insurance also offers 24/7 claims reporting through its website and mobile app, allowing customers to report claims anytime, anywhere.

Customer Support Channels

Erie Insurance offers a range of customer support channels to ensure accessibility and convenience. Customers can reach out to Erie Insurance via phone, email, or live chat. The company also maintains a dedicated customer support section on its website, providing access to frequently asked questions (FAQs), resources, and online forms.

Claims Handling Efficiency and Responsiveness

Erie Insurance aims to provide efficient and responsive claims handling. The company strives to process claims quickly and fairly, working to resolve issues promptly. Erie Insurance has a dedicated claims team that handles claims from start to finish, ensuring consistent communication and support throughout the process.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into the claims process and customer support. Erie Insurance generally receives positive reviews for its claims handling, with customers often praising the company’s efficiency, responsiveness, and professionalism. However, as with any insurance provider, there may be instances where customers have had less positive experiences. It is important to review customer feedback from various sources to gain a comprehensive understanding of Erie Insurance’s claims process and customer support.

Competitive Landscape and Differentiation

Erie Insurance operates in a highly competitive insurance market, facing challenges from both large national insurers and regional players. The company’s success depends on its ability to effectively differentiate its offerings and attract customers in a crowded landscape.

Major Competitors

Erie Insurance’s primary competitors include national insurance giants such as State Farm, Geico, and Allstate, as well as regional players like Nationwide and Progressive. These competitors offer a wide range of insurance products and services, including auto, home, business, and life insurance.

Erie Insurance’s Competitive Advantages

Erie Insurance distinguishes itself from its competitors through a combination of factors:

- Strong Regional Presence: Erie Insurance has a strong presence in the Northeast and Midwest, focusing on building relationships with local communities and agents. This localized approach allows the company to tailor its offerings to specific regional needs and preferences.

- Focus on Customer Service: Erie Insurance emphasizes exceptional customer service, building a reputation for responsiveness and personalized attention. This commitment to customer satisfaction has contributed to high customer retention rates.

- Financial Strength and Stability: Erie Insurance boasts a strong financial position, consistently earning high ratings for financial stability. This reputation for reliability and security reassures customers about the company’s ability to meet its obligations.

- Exclusive Products and Services: Erie Insurance offers unique products and services, such as its “Erie-fied” auto insurance program, which provides comprehensive coverage and discounts for safe driving habits.

- Direct and Agent Distribution Model: Erie Insurance operates through a dual distribution model, offering direct sales channels and a network of independent agents. This hybrid approach allows the company to reach a wider customer base and cater to diverse needs.

Competitive Comparison

Erie Insurance’s competitive advantages are particularly pronounced in areas like customer service, financial stability, and regional focus. For example, in terms of customer satisfaction, Erie Insurance consistently ranks among the top insurance companies in independent surveys. Its strong financial performance and stability, evidenced by high ratings from agencies like A.M. Best, also distinguish it from some of its larger competitors.

Industry Trends and Future Outlook

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and macroeconomic factors. Erie Insurance, like its peers, must adapt to these trends to remain competitive and achieve long-term success.

Impact of Industry Trends on Erie Insurance

Erie Insurance faces a complex landscape of evolving industry trends. These trends present both opportunities and challenges for the company.

- Digital Transformation: The rise of digital technologies, such as artificial intelligence (AI), big data analytics, and cloud computing, is transforming the insurance industry. Erie Insurance has been investing in digital capabilities to enhance customer experience, improve operational efficiency, and develop innovative products and services. The company’s digital transformation strategy is focused on leveraging technology to personalize customer interactions, automate processes, and create a seamless online experience.

- Shifting Customer Expectations: Consumers are increasingly demanding personalized, convenient, and transparent insurance experiences. Erie Insurance is responding to these expectations by offering digital self-service options, mobile-friendly platforms, and personalized communication channels. The company is also focusing on building trust and transparency by providing clear and concise information about its products and services.

- Emerging Risks and Climate Change: Climate change and other emerging risks, such as cyberattacks and data breaches, are increasing the complexity and frequency of insurance claims. Erie Insurance is proactively addressing these challenges by developing innovative products and services, expanding its risk management expertise, and investing in technology to enhance its risk assessment capabilities.

- Increased Competition: The insurance industry is becoming increasingly competitive, with new entrants and established players vying for market share. Erie Insurance is differentiating itself through its strong brand reputation, personalized customer service, and focus on community engagement. The company is also investing in new product development and distribution channels to expand its reach and attract new customers.

Growth Opportunities and Challenges

Erie Insurance has several growth opportunities in the coming years. These opportunities are linked to the company’s strategic initiatives and the overall industry trends.

- Expanding into New Markets: Erie Insurance has historically focused on its core markets in the Mid-Atlantic and Midwest. The company has recently expanded into new markets, such as Florida and Texas, and is exploring opportunities to expand further. This expansion strategy will allow Erie Insurance to tap into new customer segments and increase its market share.

- Developing New Products and Services: Erie Insurance is constantly developing new products and services to meet the evolving needs of its customers. The company has recently introduced innovative products, such as telematics-based insurance programs and customized coverage options. Erie Insurance is also exploring opportunities to expand its product portfolio to include niche markets, such as commercial insurance and specialty lines.

- Leveraging Technology for Growth: Erie Insurance is leveraging technology to enhance its operations, improve customer experience, and develop new products and services. The company is investing in artificial intelligence (AI), big data analytics, and cloud computing to automate processes, personalize customer interactions, and gain insights into customer behavior. Erie Insurance is also exploring the use of blockchain technology to streamline claims processing and improve transparency.

Strategic Initiatives and Future Plans

Erie Insurance has a clear vision for the future, which is focused on achieving sustainable growth and maintaining its leadership position in the insurance industry. The company’s strategic initiatives are aligned with the industry trends and are designed to address the challenges and opportunities ahead.

- Customer-Centric Approach: Erie Insurance is committed to providing exceptional customer service and building long-term relationships with its policyholders. The company is investing in technology and training to enhance its customer experience, improve communication channels, and personalize interactions. Erie Insurance is also focused on building trust and transparency by providing clear and concise information about its products and services.

- Innovation and Product Development: Erie Insurance is constantly innovating and developing new products and services to meet the evolving needs of its customers. The company is investing in research and development to identify emerging trends and develop innovative solutions. Erie Insurance is also exploring opportunities to expand its product portfolio to include niche markets, such as commercial insurance and specialty lines.

- Strategic Partnerships and Acquisitions: Erie Insurance is exploring opportunities to expand its reach and enhance its capabilities through strategic partnerships and acquisitions. The company is seeking partners that can provide complementary expertise, technology, or distribution channels. Erie Insurance is also considering acquisitions that can help it enter new markets or expand its product portfolio.

- Sustainability and Corporate Social Responsibility: Erie Insurance is committed to operating in a sustainable and responsible manner. The company is investing in environmental initiatives, promoting diversity and inclusion, and supporting community programs. Erie Insurance is also committed to ethical business practices and transparency in its operations.

Case Studies and Success Stories

Erie Insurance has a long history of providing exceptional customer service and financial stability. The company’s commitment to its policyholders is evident in numerous success stories and positive customer experiences. These examples showcase Erie Insurance’s value proposition and highlight the company’s dedication to exceeding customer expectations.

Customer Testimonials and Positive Reviews

Numerous online platforms and review sites feature positive testimonials from Erie Insurance customers. These reviews consistently praise the company’s responsiveness, helpfulness, and efficient claims processing. For example, on Trustpilot, Erie Insurance boasts an average rating of 4.5 out of 5 stars, with many customers highlighting their positive experiences with the company’s claims process and customer service representatives.

Erie Insurance’s Value Proposition

Erie Insurance’s value proposition is rooted in its commitment to providing comprehensive coverage, competitive pricing, and exceptional customer service. The company’s focus on building long-term relationships with its policyholders has resulted in high customer satisfaction and loyalty.

Notable Achievements and Awards

Erie Insurance has consistently been recognized for its commitment to customer service and financial stability. The company has received numerous awards and accolades, including:

- J.D. Power Award for Highest Customer Satisfaction Among Auto Insurers in the East: This award recognizes Erie Insurance’s dedication to providing a positive customer experience in the auto insurance sector.

- Ward’s 50 Top Performing Insurance Companies: Erie Insurance has been included in Ward’s 50 Top Performing Insurance Companies list for several consecutive years, demonstrating its financial strength and operational excellence.

- A.M. Best Financial Strength Rating of A+ (Superior): This rating reflects Erie Insurance’s strong financial position and its ability to meet its obligations to policyholders.

Case Studies

Erie Insurance’s commitment to customer service is evident in numerous case studies that demonstrate the company’s ability to resolve complex situations and exceed customer expectations. One notable case study involves a policyholder who experienced a major car accident. Erie Insurance’s claims team worked diligently to ensure the policyholder received prompt and fair compensation, while also providing support and guidance throughout the process. The policyholder was highly satisfied with the company’s response and praised Erie Insurance’s dedication to its customers.

Another case study involves a homeowner who experienced a significant water damage incident. Erie Insurance’s claims team worked closely with the homeowner to assess the damage and develop a comprehensive restoration plan. The company provided timely and efficient support throughout the process, ensuring the homeowner’s property was restored to its pre-loss condition. The homeowner was highly impressed with Erie Insurance’s responsiveness and professionalism.

These case studies demonstrate Erie Insurance’s commitment to providing exceptional customer service and support. The company’s dedication to its policyholders is evident in its ability to resolve complex situations and exceed customer expectations.

Final Wrap-Up

Erie Insurance.com embodies a unique blend of regional strength, customer-centricity, and financial stability. While it may not be a household name across the nation, its commitment to its core markets has allowed it to flourish. As the insurance industry continues to evolve, Erie Insurance’s ability to adapt and innovate, while remaining true to its core values, positions it for continued success. The company’s commitment to its customers, coupled with its strong financial performance, makes it a compelling choice for individuals seeking reliable insurance coverage in its service areas.