Ready to dive headfirst into the exciting world of JP Morgan’s markets? Great! This guide’s your all-access pass, breaking down everything you need to know about this financial behemoth, from its sprawling global reach to the nitty-gritty details of its various market offerings. Whether you’re a seasoned investor looking to expand your horizons, or a curious newcomer just starting your financial journey, we’ve got you covered. Forget the stuffy financial jargon; we’ll explain everything in plain English, focusing on the practical information you actually need.

So, what exactly is JP Morgan’s market presence? It’s HUGE. We’re talking a global network spanning continents, influencing everything from currency fluctuations to the pricing of complex derivatives. They’re not just a bank; they’re a key player shaping the financial landscape. Think of them as the maestro conducting a symphony of global finance. Their influence touches nearly every corner of the market, impacting businesses, governments, and individuals worldwide. This makes understanding their operations incredibly relevant, whether you’re planning long-term investments, hedging against risk, or simply curious about how the global economy ticks.

This comprehensive guide will unravel the mysteries behind JP Morgan’s markets, exploring its various divisions & providing actionable insights. We’ll tackle everything from their fixed income strategies & equities trading expertise, to their sophisticated derivatives market participation; no stone will be left unturned. We’ll dissect their history briefly, highlighting key milestones that shaped their current dominance. You’ll gain a firm understanding of the scale of their operations, the innovative strategies they employ & the key people behind the success of this financial powerhouse. Understanding their approach is crucial for anyone looking to navigate the intricacies of the global financial markets successfully.

But this isn’t just a dry recitation of facts & figures; we’ll aim to bring JP Morgan’s market activities to life, offering real-world examples to illustrate key concepts. We will explore case studies of their involvement in significant financial events , explaining how they navigated challenging circumstances & achieved remarkable results. This will offer a richer, more engaging, & ultimately more useful understanding of their methods & influence. Think of it as getting a backstage pass to the inner workings of one of the world’s most powerful financial institutions. What are you waiting for? Let’s get started, shall we? Are you ready to become a more informed & savvy investor? Let’s unlock the secrets of JP Morgan’s markets together!.

Your Guide to JPMorgan industrys

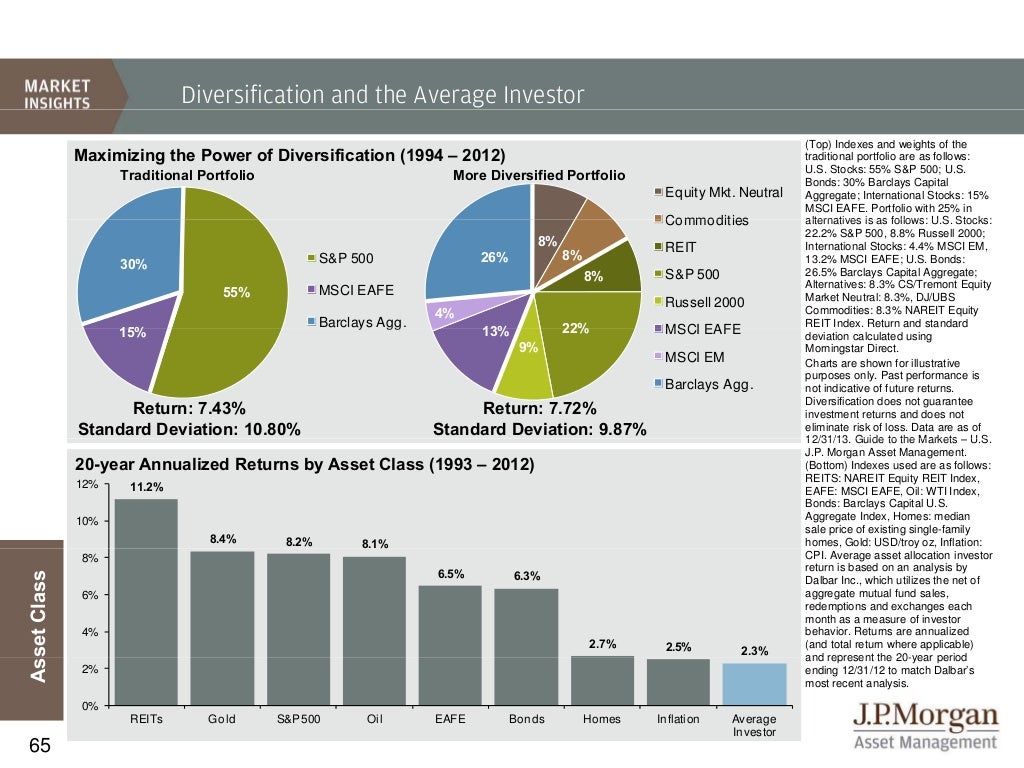

Related Post : guide to the markets jpm

Navigating the complex world of global finance can feel daunting, but understanding key players like JPMorgan Chase & Co. is crucial for informed investment decisions. This guide offers a thorough overview of JPMorgan industrys, its offerings, and how to effectively utilize its resources.

Understanding JPMorgan’s industry Presence

What is JPMorgan Chase & Co.? A brief overview.

JPMorgan Chase & Co. is a multinational financial services firm, a global leader in investment banking, financial services, and asset management. Its sheer size and influence significantly shape global financial industrys.

JPMorgan’s industry Divisions: A closer look at the varied areas (Equities, Fixed Income, Currencies, Commodities).

JPMorgan’s industrys division encompasses a vast array of financial instruments and services. They operate across Equities (stocks), Fixed Income (bonds and other debt securities), Currencies (foreign exchange trading), and Commodities (raw materials like gold, oil, etc.). Each division offers a spectrum of products and services tailored to diverse investor needs.

The scale of JPMorgan’s industry operations: Global reach and impact.

JPMorgan’s industry operations are truly global, influencing industrys worldwide. Their vast trading volume and influence on pricing make them a key player in global financial stability.

Navigating JPMorgan industrys: Products and Services

Accessing JPMorgan’s industrys: Who can trade? What are the requirements?

Access to JPMorgan’s industrys primarily depends on your investor status and the specific products you intend to trade. Generally, institutional investors, high-net-worth individuals, and corporations have preferential access. Specific requirements will vary based on the product and your location.

JPMorgan’s Trading Platforms: An overview of technology and accessibility.

JPMorgan offers state-of-the-art trading platforms, offering advanced technological capabilities and seamless accessibility. These platforms are designed for ease of use and efficiency, catering to both individual and institutional investors.

Understanding JPMorgan’s Product Offerings: A detailed breakdown of equities, bonds, derivatives, and more.

JPMorgan offers an extensive scope of products, including equities (individual stocks and ETFs), bonds (government and corporate), derivatives (options, futures, swaps), and other structured products. This breadth allows investors to diversify their portfolios and implement sophisticated trading strategies.

Fees and Commissions: Transparency in pricing and cost structures.

JPMorgan maintains transparent pricing structures, outlining fees and commissions clearly. These vary depending on the product, trading volume, and client type. Detailed fee schedules are generally available through their website or client representatives.

JPMorgan industrys: Risk Management and Security

Risk Management Strategies at JPMorgan: How JPMorgan mitigates risks for clients and itself.

JPMorgan employs robust risk management strategies to mitigate financial risks for both clients and the firm itself. These strategies involve sophisticated modeling, monitoring, and hedging techniques to minimize potential losses.

Security Measures: Protecting client data and assets.

Data security is paramount. JPMorgan utilizes advanced security protocols and technologies to safeguard client data and assets against cyber threats and unauthorized access.

Regulatory Compliance: JPMorgan’s adherence to financial regulations.

JPMorgan adheres to stringent regulatory compliance standards across all its industry operations, ensuring ethical and legal conduct within the financial industry.

JPMorgan industrys: study and examination

Accessing JPMorgan’s industry study: Reports, insights, and analytical tools.

JPMorgan offers its clients with thorough industry study, including insightful reports, economic analyses, and advanced analytical tools. Access to these resources can help investors make more informed investment decisions.

The Value of JPMorgan’s study: How it can inform investment decisions.

JPMorgan’s study offers critical industry intelligence, enabling investors to understand industry trends, assess risk, and develop effective investment strategies.

Understanding JPMorgan’s industry Forecasts: Interpreting predictions and projections.

JPMorgan’s industry forecasts and predictions are based on extensive data examination and economic modeling. While not guarantees, they offer valuable insights into potential industry movements.

JPMorgan industrys: Client Support and Resources

Contacting JPMorgan industrys: Phone numbers, email addresses, and online support.

JPMorgan offers multiple channels for client support, including phone, email, and online chat. Their website contains contact information and detailed FAQs.

Educational Resources: Webinars, tutorials, and other learning materials.

To enhance client knowledge, JPMorgan offers educational resources, such as webinars, tutorials, and industry briefings.

Client Relationship Management: The support system offered by JPMorgan.

JPMorgan’s dedication to client relationship management ensures personalized support and guidance tailored to individual investor needs.

JPMorgan industrys vs. Competitors: A Comparative examination

JPMorgan’s rival benefits: What sets it apart from other firms?

JPMorgan’s global reach, extensive product offerings, and robust study capabilities are key rival benefits. Its reputation for stability and reliability also attracts investors.

Comparing JPMorgan’s services with other major financial institutions.

Comparing JPMorgan with other major players involves considering factors like fees, product offerings, study quality, and client support.

Choosing the right industry platform: Factors to consider when selecting a broker.

When selecting a broker, consider factors such as fees, platform technology, study quality, and the level of client support offered.

Conclusion: Making Informed Decisions in JPMorgan industrys

Summary of Key Takeaways: Recap of the main points discussed.

This guide offerd a thorough overview of JPMorgan industrys, covering access, products, risk management, study, and client support.

Next Steps: How to begin engaging with JPMorgan’s industry offerings.

To begin engaging with JPMorgan’s industry offerings, study their specific products and services, and contact their client services for further guidance.

Disclaimer: crucial legal and financial considerations.

This information is for educational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.