Navigating the world of renter’s insurance can feel overwhelming, especially when you’re faced with a dizzying array of policies and terms. But don’t worry, it doesn’t have to be a complex ordeal. Renters insurance, despite its name, is more than just a safety net for your belongings. It’s a shield against a multitude of unexpected events that could otherwise leave you financially vulnerable.

This comprehensive guide will delve into the intricacies of renter’s insurance coverage, unraveling its benefits, outlining essential coverages, and addressing common concerns. By understanding the ins and outs of this crucial protection, you can confidently navigate the process of securing the right policy for your unique needs.

Introduction to Renter’s Insurance

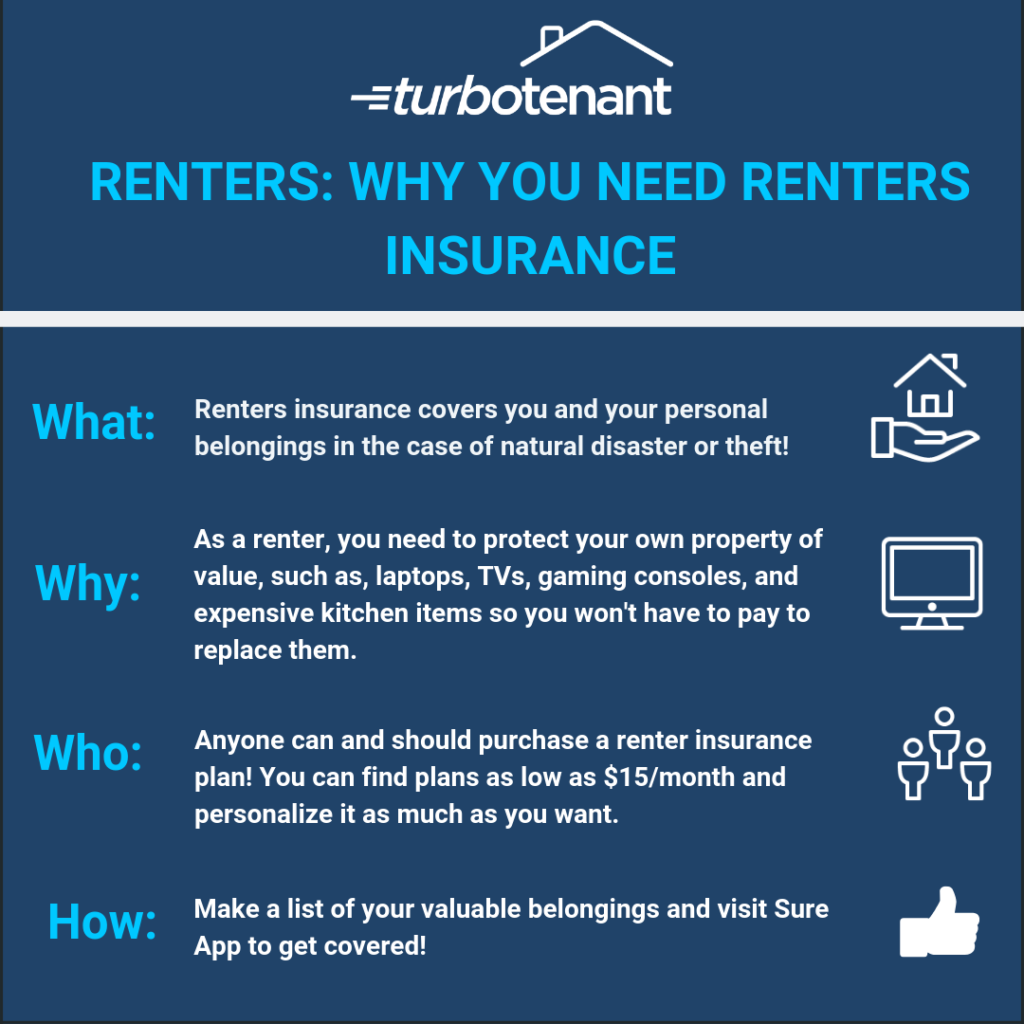

Renter’s insurance is a type of property insurance that protects renters from financial losses due to damage or theft of their personal belongings. It also provides liability coverage, which protects you from lawsuits if someone is injured on your property.

Renter’s insurance is an essential part of protecting your financial well-being. It can help you recover from a devastating event like a fire, theft, or natural disaster.

Benefits of Renter’s Insurance

Renter’s insurance offers a range of benefits that can provide peace of mind and financial protection.

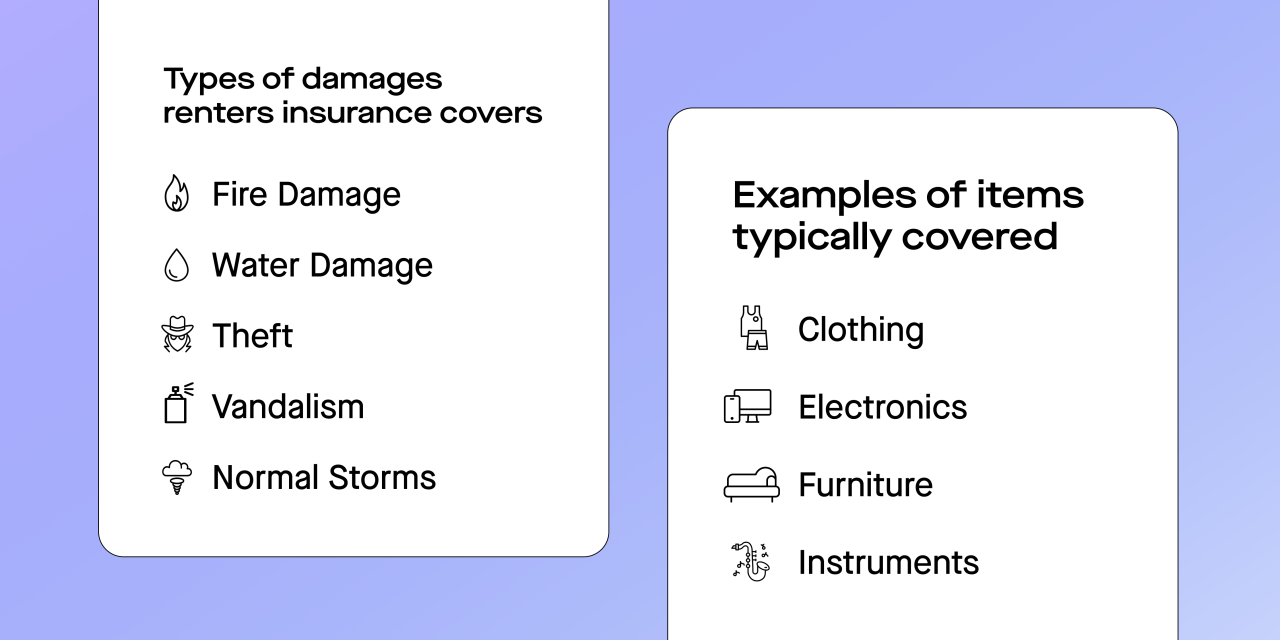

- Coverage for Personal Belongings: Renter’s insurance covers your personal belongings, such as furniture, electronics, clothing, and jewelry, against damage or theft. This coverage extends to both your apartment and any belongings you store outside your unit, such as on a balcony or in a storage locker.

- Liability Coverage: Renter’s insurance provides liability coverage, which protects you from financial losses if someone is injured on your property or if you accidentally damage someone else’s property. For example, if a guest trips and falls in your apartment, your liability coverage can help pay for their medical expenses and legal fees.

- Additional Living Expenses: If your apartment becomes uninhabitable due to a covered event, your renter’s insurance can help pay for temporary housing, meals, and other living expenses while you wait for repairs or rebuild.

- Protection Against Natural Disasters: Renter’s insurance can provide coverage for damage caused by natural disasters, such as floods, earthquakes, and hurricanes. However, it’s important to note that coverage for these events may vary depending on your insurance provider and the specific disaster.

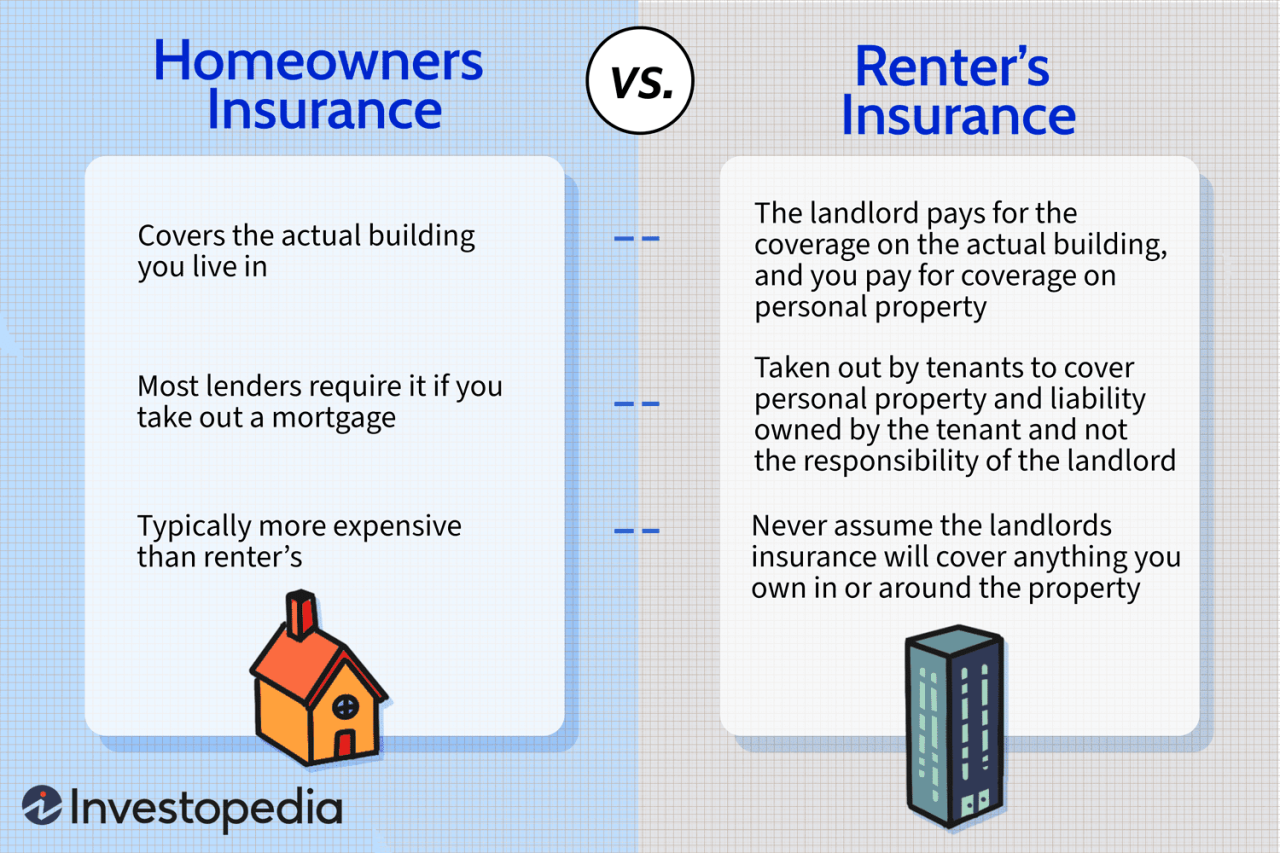

Renter’s Insurance vs. Homeowner’s Insurance

While both renter’s insurance and homeowner’s insurance protect your property, they differ in several key ways.

- Property Covered: Homeowner’s insurance covers the structure of your home, while renter’s insurance covers your personal belongings. Homeowner’s insurance also provides liability coverage for injuries that occur on your property.

- Cost: Renter’s insurance is typically less expensive than homeowner’s insurance because it doesn’t cover the structure of the building. However, the cost of both types of insurance can vary depending on factors such as the location, the value of your belongings, and the level of coverage you choose.

- Coverage Limits: Renter’s insurance and homeowner’s insurance have coverage limits, which are the maximum amounts your insurance company will pay for a covered loss. It’s important to choose coverage limits that are sufficient to protect your financial well-being.

Essential Coverages

Renter’s insurance provides financial protection against various risks associated with renting a property. Understanding the essential coverages is crucial for choosing a policy that meets your individual needs.

Personal Property Coverage

This coverage protects your belongings against damage or theft. It typically covers items such as furniture, electronics, clothing, and personal valuables. The amount of coverage you need depends on the value of your possessions. You’ll need to create an inventory of your belongings and their estimated value to determine the appropriate coverage amount.

Most policies have a limit on the amount they will pay for specific categories of items, such as jewelry, cash, and art.

Liability Coverage

Liability coverage protects you from financial losses arising from injuries or property damage caused to others by you or your household members. This coverage is essential as it can cover legal fees, medical expenses, and property repairs.

For example, if a guest slips and falls on your property, liability coverage can help pay for their medical expenses and legal costs.

Additional Coverages

- Medical Payments Coverage: This coverage pays for medical expenses incurred by guests who are injured on your property, regardless of who is at fault.

- Loss of Use Coverage: This coverage provides financial assistance if your rented property becomes uninhabitable due to a covered event, such as a fire or flood. It can help cover temporary living expenses, such as hotel costs or rent for a replacement apartment.

- Personal Injury Protection: This coverage protects you from financial losses arising from personal injuries, such as slander or libel, caused by you or your household members.

Exclusions and Limitations

While renter’s insurance provides valuable protection, it’s crucial to understand its limitations. Policies typically exclude certain perils, items, and circumstances, and they often have coverage limits. It’s essential to review your policy carefully and understand these limitations to avoid unexpected surprises.

Common Exclusions

Renter’s insurance policies typically exclude coverage for a range of events and items. Understanding these exclusions is crucial to make informed decisions about your coverage needs.

- Acts of War or Terrorism: Policies generally don’t cover losses resulting from war, acts of terrorism, or military action.

- Natural Disasters: While some policies may cover certain natural disasters, such as earthquakes, flood damage, or sinkholes, they are often excluded or require specific endorsements.

- Neglect or Intentional Acts: Coverage is typically excluded for losses caused by intentional acts or negligence, such as failing to take reasonable precautions to prevent damage.

- Pets: Damage caused by pets, such as bites or scratches, is usually not covered. However, some policies may offer limited coverage for specific incidents.

- Valuable Items: High-value items, such as jewelry, artwork, or collectibles, may require additional coverage beyond the standard policy limits. You may need to purchase a separate endorsement or floater to ensure adequate protection.

Deductibles

Deductibles are the out-of-pocket expenses you pay before your insurance coverage kicks in. Understanding how deductibles work is essential for budgeting and managing claims.

- Deductible Amount: The deductible amount is a fixed sum that you agree to pay for each covered claim. For example, if you have a $500 deductible and experience a covered loss of $2,000, you would pay $500, and your insurance would cover the remaining $1,500.

- Impact on Claims: A higher deductible generally leads to lower premiums, but you’ll have to pay more out-of-pocket if you file a claim. Conversely, a lower deductible results in higher premiums but lower out-of-pocket expenses for claims.

- Choosing the Right Deductible: The ideal deductible depends on your risk tolerance and financial situation. Consider your budget, the potential for claims, and the cost of premiums when selecting your deductible amount.

Coverage Limits

Renter’s insurance policies typically have limits on the amount of coverage available for different types of losses. It’s essential to understand these limits and ensure they meet your needs.

- Personal Property Coverage: The policy typically sets a limit on the total amount of coverage for your personal belongings. This limit is often determined by the actual cash value (ACV) or replacement cost value (RCV) of your possessions. ACV considers depreciation, while RCV covers the cost of replacing damaged or stolen items with new ones.

- Liability Coverage: Renter’s insurance provides liability coverage to protect you against claims from others for injuries or property damage caused by you or your household members. This coverage has a limit, typically ranging from $100,000 to $300,000.

- Specific Item Limits: Policies may have specific limits on the amount of coverage for certain items, such as jewelry, electronics, or cash. You may need to purchase additional coverage for these items if their value exceeds the standard policy limits.

Filing a Claim

Filing a claim with your renter’s insurance is a straightforward process, but it’s important to understand the steps involved and how to properly document your losses. This section will guide you through the process and provide tips for maximizing your chances of a successful claim.

Steps to File a Claim

The first step in filing a claim is to contact your insurance company as soon as possible after the incident. Your insurance policy will Artikel the specific time frame for reporting claims, and it’s crucial to adhere to these guidelines.

- Contact your insurance company: Reach out to your insurance company immediately, preferably by phone, to report the incident. Be prepared to provide details about the event, including the date, time, and location.

- File a claim: Your insurance company will provide you with a claim form or guide you through the online filing process. Complete the form accurately and thoroughly, including all relevant information about the damage or loss.

- Provide supporting documentation: Gather any supporting documentation that can help validate your claim. This may include police reports, photos or videos of the damage, receipts for damaged or stolen items, and any other relevant information.

- Cooperate with the insurance company: Be prepared to answer questions from your insurance company’s claims adjuster and provide any requested information. Your cooperation is essential for a smooth claims process.

Documenting Damage and Losses

Proper documentation is crucial for a successful claim. This includes:

- Taking photographs or videos: Capture clear images and videos of the damage, including any visible signs of the cause of the incident.

- Creating an inventory: List all damaged or stolen items, including their descriptions, purchase dates, and estimated values. Keep receipts for all items if possible.

- Saving receipts: Retain receipts for any repairs or replacement costs related to the incident.

The Claim Process

Once you file your claim, your insurance company will assign a claims adjuster to review your case. The adjuster will:

- Inspect the damage: The adjuster will inspect the damage to your property and assess the extent of your losses.

- Review your documentation: The adjuster will review your claim form and supporting documentation to verify the details of your claim.

- Determine coverage: The adjuster will determine whether your claim is covered under your policy and the amount of coverage available.

- Negotiate a settlement: If your claim is approved, the adjuster will negotiate a settlement amount with you based on the estimated cost of repairs or replacement.

Factors Affecting Coverage

Your renter’s insurance premium is determined by a number of factors, including your location, the type of rental property you live in, and the value of your personal belongings. Understanding these factors can help you find the right coverage and policy for your needs.

Location

The location of your rental property can significantly impact your renter’s insurance premium. Cities with higher crime rates or a greater risk of natural disasters, such as hurricanes or earthquakes, typically have higher premiums. For example, a renter in New Orleans, Louisiana, may face higher premiums due to the city’s vulnerability to hurricanes.

Rental Property Type

The type of rental property you live in also plays a role in your premium. For instance, a renter in a high-rise apartment building may pay a lower premium compared to someone living in a detached house. This is because high-rise buildings generally have more security measures and are less susceptible to certain types of damage.

Personal Belongings

The value of your personal belongings is a crucial factor in determining your premium. If you own a large amount of expensive jewelry, electronics, or artwork, you will likely pay a higher premium. This is because your insurance company will need to cover the cost of replacing these items in case of damage or theft.

Credit Score

Your credit score can also influence your renter’s insurance premium. In some states, insurance companies may use your credit score as a factor in determining your premium. A higher credit score may indicate a lower risk to the insurance company, leading to a lower premium.

Finding the Right Coverage

Finding the right renter’s insurance coverage involves carefully considering your individual needs and budget. It’s essential to compare quotes from multiple insurance companies to find the best rates and coverage options. You should also consider the following factors:

- Coverage limits: Choose coverage limits that adequately protect your belongings. Consider the replacement cost of your items and factor in potential inflation.

- Deductible: A higher deductible generally leads to a lower premium. However, it means you’ll have to pay more out of pocket in case of a claim.

- Additional coverage: Some policies offer additional coverage options, such as personal liability coverage or coverage for damage caused by floods or earthquakes.

Cost Considerations

Renter’s insurance, while essential, shouldn’t break the bank. Understanding the factors that influence premium costs and employing smart strategies can help you secure affordable coverage.

Comparing Quotes

Before committing to a policy, it’s crucial to compare quotes from multiple insurance providers. This allows you to identify the most competitive rates and features that best suit your needs.

- Online comparison websites like Policygenius, Insurify, and NerdWallet simplify the process by allowing you to enter your information once and receive quotes from various insurers.

- Directly contacting insurance companies is another option. This provides an opportunity to discuss your specific needs and get personalized quotes.

- Don’t hesitate to negotiate. Many insurers are willing to offer discounts or adjust coverage based on your circumstances.

Factors Affecting Premium Costs

Several factors influence the cost of renter’s insurance. Understanding these factors can help you make informed decisions and potentially lower your premiums.

- Location: Urban areas with higher crime rates or natural disaster risks typically have higher premiums.

- Coverage Amount: The amount of coverage you choose for your belongings directly impacts your premium. Higher coverage amounts equate to higher premiums.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally results in lower premiums.

- Credit Score: In some states, insurance companies use credit scores to assess risk. Individuals with good credit scores often qualify for lower premiums.

- Safety Features: Installing security systems, smoke detectors, and other safety features can reduce your premium.

- Discounts: Many insurers offer discounts for bundling policies, being a safe driver, or maintaining a good claims history.

Real-World Examples

Renter’s insurance can provide a safety net in various unexpected situations. Understanding how it works in practice can help you assess if it’s a worthwhile investment for your personal circumstances.

Common Scenarios Where Renter’s Insurance Proves Valuable

The following table illustrates common scenarios where renter’s insurance proves invaluable:

| Scenario | Coverage | Example |

|---|---|---|

| Theft or Burglary | Personal property coverage | Your laptop, jewelry, and clothing are stolen from your apartment. |

| Fire or Water Damage | Personal property coverage | A fire in your building damages your belongings. |

| Liability Coverage | Liability coverage | A guest is injured in your apartment and sues you. |

| Living Expenses | Additional living expenses coverage | You have to stay in a hotel while your apartment is being repaired after a fire. |

Types of Claims and Associated Coverage

Renter’s insurance covers various types of claims, with specific coverage limitations. The table below Artikels different types of claims and their associated coverage:

| Type of Claim | Coverage | Example |

|---|---|---|

| Theft | Personal property coverage | Stolen laptop, jewelry, or clothing. |

| Fire | Personal property coverage | Fire damage to belongings. |

| Water Damage | Personal property coverage | Water damage from a burst pipe or leaking roof. |

| Liability | Liability coverage | A guest is injured in your apartment. |

| Medical Payments | Medical payments coverage | A visitor is injured in your apartment. |

| Additional Living Expenses | Additional living expenses coverage | Temporary housing while your apartment is being repaired. |

Real-World Examples of Renter’s Insurance Assistance

Renter’s insurance has helped individuals recover from various unfortunate events. Here are some examples:

“My apartment was burglarized, and my renter’s insurance covered the cost of replacing my stolen electronics and jewelry. I was able to quickly get back on my feet.” – Sarah, a renter in Chicago.

“A pipe burst in my apartment, causing significant water damage. My renter’s insurance covered the cost of repairs and temporary housing while my apartment was being restored.” – John, a renter in New York City.

“A guest tripped and fell in my apartment, injuring their ankle. My renter’s insurance covered their medical expenses and legal fees, preventing a costly lawsuit.” – Emily, a renter in Los Angeles.

Tips for Protecting Your Belongings

Renters insurance is a valuable tool for safeguarding your belongings, but proactive measures can significantly reduce the risk of loss or damage. By taking preventative steps, you can minimize the likelihood of needing to file a claim and potentially save money on your premiums.

Regular Maintenance and Safety Inspections

Regular maintenance and safety inspections are crucial for preventing accidents and protecting your belongings. This includes checking smoke detectors, fire extinguishers, and carbon monoxide detectors regularly to ensure they are functioning properly. It’s also essential to inspect electrical wiring and appliances for potential hazards.

- Smoke detectors should be tested monthly and batteries replaced annually.

- Fire extinguishers should be inspected annually and recharged if necessary.

- Carbon monoxide detectors should be checked at least twice a year.

- Electrical wiring and appliances should be inspected by a qualified electrician to identify any potential issues.

Resources and Additional Information

Beyond the basics, exploring additional resources can enhance your understanding of renter’s insurance and empower you to make informed decisions about your coverage. Numerous reputable organizations and websites offer valuable insights, articles, and tools to guide you.

Reputable Organizations and Websites

Reputable organizations and websites provide a wealth of information on renter’s insurance, offering valuable insights, resources, and tools to help you make informed decisions about your coverage.

- The Insurance Information Institute (III): The III is a non-profit organization dedicated to educating the public about insurance. Their website offers comprehensive information on renter’s insurance, including articles, FAQs, and a glossary of terms.

- The National Association of Insurance Commissioners (NAIC): The NAIC is a regulatory body for insurance in the United States. Their website provides information on insurance laws, consumer protection, and resources for filing complaints.

- Your State Insurance Department: Each state has an insurance department that regulates insurance companies and provides consumer protection. You can find contact information for your state’s insurance department on the NAIC website.

- Consumer Reports: Consumer Reports provides independent reviews and ratings of various products and services, including insurance. Their website offers information on renter’s insurance, including comparisons of different policies and tips for choosing the right coverage.

Finding a Qualified Insurance Agent or Broker

Choosing the right insurance agent or broker is crucial for ensuring you receive the best possible coverage and service.

- Recommendations: Ask friends, family, and colleagues for recommendations.

- Professional Organizations: Seek out agents or brokers who are members of professional organizations, such as the National Association of Insurance Agents (NAIA) or the Council of Insurance Agents & Brokers (CIAB).

- Online Directories: Use online directories, such as those provided by the NAIC or the III, to find agents or brokers in your area.

- Insurance Company Websites: Many insurance companies have online directories of agents or brokers who represent them.

- Check Credentials: Verify the agent or broker’s credentials and license status with your state insurance department.

- Ask Questions: Before making a decision, ask potential agents or brokers about their experience, expertise, and fees.

Last Recap

In the end, renters insurance is about more than just protecting your belongings. It’s about safeguarding your peace of mind and ensuring financial stability in the face of unforeseen circumstances. By taking the time to understand your options and securing the right coverage, you can rest assured knowing that you’re prepared for whatever life throws your way.