Imagine a world where you only pay for car insurance when you actually need it. That’s the promise of auto insurance by the day, a burgeoning insurance model that’s attracting attention for its flexibility and potential cost savings. While traditional annual policies lock you into a fixed premium regardless of usage, daily insurance allows you to pay only for the days you drive, making it an appealing option for occasional drivers, travelers, and those with fluctuating driving needs.

This new approach to auto insurance is shaking up the industry, challenging the traditional model and opening up a world of possibilities for drivers seeking greater control and affordability. As we delve into the intricacies of this innovative concept, we’ll explore how it works, its advantages and disadvantages, and who stands to benefit most from this evolving insurance landscape.

What is Auto Insurance by the Day?

Auto insurance by the day, also known as pay-per-day auto insurance, is a type of coverage that allows drivers to pay for insurance only when they need it. This differs from traditional auto insurance policies, which typically require monthly or annual premiums, regardless of how often the vehicle is driven.

Pay-per-day auto insurance is gaining traction as a flexible and cost-effective alternative for drivers who don’t use their vehicles regularly.

Target Audience

Pay-per-day auto insurance is particularly attractive to individuals and groups who:

- Occasional Drivers: Individuals who drive infrequently, such as retirees, students, or those who primarily rely on public transportation.

- Short-Term Vehicle Users: People who need insurance for a limited period, such as for a rental car, a temporary vehicle loan, or a road trip.

- Seasonal Drivers: Individuals who drive only during specific seasons, like those who use their vehicle for summer vacations or winter getaways.

- Vehicle Owners with Multiple Vehicles: Individuals who own multiple vehicles but only drive one at a time may find it more cost-effective to insure each vehicle on a pay-per-day basis.

Examples of When Daily Auto Insurance Might Be Beneficial

Pay-per-day auto insurance can be a practical solution in various situations, such as:

- Borrowing a Car: When borrowing a friend’s or family member’s car for a short trip, pay-per-day insurance can provide temporary coverage.

- Renting a Car: While most rental car companies offer insurance, pay-per-day coverage can provide additional protection and potentially lower costs.

- Vehicle Storage: If a vehicle is stored for an extended period, pay-per-day insurance can be a cost-effective way to maintain coverage while the vehicle is not in use.

- Vehicle Repairs: When a vehicle is undergoing repairs and cannot be driven, pay-per-day insurance can provide temporary coverage until the vehicle is repaired.

How Does Daily Auto Insurance Work?

Daily auto insurance, also known as pay-per-use insurance, is a flexible option that allows drivers to pay for coverage only when they need it. This approach can be particularly advantageous for infrequent drivers, those who only drive occasionally, or those who need temporary coverage for specific situations.

Obtaining Daily Auto Insurance

To obtain daily auto insurance, individuals typically need to follow these steps:

- Contact an insurance provider: Various insurance companies offer daily auto insurance policies. Start by contacting a few providers to compare their offerings and pricing.

- Provide necessary information: You will need to provide basic information about yourself, your vehicle, and the dates you require coverage. This may include your driver’s license details, vehicle registration, and the intended dates and times of driving.

- Complete the application process: The insurance provider will likely have an online application or a phone-based process to complete. Once you submit the application, the provider will review it and issue a policy if approved.

Calculating and Pricing Coverage

Daily auto insurance pricing is based on several factors, including:

- Vehicle type: The make, model, and year of your vehicle play a role in determining the cost of coverage.

- Driving history: Your driving record, including any accidents or violations, can influence the premium.

- Coverage limits: The amount of coverage you choose for liability, collision, and comprehensive insurance will affect the price.

- Location: The geographical area where you will be driving can impact the premium, as different regions have varying risk levels.

- Driving duration: The number of days or hours you need coverage for will be a key factor in calculating the cost.

Key Features and Benefits

Daily auto insurance offers several key features and benefits:

- Flexibility: Pay for coverage only when you need it, eliminating the need for a traditional monthly or annual policy.

- Cost-effectiveness: For infrequent drivers, daily insurance can be significantly cheaper than traditional policies.

- Temporary coverage: Ideal for situations like renting a car, borrowing a vehicle, or needing coverage for a short trip.

- Convenience: Easy to obtain and manage, often through online platforms or mobile apps.

Comparing Daily Auto Insurance to Traditional Policies

Daily auto insurance offers a flexible alternative to traditional annual policies, appealing to drivers with occasional or short-term vehicle use needs. Understanding the key differences, advantages, and disadvantages of each option can help you choose the most cost-effective solution for your driving requirements.

Comparing Coverage and Cost

Daily auto insurance and traditional annual policies differ significantly in terms of coverage and cost. Daily policies provide temporary coverage for a specific period, typically a day or less, while annual policies offer continuous protection throughout the year. The cost of daily insurance is calculated based on the duration of coverage, while annual policies have a fixed premium paid upfront.

- Daily Auto Insurance: Coverage is typically limited to liability, collision, and comprehensive insurance. The cost is calculated based on the duration of coverage and varies depending on the vehicle, location, and coverage selected.

- Traditional Annual Policies: Coverage options are more extensive, often including personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM), and roadside assistance. The cost is fixed for the entire year, with premiums calculated based on factors like driving history, vehicle type, location, and coverage level.

Cost-Effectiveness

The cost-effectiveness of daily auto insurance depends on your driving habits and needs. Here’s a breakdown of scenarios where daily insurance might be more advantageous:

- Occasional Drivers: Individuals who drive infrequently, such as those who use their car for weekend trips or occasional errands, might find daily insurance more cost-effective than maintaining an annual policy.

- Rental Car Users: When renting a car, daily insurance can provide temporary coverage that complements or replaces the rental company’s insurance options.

- Short-Term Vehicle Use: For situations involving temporary vehicle use, such as borrowing a car for a few days or driving a vehicle during a short-term relocation, daily insurance can offer a convenient and affordable solution.

Advantages and Disadvantages

Here’s a comparison of the advantages and disadvantages of daily auto insurance and traditional annual policies:

| Daily Auto Insurance | Traditional Annual Policies | |

|---|---|---|

| Advantages | Flexibility and affordability for occasional drivers | Comprehensive coverage and predictable costs |

| Disadvantages | Limited coverage options and potential for higher costs for frequent drivers | Higher upfront costs and potential for unused coverage |

Types of Daily Auto Insurance Coverage

Daily auto insurance, also known as pay-per-use insurance, offers various coverage options similar to traditional policies, albeit on a shorter, more flexible basis. The primary difference lies in the duration of coverage, which is typically measured in days rather than months or years.

Liability Coverage

Liability coverage is a fundamental aspect of most auto insurance policies, including daily plans. It safeguards you financially in case you cause an accident that results in injury or damage to another person or property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by individuals injured in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs of property damaged by your vehicle, such as another car, a building, or a fence.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in a collision with another vehicle or an object. It covers the cost of repairs or replacement of your car, minus any deductible you may have.

Comprehensive Coverage

Comprehensive coverage safeguards you against damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage also typically includes a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs.

Coverage Options and Typical Costs

| Coverage Type | Typical Cost (per day) | Description |

|---|---|---|

| Liability Only | $5-$15 | Provides basic protection for bodily injury and property damage to others. |

| Liability & Collision | $10-$25 | Includes liability coverage and protection for damage to your own vehicle in a collision. |

| Liability & Comprehensive | $15-$35 | Offers liability coverage and protection for damage to your vehicle from non-collision events. |

| Full Coverage | $20-$50 | Provides the most comprehensive protection, including liability, collision, and comprehensive coverage. |

Who Needs Daily Auto Insurance?

Daily auto insurance can be a cost-effective solution for drivers who don’t need coverage all the time. This type of insurance provides temporary coverage for a specific period, typically ranging from a day to a month.

Daily auto insurance can be beneficial for various individuals and situations, making it a suitable choice for those seeking flexible and affordable coverage options.

Occasional Drivers

Occasional drivers, such as those who only drive a few times a month or for specific events, can benefit from daily auto insurance. They can avoid paying for a full-year policy, only paying for coverage when they need it.

For example, someone who only drives their car for weekend trips or to commute to work a few days a week could save money by using daily auto insurance instead of a traditional policy.

Finding Daily Auto Insurance Providers

Securing daily auto insurance is a straightforward process, with various providers offering this flexible coverage option. You can find these providers through a variety of channels, including online search engines, insurance comparison websites, and direct contact with insurance companies.

Locating Daily Auto Insurance Providers

Several reputable companies offer daily auto insurance. Some of these include:

- Nationwide: Nationwide offers daily auto insurance through its “On-Demand” program, providing coverage for rentals, short-term car loans, and other temporary driving needs.

- Liberty Mutual: Liberty Mutual provides daily car insurance through its “Drive Safe & Save” program, offering coverage for occasional drivers and those with fluctuating driving needs.

- Progressive: Progressive offers daily auto insurance through its “Pay Per Use” program, providing coverage for rentals, short-term car loans, and other temporary driving needs.

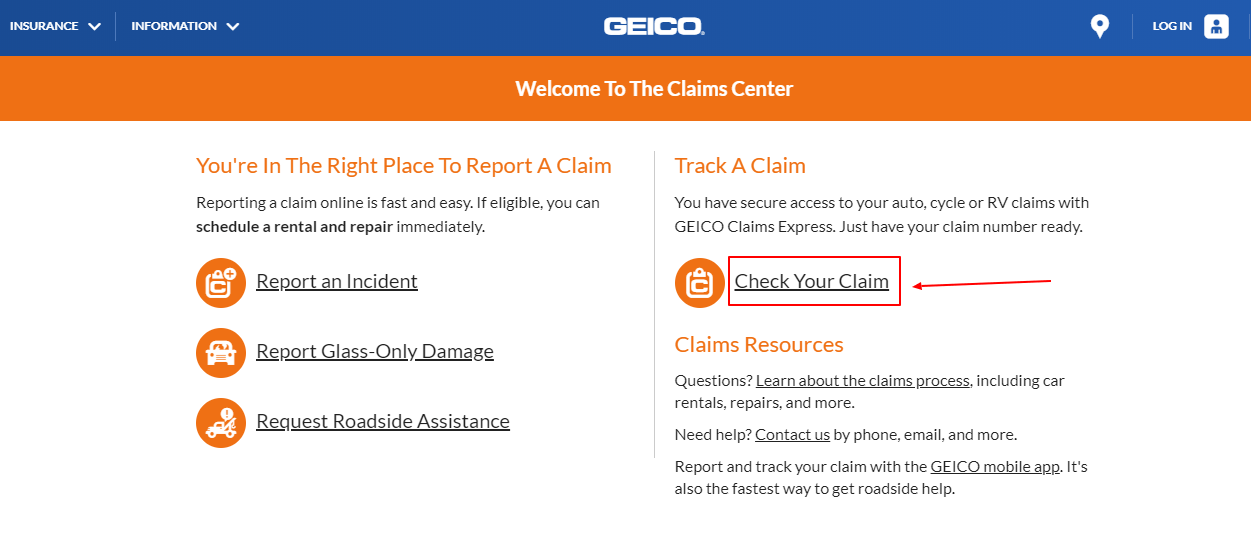

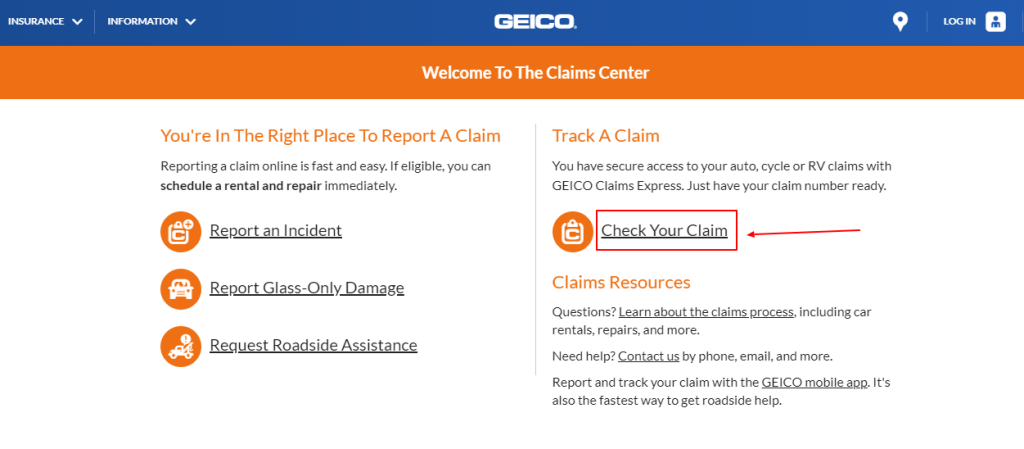

- Geico: Geico offers daily auto insurance through its “DriveShare” program, providing coverage for occasional drivers and those with fluctuating driving needs.

Comparing Daily Auto Insurance Providers

To choose the best daily auto insurance provider, consider factors such as coverage options, pricing, and customer service. Here’s a comparison table outlining key features and pricing for different providers:

| Provider | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| Nationwide | Liability, collision, comprehensive | $10-$30 per day | 4.5 stars |

| Liberty Mutual | Liability, collision, comprehensive | $15-$40 per day | 4 stars |

| Progressive | Liability, collision, comprehensive | $12-$35 per day | 4.2 stars |

| Geico | Liability, collision, comprehensive | $8-$25 per day | 4.8 stars |

Choosing the Best Daily Auto Insurance Provider

Several factors can influence your choice of daily auto insurance provider.

- Coverage Needs: Assess your specific coverage requirements based on your driving needs and the type of vehicle you will be driving.

- Pricing: Compare quotes from different providers to find the most affordable option that meets your coverage needs.

- Customer Service: Consider the provider’s reputation for customer service and responsiveness.

- Ease of Use: Choose a provider with a user-friendly platform for purchasing and managing your policy.

The Future of Daily Auto Insurance

The daily auto insurance market is poised for significant growth and evolution, driven by changing consumer preferences, technological advancements, and a growing need for flexible insurance solutions. As more people seek on-demand services and customized solutions, daily auto insurance is well-positioned to become a prominent player in the insurance landscape.

Impact of Emerging Technologies

Emerging technologies are playing a crucial role in shaping the future of daily auto insurance. The integration of telematics, artificial intelligence (AI), and data analytics is transforming how insurers assess risk, price policies, and provide personalized coverage.

- Telematics: Telematics devices, such as GPS trackers and smartphone apps, collect data on driving behavior, allowing insurers to assess risk more accurately and offer personalized rates based on individual driving habits. This data-driven approach enables insurers to provide more affordable coverage to safe drivers while adjusting premiums for those with riskier driving patterns.

- Artificial Intelligence (AI): AI algorithms are being used to automate underwriting processes, streamline claims handling, and personalize customer experiences. AI-powered chatbots and virtual assistants can provide instant quotes, answer customer inquiries, and even handle basic claims without human intervention. This enhances efficiency and improves customer satisfaction.

- Data Analytics: Big data analytics allows insurers to analyze vast amounts of data, including driving records, accident history, and demographic information, to identify trends and patterns. This enables insurers to develop more accurate risk models, tailor coverage options to specific needs, and optimize pricing strategies.

Predictions for the Future

The future of daily auto insurance is bright, with several key predictions:

- Increased Adoption: As awareness of daily auto insurance grows, more consumers will adopt this flexible and affordable option. The increasing demand for on-demand services and the rise of gig economy workers will further fuel the adoption of daily auto insurance.

- Expansion of Coverage Options: Insurers will expand their daily auto insurance offerings to include a wider range of coverage options, such as comprehensive and collision coverage, to meet the diverse needs of customers.

- Integration with Mobility Services: Daily auto insurance will become seamlessly integrated with ride-hailing platforms, car-sharing services, and other mobility solutions. This integration will offer users convenient and affordable insurance options while they are using these services.

- Personalized Pricing and Coverage: Telematics and AI will enable insurers to offer highly personalized pricing and coverage based on individual driving behavior, risk profiles, and usage patterns. This will lead to more equitable and efficient insurance solutions.

Case Studies

Daily auto insurance, a relatively new concept, is gaining traction, and real-world examples offer insights into its practical applications and potential benefits. These case studies demonstrate the diverse situations where daily insurance can be advantageous, highlighting the benefits and challenges encountered.

Rental Car Insurance

Daily auto insurance can be a cost-effective alternative to traditional rental car insurance. Consider the following:

- A traveler renting a car for a weekend trip might opt for daily insurance instead of paying for a full week’s coverage. The traveler could save money by only paying for the days they need coverage.

- A business professional might use daily insurance for a one-day business trip, avoiding the cost of a full-year policy that wouldn’t be used for the rest of the year.

Benefits include cost savings and flexibility, while challenges could involve the potential for higher daily premiums compared to traditional policies.

Occasional Drivers

Individuals who drive infrequently, such as retirees or students, might find daily insurance a suitable option.

- A retired individual who only drives occasionally for errands or social outings might choose daily insurance instead of paying for a full-year policy that sits unused for most of the year.

- A student who only drives to school and back might benefit from daily insurance, especially if they have limited driving needs.

Benefits include cost savings and reduced premiums for occasional drivers, while challenges could involve remembering to activate and deactivate coverage on a daily basis.

Short-Term Vehicle Use

Daily auto insurance can provide coverage for short-term vehicle use scenarios, such as:

- Borrowing a friend’s car for a day trip.

- Driving a family member’s car while they are out of town.

Benefits include flexibility and temporary coverage for specific driving needs, while challenges could involve potential complications with insurance claims if the vehicle owner’s policy isn’t aware of the temporary use.

Seasonal Vehicle Use

Individuals who drive seasonally, such as those with a summer home or a vehicle used for recreational activities, can benefit from daily insurance.

- A person who owns a classic car that they only drive during the summer months might choose daily insurance instead of paying for a full-year policy that sits unused for most of the year.

- A seasonal resident who uses a vehicle for a few months each year might find daily insurance a cost-effective option.

Benefits include cost savings and coverage only when needed, while challenges could involve the potential for higher daily premiums compared to traditional policies.

FAQs About Daily Auto Insurance

Daily auto insurance, also known as pay-per-use or per-trip insurance, is a relatively new concept in the insurance world, and it’s understandable that you might have some questions. This section addresses some common concerns and inquiries to help you understand the ins and outs of this innovative insurance solution.

Eligibility and Coverage

Daily auto insurance provides temporary coverage for a specific period, typically a day or a few days. You may be wondering if you qualify for this type of coverage and what it actually covers.

- Who is eligible for daily auto insurance? Daily auto insurance is generally available to individuals who need temporary coverage for a specific reason, such as renting a car, driving a borrowed vehicle, or using a personal vehicle for a short trip. Most providers have age and driving record requirements.

- What does daily auto insurance cover? Daily auto insurance typically covers the same basic perils as a traditional policy, including liability, collision, and comprehensive coverage. However, the specific coverage options and limits may vary depending on the provider and the chosen plan.

- What are the limitations of daily auto insurance? Daily auto insurance may not be suitable for all situations. For example, it might not be available for commercial vehicles or for drivers with certain pre-existing conditions. It is essential to carefully review the policy terms and conditions before purchasing daily auto insurance.

Pricing and Payment

Understanding the cost and payment methods associated with daily auto insurance is crucial for making informed decisions.

- How is daily auto insurance priced? The cost of daily auto insurance is typically calculated based on various factors, including the vehicle type, driver’s age and driving history, the coverage level, and the duration of the policy.

- How do I pay for daily auto insurance? Payment options for daily auto insurance may vary depending on the provider. Some providers offer online payment options, while others may require payment through a phone call or at a physical location.

- Can I get a discount on daily auto insurance? Some providers may offer discounts for specific groups, such as AAA members or senior citizens. It is worth inquiring about available discounts when purchasing daily auto insurance.

Comparison and Alternatives

Daily auto insurance is a flexible option, but it is important to compare it with traditional policies and explore alternative insurance solutions.

- How does daily auto insurance compare to traditional auto insurance? Traditional auto insurance provides continuous coverage for a specific period, typically a year. Daily auto insurance, on the other hand, offers temporary coverage for a specific period, such as a day or a few days.

- Are there any other alternatives to daily auto insurance? If you only need occasional coverage, consider short-term insurance, which offers coverage for a period of a few weeks or months.

- When is daily auto insurance a better option than traditional insurance? Daily auto insurance can be a more cost-effective option for individuals who only need coverage for short periods, such as when renting a car or driving a borrowed vehicle.

Claims and Procedures

Understanding the claims process is crucial for any type of insurance, and daily auto insurance is no exception.

- How do I file a claim with daily auto insurance? The claims process for daily auto insurance is similar to that of traditional insurance. You will need to contact the provider and report the incident. They will guide you through the necessary steps, such as providing documentation and completing forms.

- What happens if I have an accident while using daily auto insurance? If you have an accident while using daily auto insurance, the provider will handle the claim according to the policy terms and conditions. You will be responsible for paying the deductible, if applicable.

- Can I cancel my daily auto insurance policy? You can typically cancel your daily auto insurance policy at any time, but you may be subject to cancellation fees depending on the provider’s policy.

Resources and Further Information

This section provides a comprehensive list of resources for further research and exploration on daily auto insurance. It includes relevant websites, articles, organizations, government resources, consumer advocacy groups, and industry publications.

Government Resources

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that serves as a resource for state insurance regulators. It provides information on insurance regulations, consumer protection, and industry trends. The NAIC’s website offers a wealth of information on daily auto insurance, including state-specific regulations and consumer guides. [https://www.naic.org/](https://www.naic.org/)

- Federal Trade Commission (FTC): The FTC is a federal agency that protects consumers from unfair or deceptive business practices. The FTC’s website provides information on consumer rights and how to file complaints against insurance companies. [https://www.ftc.gov/](https://www.ftc.gov/)

Consumer Advocacy Groups

Consumer advocacy groups provide independent information and support to consumers regarding insurance and other financial products.

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on consumer products and services. It provides reviews and ratings of insurance companies and offers advice on choosing the right insurance policy. [https://www.consumerreports.org/](https://www.consumerreports.org/)

- National Consumer Law Center (NCLC): The NCLC is a non-profit organization that advocates for consumer rights and provides legal assistance to low-income consumers. The NCLC’s website offers information on insurance regulations and consumer protection. [https://www.nclc.org/](https://www.nclc.org/)

Industry Publications

Industry publications provide insights into the insurance market, trends, and regulatory developments.

- Insurance Journal: Insurance Journal is a leading publication covering the insurance industry. It provides news, analysis, and commentary on daily auto insurance and other insurance products. [https://www.insurancejournal.com/](https://www.insurancejournal.com/)

- National Underwriter: National Underwriter is a trade publication that covers the insurance industry. It provides news, analysis, and commentary on insurance regulations, products, and trends. [https://www.nationalunderwriter.com/](https://www.nationalunderwriter.com/)

End of Discussion

Auto insurance by the day represents a significant shift in the way we think about car insurance. It offers a compelling alternative to traditional annual policies, empowering drivers with greater control over their coverage and costs. While this emerging model still faces challenges and requires careful consideration, its potential to cater to evolving driving habits and preferences makes it a compelling force in the future of the insurance industry.