Florida, a state known for its beautiful beaches and warm climate, also faces unique challenges when it comes to homeowners insurance. The state’s susceptibility to hurricanes, flooding, and other natural disasters drives up insurance costs, making it a significant expense for many residents. Understanding the factors that influence homeowners insurance rates in different counties can help Florida homeowners make informed decisions about their coverage and potentially save money.

This comprehensive guide delves into the complexities of Florida homeowners insurance rates, examining the key factors that determine premiums, providing county-specific data, and offering practical tips for lowering costs. We’ll also explore government programs and initiatives designed to assist homeowners with insurance expenses.

Understanding Florida Homeowners Insurance

Florida homeowners insurance is notoriously expensive, and for good reason. The state faces unique risks, including hurricanes, flooding, and other natural disasters. This makes it crucial for homeowners to understand the intricacies of their insurance policies and the factors that influence their premiums.

Factors Contributing to High Insurance Costs

The high cost of homeowners insurance in Florida is driven by a complex interplay of factors. These include:

- High-Value Properties: Florida is home to many expensive properties, particularly along the coast. The cost of rebuilding these homes after a disaster is significant, which translates into higher premiums.

- Hurricane Risk: Florida is in the path of hurricanes, making it one of the most hurricane-prone states in the US. The potential for significant damage from hurricanes drives up insurance costs.

- Increased Litigation: Florida has a history of high litigation rates related to insurance claims. This can lead to higher insurance costs as insurers factor in the risk of lawsuits.

- Reinsurance Costs: Reinsurance is insurance that insurance companies buy to protect themselves against catastrophic losses. Florida’s high hurricane risk leads to high reinsurance costs, which are passed on to homeowners.

- Fraud and Abuse: Insurance fraud and abuse can inflate insurance costs for all homeowners. This includes staged accidents and inflated claims.

Unique Risks Faced by Florida Homeowners

Florida homeowners face unique risks due to the state’s geographical location and susceptibility to natural disasters.

- Hurricanes: Hurricanes are a major threat to Florida homeowners. These storms can cause widespread damage to homes and property, leading to significant financial losses.

- Flooding: Florida is prone to flooding from both heavy rainfall and storm surge. This can damage homes and their contents, requiring expensive repairs.

- Sinkholes: Sinkholes are a common geological hazard in Florida. They can occur suddenly and cause significant damage to homes and property.

- Wildfires: While less common than hurricanes and flooding, wildfires can also pose a significant risk to Florida homeowners, particularly during dry periods.

Common Coverage Options for Florida Homeowners

Homeowners insurance policies in Florida typically offer a range of coverage options to protect against different risks.

- Hurricane Coverage: This coverage is essential for Florida homeowners and protects against damage caused by hurricanes. It typically covers wind damage, storm surge, and other hurricane-related losses.

- Flood Coverage: Flood insurance is separate from homeowners insurance and is typically purchased through the National Flood Insurance Program (NFIP). It protects against damage caused by flooding, which is not typically covered by standard homeowners insurance.

- Sinkhole Coverage: This coverage protects against damage caused by sinkholes. It is typically offered as an optional add-on to standard homeowners insurance.

- Other Coverage Options: Other common coverage options include:

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, and clothing, against damage or loss.

- Liability Coverage: This protects you against financial losses if someone is injured on your property.

- Additional Living Expenses Coverage: This helps cover your living expenses if your home is damaged and uninhabitable.

County-Specific Rate Variations

Florida’s homeowners insurance market is highly fragmented, with rates varying significantly across counties. These differences are driven by a complex interplay of factors, including the risk of natural disasters, the density of development, and the availability of reinsurance.

Factors Influencing Rate Variations

The cost of homeowners insurance in Florida is influenced by a multitude of factors, but some key drivers stand out. These factors create a complex web of variables that determine the premiums charged in different counties.

- Hurricane Risk: Florida’s coastal counties, particularly those on the Atlantic coast, face a higher risk of hurricanes, leading to higher insurance premiums. This risk is assessed based on historical hurricane activity, projected storm tracks, and the vulnerability of properties to hurricane damage.

- Property Values: Areas with higher property values generally have higher insurance premiums. This is because the potential financial loss from a catastrophic event is greater in these areas. For example, a luxury home in Miami Beach would likely have a higher premium than a modest single-family home in a less affluent part of the state.

- Construction Codes: Counties with stricter building codes and more stringent hurricane-resistant construction requirements tend to have lower insurance premiums. This is because properties built to these standards are less likely to be damaged in a hurricane, reducing the insurer’s risk.

- Reinsurance Availability: The availability and cost of reinsurance, which helps insurers cover catastrophic losses, can also impact premiums. Areas with limited reinsurance options may see higher premiums as insurers pass on the cost of risk to policyholders.

- Claims History: Counties with a history of frequent or high-cost claims tend to have higher insurance premiums. This is because insurers use claims data to assess the risk of future losses. For example, counties that have experienced a significant number of hurricane-related claims may see higher premiums in the years following the storms.

County-Specific Premium Comparisons

To illustrate the wide range of homeowners insurance premiums across Florida, here is a table showing average premiums for selected counties, categorized by property type:

| County | Single-Family Home | Condo | Townhouse |

|---|---|---|---|

| Miami-Dade | $3,500 | $1,800 | $2,200 |

| Broward | $2,800 | $1,500 | $1,900 |

| Palm Beach | $3,200 | $1,700 | $2,100 |

| Pinellas | $2,500 | $1,300 | $1,700 |

| Duval | $1,800 | $900 | $1,100 |

Note: These are average premiums and may vary depending on specific property characteristics, coverage levels, and insurer.

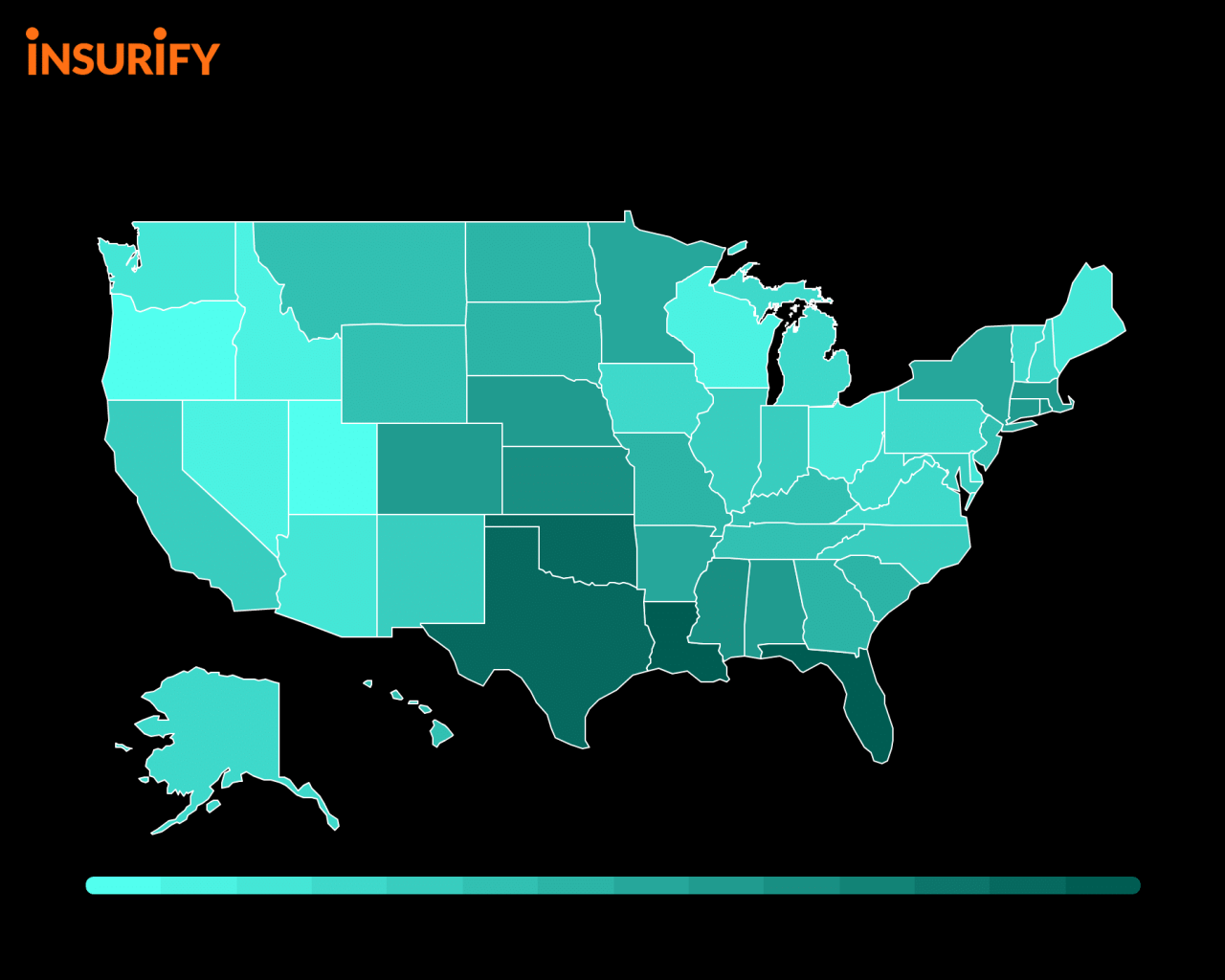

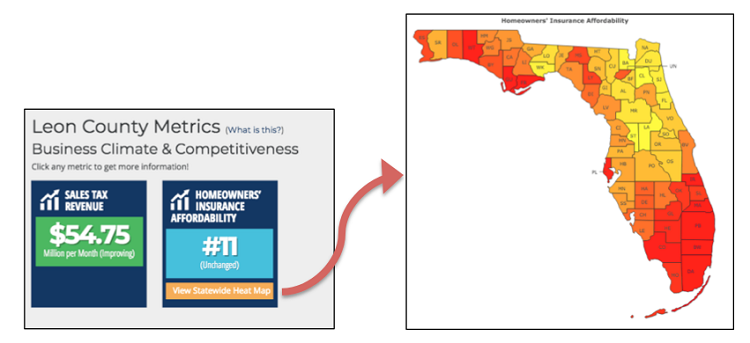

Geographic Distribution of Insurance Rates

A map of Florida, with different counties shaded based on average homeowners insurance premiums, would visually illustrate the geographic variation in rates. For example, counties along the Atlantic coast, particularly those in South Florida, would likely have darker shades representing higher premiums. In contrast, counties in the interior of the state, farther from the coast, would have lighter shades indicating lower premiums.

Impact of Risk Factors on Rates

Florida homeowners insurance premiums are influenced by a complex interplay of risk factors. These factors determine the likelihood of an insurance claim and the potential cost of that claim. Understanding these risk factors can help homeowners understand why their premiums are set at a particular level.

Property Location

The location of a property is a key factor in determining insurance rates. Properties in areas with a higher risk of hurricanes, floods, and other natural disasters will typically have higher premiums.

- Hurricane Risk Zones: Properties located in areas with a higher risk of hurricane damage, as designated by the Florida Hurricane Catastrophe Fund (FHCF), will face higher premiums. The FHCF divides Florida into different hurricane zones based on historical hurricane activity and the potential for future storms.

- Flood Zones: Properties located in flood zones, as designated by the Federal Emergency Management Agency (FEMA), are at a higher risk of flooding. Flood insurance is typically required for properties in these zones, and the cost of this insurance can significantly impact overall premiums.

- Proximity to Coast: Properties located closer to the coast are at a higher risk of hurricane damage and storm surge. Premiums are often higher for coastal properties compared to those located inland.

Age and Construction Type

The age and construction type of a property also influence insurance rates. Older homes are generally considered more vulnerable to damage and may have outdated building codes, leading to higher premiums.

- Age of Home: Older homes may have outdated building materials and systems that are more susceptible to damage. They may also lack modern safety features like impact-resistant windows and hurricane shutters, which can increase the risk of damage.

- Construction Type: Homes built with hurricane-resistant materials and construction techniques are less likely to suffer severe damage in a storm. For example, concrete block homes are generally considered more resilient than wood-framed homes.

Risk Mitigation Measures

Homeowners can take steps to mitigate their risk and potentially reduce their insurance premiums.

- Hurricane Shutters: Installing hurricane shutters can significantly reduce the risk of damage from wind and debris during a hurricane. Insurance companies often offer discounts for homes with hurricane shutters.

- Impact-Resistant Windows: Impact-resistant windows are designed to withstand high winds and flying debris. They can significantly reduce the risk of broken windows during a hurricane and are often eligible for insurance discounts.

- Roof Upgrades: Replacing an old roof with a new, hurricane-resistant roof can also reduce premiums. Newer roofs are often made with stronger materials and have a better seal, which can help protect the home from wind and rain damage.

- Flood Mitigation: Installing flood mitigation measures, such as sump pumps and backflow valves, can help prevent water damage and may qualify for insurance discounts.

Insurance Company Comparisons

Navigating the Florida homeowners insurance market can be complex, with numerous insurers offering diverse coverage options and premiums. Understanding the differences between these companies is crucial for finding the best fit for your specific needs and budget.

Comparing Rates and Coverage

This section will delve into the rates and coverage options offered by various insurance companies in Florida. We will examine the average premiums charged by leading insurers and highlight key coverage features that distinguish them.

| Insurance Company | Average Premium | Windstorm Coverage | Flood Coverage | Deductible Options |

|---|---|---|---|---|

| Company A | $2,500 | Yes | Optional | $1,000, $2,500, $5,000 |

| Company B | $2,800 | Yes | Included | $1,000, $2,000, $3,000 |

| Company C | $2,200 | Yes | Optional | $1,000, $2,500, $5,000 |

The table above provides a snapshot of average premiums and coverage features offered by three prominent insurance companies in Florida. While Company A offers the lowest average premium, it does not include flood coverage. Company B has a higher average premium but includes flood coverage as a standard feature. Company C presents a middle ground, with a moderate premium and optional flood coverage.

Reputation and Financial Stability

The financial stability and reputation of an insurance company are crucial considerations when selecting coverage. It is essential to choose a company that has a strong track record of paying claims promptly and fairly. A company’s financial strength can be assessed through its ratings from agencies like A.M. Best and Standard & Poor’s.

“A.M. Best assigns financial strength ratings to insurance companies based on their capital adequacy, operating performance, and business profile.”

“Standard & Poor’s assesses the financial strength of insurance companies based on their risk management practices, capital structure, and earnings.”

Companies with high ratings from these agencies generally have a strong financial foundation and are more likely to be able to meet their obligations to policyholders.

Tips for Lowering Insurance Costs

Florida homeowners face some of the highest insurance premiums in the nation, primarily due to the state’s vulnerability to hurricanes. However, there are several steps homeowners can take to reduce their insurance costs and protect their financial well-being.

Strengthening Your Home’s Hurricane Resistance

Homeowners can significantly lower their insurance premiums by taking proactive measures to improve their home’s hurricane resistance. These upgrades not only reduce the risk of damage but also demonstrate to insurers that the property is less likely to incur significant losses.

- Roof Reinforcements: Replacing an older roof with a hurricane-resistant roof, such as one made with impact-resistant shingles or metal, can dramatically lower insurance premiums. This is because a stronger roof is less likely to be damaged during a storm, resulting in lower claims and insurance costs for the insurer.

- Impact-Resistant Windows and Doors: Installing impact-resistant windows and doors provides an extra layer of protection against windborne debris, a major cause of damage during hurricanes. These windows and doors are specifically designed to withstand high winds and flying objects, minimizing potential damage and lowering insurance premiums.

- Storm Shutters: Storm shutters, whether manually operated or automatic, offer a cost-effective way to protect windows and doors from damage. They can be made of various materials, including aluminum, steel, or even plywood. Insurance companies often provide discounts for homes with storm shutters, recognizing the reduced risk of damage.

- Landscaping Mitigation: Proper landscaping can significantly reduce the risk of wind damage. Trimming trees and removing dead or diseased branches minimizes the chance of falling debris during a storm. Planting smaller trees and shrubs near the house also reduces the risk of wind damage.

Maintaining a Good Credit Score

While it may seem counterintuitive, a good credit score can actually lower your homeowners insurance premiums. Insurance companies use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible homeowners.

- Credit Score Impact: A good credit score can lead to lower insurance premiums because insurers perceive you as a lower-risk customer. They may offer discounts or lower rates based on your creditworthiness.

- Improving Credit Score: To improve your credit score, make timely payments on all your bills, keep your credit utilization ratio low, and avoid opening too many new credit accounts. A higher credit score can lead to significant savings on your homeowners insurance.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts to incentivize homeowners to take steps to reduce their risk. By taking advantage of these discounts, homeowners can significantly lower their insurance premiums.

- Safety Features: Installing security systems, smoke detectors, and fire sprinklers can qualify you for discounts. These safety features reduce the risk of fire and theft, making your home more desirable to insurers.

- Bundle Discounts: Bundling your homeowners insurance with other policies, such as auto insurance, can often lead to significant savings. Insurance companies often offer discounts for combining multiple policies.

- Loyalty Discounts: Staying with the same insurance company for an extended period can earn you loyalty discounts. Insurers reward long-term customers with lower premiums as a sign of appreciation.

- Other Discounts: Some insurance companies offer discounts for homeowners who are members of certain organizations, such as professional associations or alumni groups. It’s always worth asking your insurer about any available discounts.

Other Cost-Saving Tips

Beyond these specific measures, there are other general strategies homeowners can employ to lower their insurance costs:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Don’t be afraid to switch insurers if you find a better deal.

- Increase Deductible: Raising your deductible can lower your premium. However, make sure you can afford to pay the deductible in case of a claim.

- Avoid Claims: Minimize the number of claims you file, as each claim can increase your future premiums. For minor damages, consider paying out of pocket.

- Maintain Your Home: Regular maintenance can prevent costly repairs and reduce the likelihood of claims. Keep your home in good condition to minimize insurance premiums.

Government Programs and Initiatives

The Florida government recognizes the challenges homeowners face with insurance costs, particularly in a hurricane-prone state. To mitigate these challenges, various programs and initiatives have been implemented to offer assistance and support.

Florida Insurance Guaranty Association (FIGA)

The Florida Insurance Guaranty Association (FIGA) serves as a safety net for policyholders in the event of insurer insolvency. FIGA is a non-profit organization funded by insurance premiums, and it steps in to provide coverage for unpaid claims up to a certain limit when an insurance company becomes insolvent. This ensures that policyholders are not left without coverage in such situations.

State-Funded Programs for Hurricane Mitigation and Insurance Premiums

The state of Florida offers several programs designed to assist homeowners with hurricane mitigation and insurance premiums. These programs aim to reduce the risk of damage from hurricanes, thereby lowering insurance costs.

- Florida Hurricane Catastrophe Fund (FHCF): The FHCF is a reinsurance fund that provides coverage to insurance companies in the event of a major hurricane. This helps insurance companies to avoid large financial losses, which in turn can contribute to lower premiums for policyholders.

- Florida Residential Mitigation Program (FRMP): The FRMP offers financial incentives for homeowners to make their homes more resistant to hurricane damage. These incentives can cover a portion of the cost of mitigation measures such as roof upgrades, impact-resistant windows, and storm shutters.

- Florida Windstorm Underwriting Association (FWUA): The FWUA is a state-backed insurer that provides coverage for homes in areas where private insurers are reluctant to offer policies due to high hurricane risk. While the FWUA may have higher premiums than private insurers, it provides a crucial safety net for homeowners who may otherwise struggle to find insurance.

Understanding Insurance Policies

Navigating the intricacies of a Florida homeowners insurance policy can be daunting, but understanding its key elements is crucial for securing adequate coverage and financial protection. This section provides a comprehensive overview of the standard policy, outlining its coverage components, limitations, and common exclusions.

Coverage Components

Florida homeowners insurance policies typically offer coverage for various aspects of your property and potential liabilities. The most common coverage components include:

- Dwelling Coverage: This protects the physical structure of your home, including the attached structures like garages and patios, against perils like fire, windstorm, and hail. The coverage amount is typically based on the replacement cost of your home, which means the policy will pay for rebuilding your home to its original condition, minus any applicable deductible.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, electronics, clothing, and personal items. The coverage amount is usually a percentage of your dwelling coverage, typically ranging from 50% to 70%. You can purchase additional coverage for valuable items like jewelry or artwork.

- Liability Coverage: This protects you financially if someone is injured on your property or you are held liable for damages caused by you or a member of your household. Liability coverage typically covers medical expenses, legal fees, and judgments against you up to a certain limit.

- Other Coverage: Additional coverage options may include coverage for loss of use, which provides financial assistance if you cannot live in your home due to a covered event, and coverage for detached structures, such as sheds or fences.

Policy Limitations

While homeowners insurance provides valuable protection, it is essential to understand its limitations.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Deductibles can vary significantly based on the policy and coverage type.

- Coverage Limits: Your policy will have maximum limits on the amount of coverage for each component, such as dwelling, personal property, and liability. If the damage exceeds these limits, you will be responsible for the difference.

- Exclusions: There are specific events or damages that are not covered by standard homeowners insurance policies.

Common Policy Exclusions

Florida homeowners insurance policies typically exclude coverage for certain events or damages.

- Flood Damage: Flood insurance is a separate policy, not typically included in standard homeowners insurance.

- Earthquakes: Earthquake coverage is not usually included in standard policies.

- Acts of War: Damage caused by war or terrorism is typically excluded.

- Neglect or Intentional Damage: Damage caused by negligence or intentional acts is usually not covered.

- Wear and Tear: Normal wear and tear or deterioration of your property is not covered.

Potential Situations Not Covered

Understanding common policy exclusions is crucial to avoid unexpected financial burdens. Here are some examples of situations that may not be covered:

- Damage from a sewer backup: While sewer backup coverage is available, it is not always included in standard policies.

- Damage from a tree falling on your home: Tree damage is often excluded unless the tree is on your property.

- Damage from a hurricane: While hurricane coverage is usually included, there may be specific exclusions or limitations, such as wind damage versus water damage.

- Damage from a mold infestation: Mold damage may be excluded unless it is a direct result of a covered event, such as a water leak.

The Role of Insurance Agents

Navigating the complexities of Florida homeowners insurance can be a daunting task, especially given the unique challenges and risks associated with the state’s climate and property values. In such a scenario, the expertise and guidance of an experienced insurance agent can prove invaluable.

An insurance agent acts as your advocate, helping you understand your insurance needs, compare different policies, and make informed decisions about your coverage. They provide personalized advice tailored to your specific situation, ensuring you have the right protection for your home and family.

Services Provided by Insurance Agents

Insurance agents offer a wide range of services that can significantly benefit Florida homeowners.

- Policy Analysis: Agents meticulously review your existing insurance policies, identifying potential gaps in coverage, unnecessary expenses, or areas where you might benefit from additional protection. This comprehensive analysis helps you optimize your insurance strategy, ensuring you are adequately covered for potential risks.

- Shopping for Quotes: Agents leverage their extensive knowledge of the insurance market to access quotes from multiple reputable insurance companies. This competitive comparison allows you to identify the most favorable rates and coverage options, maximizing your savings while ensuring you have the right protection.

- Claim Assistance: In the event of a claim, your insurance agent acts as your intermediary, guiding you through the process, advocating for your interests, and ensuring a smooth and efficient claim resolution. This support is particularly valuable during stressful times, relieving you of the burden of navigating complex insurance procedures.

Finding a Qualified and Trustworthy Insurance Agent

Choosing the right insurance agent is crucial to ensure you receive the best possible service and protection.

- Seek Recommendations: Start by asking for recommendations from trusted friends, family, or neighbors who have experience with Florida homeowners insurance. Their insights can provide valuable guidance and help you narrow down your search.

- Verify Credentials and Experience: Ensure your prospective agent is licensed and holds the necessary credentials to operate in Florida. Inquire about their experience in the homeowners insurance market, specifically their expertise in handling claims related to hurricane damage and other Florida-specific risks.

- Check Reputation and Reviews: Research the agent’s reputation online, looking for reviews and testimonials from previous clients. Pay attention to feedback regarding their responsiveness, communication, and overall customer service.

- Schedule an Interview: Before making a decision, schedule a consultation with the agent to discuss your specific needs and ask any questions you may have. This personal interaction will allow you to assess their communication style, expertise, and overall suitability as your insurance advisor.

Navigating Insurance Claims

Filing a homeowners insurance claim in Florida can be a stressful process, but understanding the steps involved can make it more manageable. It is crucial to act promptly and communicate effectively with your insurance company to ensure a smooth and efficient claims resolution.

Documentation Required for Claims

It is essential to gather all necessary documentation to support your claim. This includes:

- Photographs: Capture clear and detailed photographs of the damage to your property, including the exterior, interior, and any affected personal belongings.

- Receipts: Collect receipts for any repairs or replacements you have made to the damaged property. This will help to verify the cost of the damage.

- Property Inventory: Create a detailed inventory of all your belongings, including their estimated value. This will assist in determining the amount of coverage you are entitled to.

Communicating Effectively with Insurance Adjusters

Effective communication is vital throughout the claims process.

- Be clear and concise when describing the damage to your property. Provide specific details about the date and time of the incident, the cause of the damage, and the extent of the damage.

- Be respectful and professional in your interactions with the insurance adjuster. This will help to foster a positive and productive relationship.

- Keep accurate records of all your communications with the insurance company, including the date, time, and content of each conversation.

Steps to File a Homeowners Insurance Claim in Florida

Here is a step-by-step guide to filing a homeowners insurance claim in Florida:

- Contact your insurance company as soon as possible after the incident. Report the damage and provide basic details about the event.

- Follow your insurance company’s instructions for filing a claim. This may involve completing a claim form or providing additional information.

- Cooperate with the insurance adjuster. Schedule an inspection of your property and provide all the required documentation.

- Review the insurance adjuster’s report carefully. Ensure that all the damage is accurately documented and that the estimated cost of repairs is reasonable.

- Negotiate a settlement with the insurance company. If you disagree with the offered settlement, be prepared to provide additional information or documentation to support your claim.

Summary

Navigating the intricacies of Florida homeowners insurance can be a daunting task, but with careful planning and research, homeowners can find affordable coverage that meets their needs. By understanding the factors that influence rates, comparing insurance companies, and taking advantage of available resources, Florida residents can protect their homes and their finances from the unexpected.