Looking for car insurance quotes in Texas? Finding the perfect car insurance policy shouldn’t feel like navigating a maze, right?. It should be simple, straightforward, & hassle-free. But let’s be honest, with so many insurance companies vying for your attention, it can feel overwhelming!. You’re bombarded with flashy ads, confusing jargon, & promises that seem too good to be true. So, where do you even begin?.

That’s where we come in!. We’re here to be your friendly guide through the wild west of Texas car insurance quotes. We’ll help you cut through the noise & find the best coverage that fits your needs & your budget. Forget those long hours spent scrolling through endless websites comparing rates—we’ll make it easier than ordering takeout!.

In Texas, car insurance isn’t just a good idea, it’s the law. You’re legally required to carry minimum liability coverage, & failing to do so can lead to serious consequences— hefty fines, & even license suspension. That’s why finding the right coverage isn’t a luxury, it’s a necessity. But even with the legal requirements, understanding the different types of coverage can feel complicated. Do you need comprehensive? What about collision? What about uninsured/underinsured motorist protection? These are questions that we will be answering as you keep reading.

Think about this, choosing the wrong car insurance policy could end up costing you significantly more in the long run, not just because of your monthly premiums but even your coverage gaps. A cheaper option, seemingly, that has a very limited liability is actually riskier and could bankrupt you in case of accident, wouldn’t it? But this won’t happen with us because we’ll cut through the confusing factors and find suitable deals.

Our aim? To arm you with the knowledge & resources to make informed decisions. We’ll break down the complexities of Texas car insurance quotes, making the process crystal clear, step by step. Whether you’re a new driver, an experienced motorist, or simply looking to switch providers & save some cash, this guide will provide you with helpful steps, information you need. We will tackle everything, from understanding minimum coverage requirements, navigating various policy types (like comprehensive, collision, and liability coverage), all the way to finding top-rated insurance companies in your Texas area! So what are you waiting for?

So, are you ready to simplify your search for Texas car insurance quotes?. Let’s get started!. We will provide a guide of useful steps you could implement & tips on how to search and select your car insurance that you’ll enjoy and that also matches your personal circumstances.

Because after all, protecting yourself & your vehicle shouldn’t be a stressful chore. It should be simple, quick and stress-free. We will show you how, with a straightforward and transparent information in the steps that follows! Keep reading.

Finding the optimal Car Insurance Quote in Texas: A thorough Guide

Finding affordable and adequate Texas car insurance can feel overwhelming. With so many offerrs and policy options, securing the optimal insurance quote requires study and understanding. This thorough guide will walk you through the process, helping you navigate the world of Texas auto insurance and find the perfect fit for your needs.

Understanding Texas Car Insurance Requirements

Texas, like all states, mandates minimum car insurance coverage. Understanding these requirements is crucial to avoid hefty fines and legal repercussions.

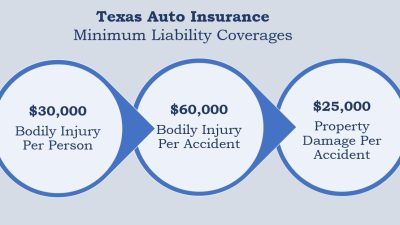

Minimum Coverage Requirements in Texas

Texas law requires drivers to carry a minimum of 30/60/25 liability coverage. This means $30,000 in bodily injury liability coverage per person, $60,000 per accident, and $25,000 in property damage liability coverage. Failing to meet this minimum can lead to significant penalties.

Liability Coverage Explained: Bodily Injury and Property Damage

Liability coverage protects you financially if you cause an accident outcomeing in injuries or property damage to others. It covers medical bills, lost wages, and vehicle repairs for the other party involved.

Uninsured/Underinsured Motorist Coverage: Why It’s Crucial in Texas

Uninsured/underinsured motorist (UM/UIM) coverage is highly recommended. This protection safeguards you if you’re involved in an accident with an uninsured or underinsured driver. Given the number of uninsured drivers in Texas, this is an essential safeguard.

What is Collision and thorough Coverage? Do I Need It?

Collision coverage pays for damage to your vehicle outcomeing from an accident, regardless of fault. thorough coverage covers damage caused by events other than accidents, such as theft, vandalism, or hail. While not mandated, these add-ons offer valuable protection.

How to Get a Car Insurance Quote in Texas

Several avenues exist for obtaining car insurance quotes in Texas. Each method has its pros and cons.

Online Car Insurance Quote Tools: Pros and Cons

Online quote tools offer convenience and speed, allowing you to compare multiple insurers quickly. However, they might lack personalized attention.

Getting Quotes Over the Phone: What to Expect

Calling insurers directly offers a more personal touch, allowing you to ask specific querys. Be prepared to offer detailed information about your vehicle and driving history.

Working with an Insurance Agent: Personalized Advice and Support

Working with an insurance agent offers personalized advice and assistance. They can help you understand your options and find the optimal coverage for your needs.

Comparing Quotes: Apples to Apples

When comparing quotes, ensure you’re comparing similar coverage levels. Don’t just focus on price; prioritize adequate protection.

Factors Affecting Your Texas Car Insurance Quote

Several factors influence your car insurance quote in Texas. Understanding these factors can help you secure a more rival rate.

Your Driving Record: Accidents, Tickets, and Points

Accidents, traffic violations, and points on your driving record significantly impact your premiums. A clean driving record leads to lower rates.

Your Age and Driving Experience: How it Impacts Premiums

Younger, less experienced drivers typically pay higher premiums due to a statistically higher risk of accidents.

Your Vehicle: Make, Model, Year, and Safety attributes

The make, model, year, and safety attributes of your vehicle affect your insurance cost. Newer cars with advanced safety attributes often command lower premiums.

Your Location: Zip Code and Risk Factors

Your zip code influences your rate based on the accident and crime rates in your area. Higher-risk areas outcome in higher premiums.

Your Credit Score: The Surprising Impact on Rates (Texas Specific)

In Texas, your credit score can influence your car insurance rate. Maintaining a good credit score can lead to lower premiums.

Saving Money on Your Texas Car Insurance

Several strategies can help you save money on your Texas car insurance.

Discounts Available: Bundling, Safe Driver, Good Student, etc.

Many insurers offer discounts for bundling policies, maintaining a safe driving record, or being a good student.

Comparing Quotes from Multiple Insurers: A Must-Do

Comparing quotes from multiple insurers is essential to find the optimal rate for your coverage needs.

Negotiating Your Rate: Tips and Strategies

Don’t hesitate to negotiate your rate. Point out any discounts you qualify for and compare rates from varied insurers.

Reviewing Your Coverage Annually: Avoid Overpaying

Review your coverage annually to ensure you’re not overpaying for unnecessary coverage.

Choosing the Right Car Insurance offerr in Texas

selecting the right offerr is crucial. Consider several factors.

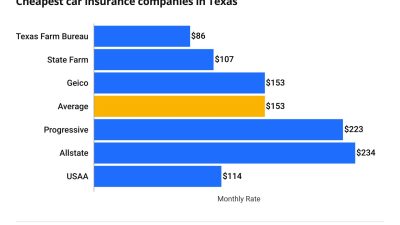

Top Car Insurance Companies in Texas: A Comparison

study top-rated insurance companies in Texas to compare their offerings and customer service.

Reading Policy Documents Carefully: Understanding What’s Covered

Carefully read your policy documents to understand what’s covered and what’s excluded.

Customer Service and Claims Process: crucial Considerations

Assess the insurer’s customer service reputation and claims process. A smooth claims process is vital in case of an accident.

Financial Stability of the Insurer: Protecting Your Investment

select a financially stable insurer to ensure they can pay out claims when needed.

Specific Texas Car Insurance Laws and Regulations

Texas has specific laws and regulations regarding car insurance.

SR-22 Insurance: When You Need It in Texas

SR-22 insurance is required in certain situations, such as after a DUI conviction.

Texas Department of Insurance Resources: Finding Help and Information

The Texas Department of Insurance offers valuable resources and information about car insurance.

Understanding Your Policy and Avoiding Penalties

Understanding your policy terms and conditions is crucial to avoid penalties.

Frequently Asked querys (FAQs) about Texas Car Insurance Quotes

What happens if I don’t have car insurance in Texas? Driving without insurance in Texas outcomes in significant fines and potential license suspension.

Can I get car insurance with a DUI in Texas? You may still obtain car insurance after a DUI, but expect higher premiums.

How do I file a claim with my car insurance company? Contact your insurer immediately after an accident to begin the claims process.

What are the penalties for driving without insurance in Texas? Penalties include hefty fines, license suspension, and potential court appearances.

Conclusion: Securing Affordable and Adequate Car Insurance in Texas

Securing affordable and adequate car insurance in Texas requires careful planning and study. By understanding the requirements, comparing quotes, and choosing the right offerr, you can protect yourself and your finances. Remember to review your policy annually to ensure it continues to meet your needs!